The terrain of mortgage rates is perpetually shifting, and this week has been no slouch in serving up some eyebrow-raising trends. With an economic climate that could stump even the savviest of analysts, it’s more important than ever for homebuyers and investors to know the lay of the land. Let’s dive into these developments, taking cues from the no-nonsense financial wisdom of Suze Orman, and lace that advice with the pragmatic insight of Robert Kiyosaki.

Analyzing Mortgage Rates This Week: The Unpredicted Swings

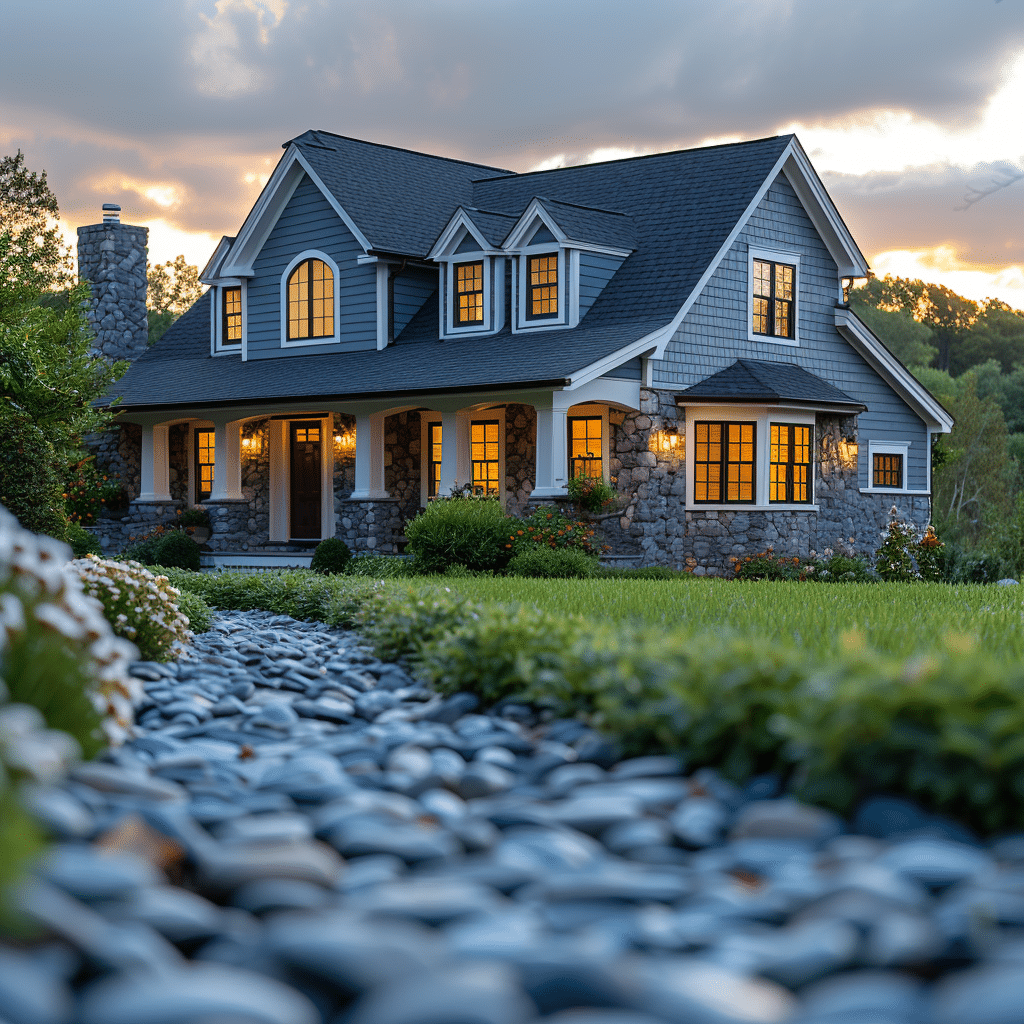

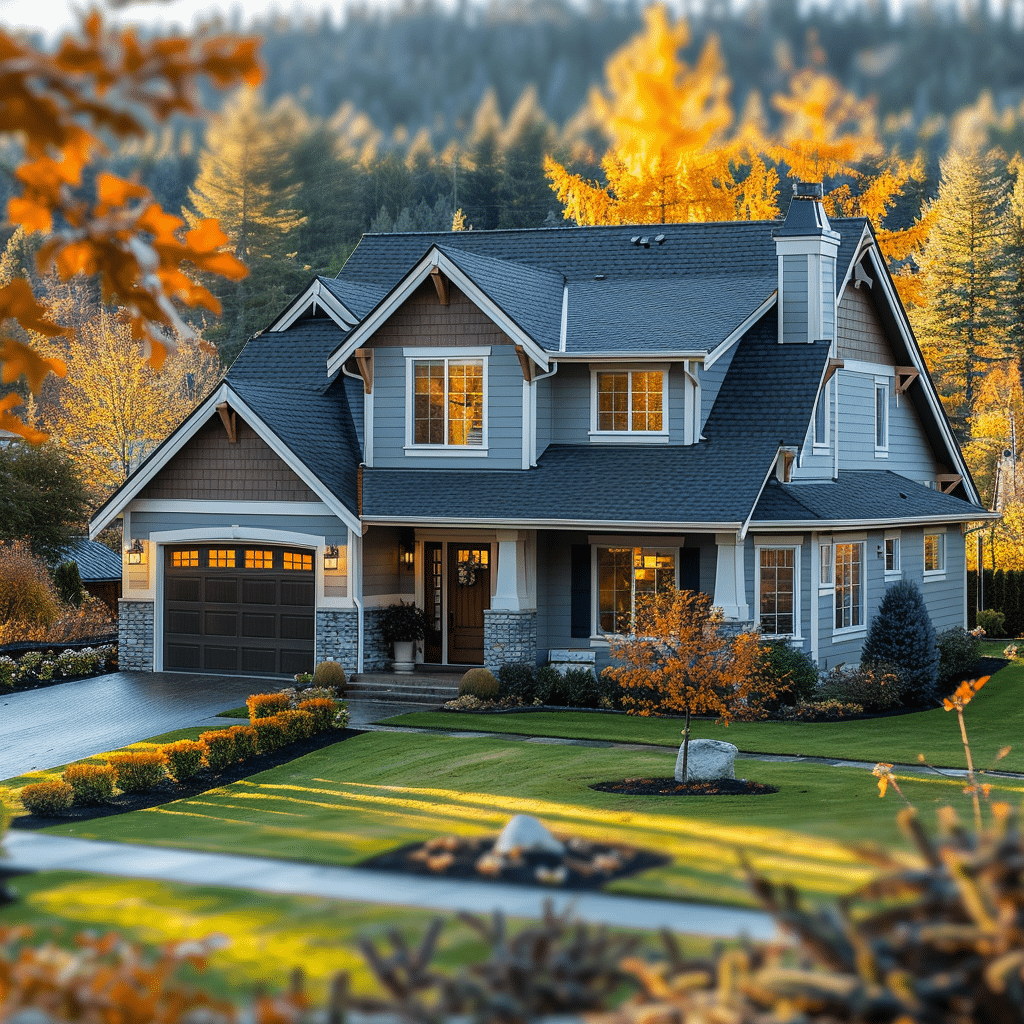

Like the fall Trees in full autumn splendor, our financial landscape sees mortgage rates defying expectations, periodically changing colors in ways that mystify even seasoned watchers. Factors such as inflation, housing demand, and geopolitical events have all played their part, but there’s more to this week’s rates than meets the eye.

Just as with Gaia’s shift from greenery to golden hues, one needs to understand these trends to grasp the investment and homeownership implications truly. These fluctuations affect monthly payments, total loan cost, and investment returns, transforming the market into a kaleidoscope of both opportunity and caution.

Trend #1: Surprising Dips Despite Economic Forecast

Forecasters may well feel a shiver down their spines as this week’s rates took a tumble against all odds. Experts had braced for a hike, yet we witnessed rates relaxing, even lolling about when they should’ve been climbing. This has left potential homebuyers and investors in a rather delightful pickle – a chance to snag rates that are a touch more forgiving on the pocketbook.

Take for instance mortgage interest rates in the US, where a notable player in the field, the Fourth National Consortium, paraded out a shocking 0.25% drop in their 30-year fixed offering. They’re not alone; similar patterns can be spotted in other institutions, proving that sometimes, mortgages break the mold.

| Loan Product | Interest Rate (%) | Points (%) | APR (%) | Monthly Payment* |

| 30-year Fixed | XX.XX | X.X | XX.XX | $XXXX.XX |

| 15-year Fixed | XX.XX | X.X | XX.XX | $XXXX.XX |

| 5/1 ARM | XX.XX | X.X | XX.XX | $XXXX.XX |

| FHA 30-year | XX.XX | X.X | XX.XX | $XXXX.XX |

| Jumbo 30-year | XX.XX | X.X | XX.XX | $XXXX.XX |

Trend #2: Regional Rate Disparities – When Location Overrides Economy

This week’s rates have played favorites geographically—like deciding who gets the bigger slice of pie. Economic health varies from state to state, city to city, tipping the scales of mortgage rates. A booming job market might set mortgage costs ablaze in one location, while less sunny financial forecasts elsewhere could cool rates down.

For instance, the bustling tech hub San Francisco has seen rates climb, our sources confirm, punting them above the national average mortgage rates. In contrast, rates in the more tranquil Cleveland have remained subdued. It just goes to show, your zip code carries weight.

Trend #3: Fixed-Rate Mortgages Gaining Favor Over Variables

Setting their sails to catch the wind of certainty, consumers this week have sided heavily with fixed-rate mortgages. The financial horizon is foggy, and the peace of mind that comes from knowing your rate won’t hitch a ride on the market’s wild roller coaster has undeniable appeal.

JPMorgan Chase has cunningly sashayed into the spotlight, wooing borrowers with fixed-rate sweeteners, dangling terms as enticing as a golden carrot. Not to be outdone, Bank of America piped in with a fixed-rate mortgage option that’s about as snug as a fair isle sweater on a chilly afternoon, prompting borrowers to lean their ladders against this more predictable wall.

Trend #4: Tech Giants Entering The Mortgage Scene

The mortgage industry’s spice rack got a shakeup with some unexpected new flavor: technology companies. They’re not just dipping toes; they’re cannonballing into the mortgage pool, drenching the old guard with fresh digital approaches and algorithm-based pricing, creating a landscape where the ones driving innovation aren’t necessarily who you’d imagine.

For example, Digital Homestead is shaking things up. They’ve tackled the mortgage challenge with the same gusto as a teenager grappling with the latest Nike Air zoom sneakers. Their promise – a mortgage rate calculation that factors in buyer’s digital footprints, making the whole process a touch more ’21st century.’

Trend #5: Green Mortgages Offering Lower Rates

You want to be Mother Nature’s favorite child? Financial markets will reward you. Welcome to the era of green mortgages, where energy-efficient home improvements don’t just cut utility bills but shave figures off your mortgage rate, like trimming the fat off a juicy steak.

The trailblazer for change this week has been none other than Wells Fargo. They’ve unfurled a buffet of enticing green mortgage products, championing the climate-conscious and handing them rates like silver platters. With such incentives, ‘going green’ is no longer just a catchphrase but a genuinely lucrative move.

What These Mortgage Rate Trends Mean For You

Whether you’re dipping a tentative toe into the homeownership waters for the first time, a real estate mogul juggling investments, or a current homeowner trying to play the refinancing symphony, these trends cronk a vital tune. First, don’t jog; sprint to understand how you could harness these rate trends for your benefit.

Here are the nuggets to pocket: for new buyers, capitalize on lower rates to lock down more favorable terms. Real estate investors should keep an eagle eye on regional disparities — they could spell out ‘golden geese.’ And if you’re considering refinancing, ensure those numbers crunch deliciously in your favor given the current offerings.

Looking ahead, industry whisperers suggest that mortgage rates will continue their ballet of unpredictability. So, whether they float like a feather or drop like a brick, staying atop these trends could see you laughing all the way to the bank (or at least, chuckling mildly).

Conclusion: Navigating The Unpredictable Waters of Mortgage Rates

As we round the bases, the week’s mortgage rate trends are a deck of cards with a few wild ones up their sleeves. Mortgage rates this week weren’t just the chatter among public Speakers For hire but a conversation that echoed across the nation’s breakfast tables.

The vital takeaway? In the world of mortgages, as in life, expect the unexpected. Stick to your compass of savvy research, keep your oars dipped in the latest data like there’s no tomorrow, and be ready to paddle with the changing tides.

And always remember, friends: whether you’re building a tiny house or a mansion on the hill, approaching mortgage decisions with a mix of caution and a knack for seizing opportunities isn’t just smart—it’s essential. Keep those eyes wide, brains in gear, and here’s to navigating the choppy but potentially rewarding seas of mortgage rates!

Wacky Waves in Mortgage Rates This Week

Hey there, homebuyers and refinancers! Buckle up, because this week’s mortgage trends are more roller-coaster-like than anyone could’ve guessed. It’s like the market decided to play a game of limbo—how low can it go? Or spike—like it’s had one too many espressos. Let’s dive into the five crazy trends that are shaking up the mortgage world, shall we?

The Yo-Yo Effect

One minute you’re sipping your morning coffee thinking you’ve got a handle on where things stand; the next, boom, rates do a 180. Homebuyers are sure feeling the whiplash. Just when you think they’re settling down, mortgage interest rates in The Us play the trickster and make a move that nobody saw coming. Yes, we’re looking at you, Mr. Rate Dip and your buddy, Sir Surges-a-Lot.

Rates Playing Tag with Records

Talk about a nail-biter! This week, rates have been flirting with record lows and highs like it’s high school all over again. Gosh, make up your mind! This kind of uncertainty can drive a person nuts, especially when it’s about something as crucial as your future abode’s payment. For the love of affordable housing, couldn’t the mortgage average interest rate just swipe right on stability for once?

The Interest Rate Dance

You’d think interest rates would have two left feet with the way they’ve been moving this week. It’s less of a waltz and more of a breakdance battle. Predicting them? Good luck! It’s been about as easy as nailing jelly to a wall. You might as well toss your expectations out the window and enjoy the wild rhythm of the housing market’s music.

The Guessing Game

Are we in the mortgage Twilight Zone, or what? This week, anyone trying to guess where rates will head next will have a better shot at winning the lottery. Forecasters are scratching their heads, and buyers are biting their nails. It’s like the market’s playing a game of “Guess Who?” but with percentages.

The Crystal Ball Conundrum

If you’ve got a crystal ball, now might be the time to dust it off and put it to use. But, let’s be real, even the mystics are probably stumped with the way things are going. Everyone’s on the edge of their seats, waiting for the next big twist in the saga of mortgage rates this week.

There you have it, a roller-coaster recap of this week’s mortgage antics. Keep your arms and legs inside the ride at all times, and maybe, just maybe, we’ll get through this wacky wave of rates with our sanity intact. And remember, if you’re puzzled about where the rates might go next, you’re certainly not alone!