Ah, California, with its sprawling beaches, the bustling cities, and, of course, those ever-shifting mortgage refinance rates that keep homeowners on their toes. Whether you’re nestled in the Bay Area or soaking up the sun in SoCal, if you’re thinking about dipping your toes in the refinancing pool, you’re gonna want to buckle up and pay attention. We’re about to embark on a wild ride through the golden waves of California’s refinance rates in 2024.

Evaluating Mortgage Refinance Rates California

First off, let’s take a gander at what we’re up against. The mortgage refinance rates California homeowners are seeing have been bobbing up and down like a surfer riding the Pacific swells. The economic gurus out there have been scratching their heads, forecasting that while we may see rates trending down in 2023 and 2024, right now, the market’s hotter than a jalapeño in July.

Here’s the skinny: economic trends, like job growth and inflation, are big players in this drama – and let’s just say they’ve been hogging the limelight. Why does comparing rates matter? Well, my friends, it’s pretty simple – you wouldn’t buy a surfboard without checking out a couple of shops first, would you? Shopping around for rates can save you some serious dough in the long run.

Unraveling the Appeal of 15-Year Refinance Rates in California

Now, let’s chat about those snazzy 15-year refinance plans. Why are they catching eyes like wildflowers in spring? It’s ’cause they’re often paired with lower interest rates compared to their 30-year cousins, meaning you could save a mountain of money on interest and own your home faster than you can say “Eureka!”

Currently, the average 15-year refi rates in California are as tempting as a beach bonfire in November. Whispers in the financial halls say lenders like “finance Of america reverse” are rolling out some pretty competitive rates.

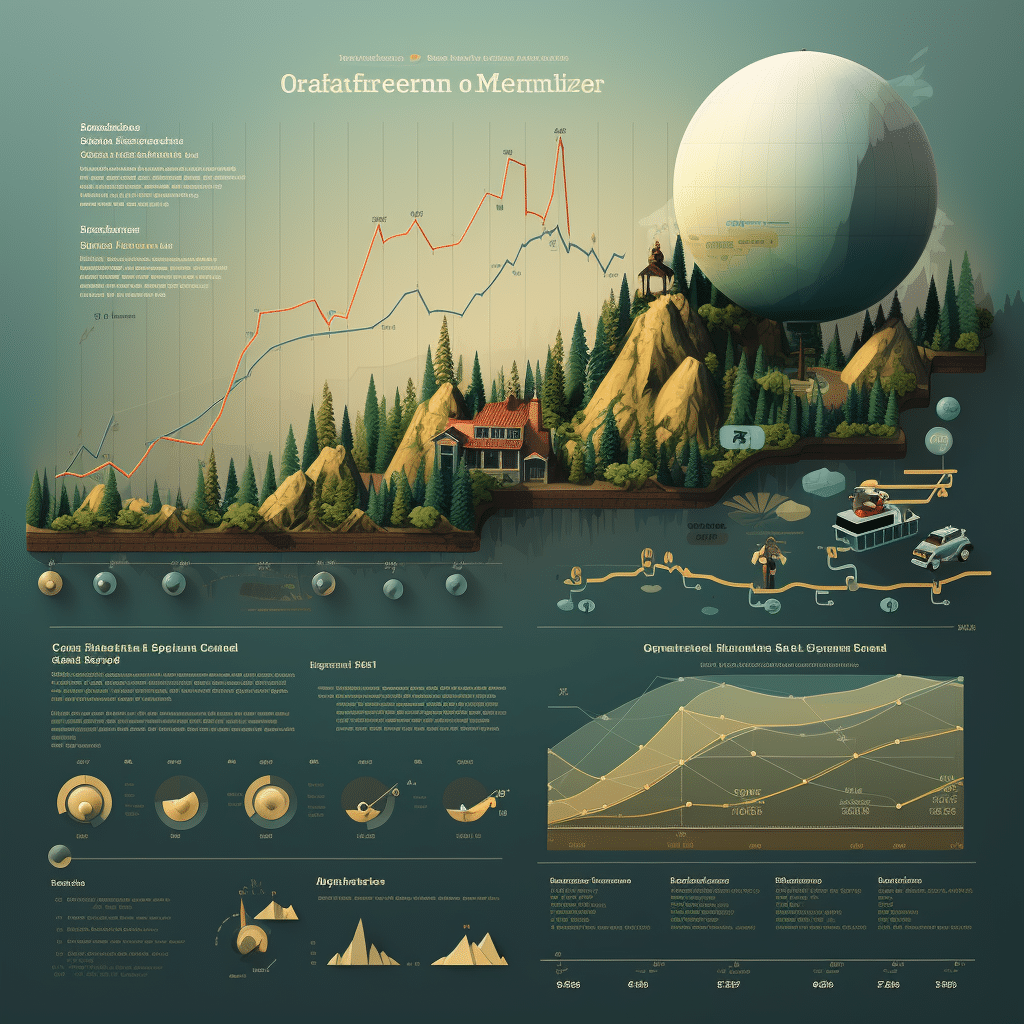

| **Factor** | **Description** |

|---|---|

| Current Average Refinance Rates | – 30-year Fixed: X.XX%*- Data as of [Most Recent Date] |

| – 15-year Fixed: X.XX%* | |

| – 5/1 ARM: X.XX%* | |

| Rate Trends Projection for 2023 | – Fannie Mae predicts a downward trend in 30-year fixed rates throughout 2023 and 2024. |

| Impact of Lowering Refinance Rates | – Borrowers typically secure a lower interest rate during a refinance, reducing lender profits. |

| Lenders’ Response | – To maintain profit margins, some lenders have raised refinance rates slightly. |

| Potential Benefits of Refinancing | – Lower monthly payments. |

| – Shortened loan term. | |

| – Debt consolidation opportunity. | |

| – Potential for cash-out to fund home improvements or other expenses. | |

| Factors Influencing Rates | – Economic indicators such as inflation and employment figures. |

| – Federal Reserve policies including interest rate adjustments. | |

| – Housing market supply and demand dynamics. | |

| Refinance Rate Variability | – Rates vary by lender, location, borrower credit score, and loan-to-value ratio. |

| Rate Lock Option | – Borrowers may choose to lock in a rate to protect against increases during the refinance process. |

| Prepayment Penalties | – Typically absent in California refinance loans, but borrowers should confirm with lender. |

| Average Closing Costs | – Approximately 2-5% of the principal, but varies by lender and loan size. |

| Break-Even Period | – Time it takes for savings from refinanced loan to surpass cost of refinancing, varies by loan. |

Pros and Cons of 20-Year Refinance Rates in California

Still with me? Good. ‘Cause now we’re talking 20-year refinance rates. This option’s like the Goldilocks of home loans – not too long, not too short. The interest rates for these middle-of-the-road mortgages are often lower than 30-year rates but a tad higher than the 15-year dealio.

The 20-year refinance rates California residents are seeing are hovering in a comfy zone. These institutions are trying to give you that just-right feel, and sources say some lenders are even sweetening the pot with rates that’ll make you wanna slap on your flip-flops and do a happy dance right there in the bank.

The Staying Power of 30-Year Fixed Refinance Rates in California

Let’s circle back to the ever-popular 30-year fixed rate. This bad boy has been a fan favorite for a long while, and for a good reason. The stability of knowing what your payment looks like each month is like knowing there’s always going to be traffic on the 405 – it’s dependable.

As we peek at the current 30-year fixed refinance rates California homeowners are faced with, let’s not forget that recent economic whispers predict a slow and steady descent like a perfect sunset. Hunting for the lowest rates? You better believe it’s crucial, like finding the best taco truck at a food festival.

Comparing 30-Year Refinance Rates California: Is Longer Necessarily Better?

Comparing the long-term jig is up next. So, here’s the deal – a 30-year plan might not have the lowest rates upfront when you compare them to shorter terms, but they’re like a marathon; it’s about pacing.

Those looking to snag the best 30-year refinance rates California has on the market need to gear up for some serious recon. And don’t be fooled by the sticker price, kiddos. It’s not just about the rate – you gotta dig deeper and look at the entire package, like inspecting a surfboard for dings and cracks.

Scouting for the Best California Refinance Rates: Insider Tips

Scouting out the finest California refinance rates involves a little more than just a shot in the dark. It’s more like feeling the waves before you dive in. My inside tip? Start scrubbing through those rates early, like you’re looking for the freshest avocado at the market.

Finding the best refi rates California has to offer is a mix of timing, credit smarts, and, sometimes, who you know. Want another hot tip? Lenders are like seagulls flocking to a beach picnic – if you look like you’ve got your act together, they’ll swarm you with offers.

Deciphering Best Refi Rates California: The Elite Few

Let’s break it down now. Those elite lenders, the ones offering the best refi rates in California, have a few things in common. They’re usually sporting strong financial health, customer service that puts you at ease, and a proven track record that sparkles like the Pacific Ocean at high noon.

Looking for a face-off? Some diligent souls have done side-by-side comparisons of the best refinance rates California’s slice of paradise produces, and let me tell you, it’s juicier than a Valencia orange in peak season.

A Deep Dive into CA Mortgage Refinance Rates: True Cost Analysis

Here’s where we plunge into the deep end. The true cost analysis of CA refi mortgage rates isn’t just about the rate itself. It’s about all those pesky fees, closing costs, and the fine print that can sneak up on you like a high tide.

Real Californians—real homeowners—have spilled the beans on how they navigated the CA mortgage refinance rates to optimize their home loans. These case studies? They’re like maps to buried treasure, matey, and it’s your turn to set sail.

California Refi Mortgage Rates: Trend Tracking and Predictions

Got your crystal ball ready? Neither do I, but what we do have are stats and forecasts. The most recent murmurs in the wind have experts predicting a mellowing out of the California mortgage refinance rates. The future might just hold a welcome break in the high tides of interest.

Keeping your eye on the California refinance mortgage rates and the economy is like watching the swells for the perfect wave. But remember, even the best surfers wipe out now and then, so staying on top of predictions is your best bet to not get tossed.

Showcase of Current CA Refinance Rates: Today’s Market Snapshot

Alright, ready for the daily download? The current CA refinance rates are serving up a mixture of hi’s, lo’s, and “hmm’s”. The movers and shakers, those lenders who are shaking up the refi landscape, are making some waves with rates that give you, the homeowner, the stoke of a perfectly executed pop-up.

Today refinance rates California is flaunting can feel as fleeting as sand slipping through your fingers, which is why it’s vital to keep on top of the market.

Lowest Refinance Rates California: Finding the Diamond in the Rough

Now, let’s put on our treasure hunting hats and discuss fishing out the lowest refinance rates California has hidden in its depths. There are tricks, there are tactics, and there are tried and true methods – like knowing exactly when to pounce, similar to catching the early bird special at your favorite diner.

Glimpses from those who have clinched the refi interest rates California dreams are made of are like tales of legend, and it turns out, it’s not just a stroke of good fortune. It’s about strategy, baby, and maybe a dash of luck, just like hitting every green light on your way to the coast.

A Comprehensive Guide to Refinance Rates California Today: What to Know Before You Sign

Every day brings fresh rollercoaster twists to the refinance rates California today story, and keeping a finger on the pulse of those numbers is as crucial as remembering your sunscreen on a beach day. And let’s face it, the date you choose to lock it in? That’s like choosing the perfect day for your beachside wedding – timing is everything.

Before you sign on the dotted line, remember that the refinance mortgage rates California lenders are offering you are about as multifaceted as a Hollywood blockbuster. You’ve gotta sit through the previews, understand the plot, and make sure you’re prepped for the entire show.

Innovating Financial Futures: Mastering Mortgage Refinance Rates in California

Alright, folks, we’ve surfed through the gnarly waves of the California refinance interest rates, and it’s time to talk about how this journey doesn’t just end here. Innovating your financial future means staying adaptable, willing to learn, and ready to pivot – like a skateboarder mastering a new trick.

The Californians who’ve mastered the mortgage refinance rates in California dance have stories that’ll peak Your interest. These aren’t fairy tales; they’re lessons in financial savvy, courage, and sometimes, a sprinkle of trial and error.

As the sun sets on our California refinance rates exploration, let it be known that the landscape we’ve traversed is ever-changing but always conquerable. With your newfound knowledge, the golden gates of smart refinancing stand wide open – ready for you to walk through and claim your rightful place as Master of the Mortgage Seas. Keep that compass of wisdom handy, and chart your course towards brighter financial horizons, my friends.

What is the current refinance rate in California?

Whoa, talk about surfing the rates! The current refinance rate in California is riding the market wave, and it’s as changeable as the Pacific tides. For today’s exact numbers, you’ll wanna catch the latest update from a reliable financial website or give your local lender a buzz.

What are mortgage refinancing rates today?

Looking for the scoop on today’s mortgage refinancing rates? Well, they’re as fresh as today’s doughnuts! But remember, like those pastries, they don’t stay hot all day, so check out a reputable financial site or call up a lender for the most current rates—they can vary faster than you can say “hot cakes!”

Will mortgage rates go down in 2023?

Will mortgage rates go down in 2023? Boy, if I had a crystal ball! Predicting rates is like guessing the winner of the derby before the gates even open. Some experts forecast a drop, others bet on a rise, while a few hedge their bets on steady as she goes. Keep an eye on the economic forecast—they’re our best odds for a hint.

Why are refinance rates so high?

Why are refinance rates through the roof? Simple, they’re tied to the economy like a kite to a string. When the economy’s buzzing, rates might climb high, and right now, they’re getting quite the workout. Plus, lenders have got to make their bread somehow, and higher rates spell more dough for them.

Are mortgage rates expected to drop?

“Drop it like it’s hot,” they say, but will mortgage rates get the memo? Some market maestros predict a lil’ dip on the horizon, while others aren’t betting their bottom dollar on it. Stay tuned and keep a weather eye on economic trends—they’ll give us the best clue!

Is it better to refinance with your current lender?

Is it better to stick with the devil you know, aka your current lender, for a refi? Well, it’s cozy and convenient, and they might sweeten the deal to keep you. But don’t be shy to play the field—you might find a better rate that makes it worth the switch. Remember, there’s no harm in a little flirtation with other lenders!

How do I find the lowest rate to refinance?

Hunting for the rock-bottom refinance rate? Roll up your sleeves and put on your detective hat because it’s time to do some serious digging. Compare lenders like you’re speed dating, negotiate like a market trader, and don’t forget to check those online comparison tools—they’re real gems!

Will refinance rates drop?

Will refinance rates take a dive anytime soon? Boy, wouldn’t that be nice! But just like waiting for your favorite band to go back on tour, there’s no guarantee. Keep your ears to the ground, listen to the experts, but remember, rate predictions can be as unpredictable as a game of pin the tail on the donkey.

Will refinance rates go down in 2024?

Peer into the crystal ball for refinance rates in 2024? That’s tougher than nailing jelly to a wall. Economists are tossing their theories around like a salad, but it’s really anyone’s guess. Stay in the loop with financial news, and maybe, just maybe, we’ll get a clearer picture as we edge closer.

How high could mortgage rates go in 2023?

How high could mortgage rates climb in 2023? Well, they say the sky’s the limit, but let’s hope it’s not a sky-high figure. In all seriousness, it hinges on heaps of factors—think economy, inflation, and central bank moves. So buckle up, and let’s hope for a gentle hike and not a rocket launch.

What will mortgage rates be in 2024?

Fast forward to 2024, and what’ll mortgage rates look like? If I could see that far ahead, I’d be at the races! But let’s just say, it’s a mixed bag of predictions—some say up, some say down, some say it’ll be as flat as a pancake. Keep tabs on the trend and brace yourself for any sort of rollercoaster.

How many times can you refinance your home?

How many times can you give your home loan a makeover? Well, there’s no cap—seriously, no limit. You can refinance as many times as your heart desires and your wallet allows. Just make sure each redo is a home run and you’re not just spinning your wheels.

Is it smart to refinance your home right now?

Pondering whether to refinance right this minute? Hmm, it’s as tricky as a game of hopscotch. Crunch the numbers, consider your timing, and weigh the pros and cons. Smart moves depend on personal goals, market conditions, and, of course, your pocketbook.

Is it cheaper to purchase or refinance?

Is it more of a bargain to buy a new pad or give your current digs a refi? Here’s the deal: purchase loans and refinance options have different costs and rates. Purchasing might be like paying cover at a club, while refinancing could be like snagging the happy hour deal. Do the math and see what saves you a pretty penny.

Is it a bad time to refinance?

Is it a bum time to refinance? Totally depends on your situation. If rates have skyrocketed since your last mortgage dance, it might feel like throwing a party when no one shows up. But if you’ve got reasons like slashing your term or cashing out equity, it could still be a smart play.

What is today’s 30 year refinance rate?

What’s today’s 30-year refinance rate you ask? Well, it’s as current as the morning news, so grab your coffee and hit up a trustworthy financial news source. They’ll give you the lowdown for your refi-gamble.

What is the interest rate on a 30 year fixed right now?

On the lookout for the interest rate on a 30-year fixed? Numbers change quicker than fashion trends, so for the most on-point rate, you’ll need to check today’s financial forecast or get in touch with a lender who’s up to speed.

Is it worth it to refinance for 1 percent?

Is refinancing for a measly 1 percent less worth the paperwork? Hey, sometimes a little can go a long way, like adding a dash of hot sauce to your taco. That one little percentage point might save you a decent chunk of change over time. Get out your calculator and see if it spices up your financial life!

Are refinance rates going up?

Are refinance rates going up, you wonder? Well, they’ve been on a bit of a rollercoaster, and right now, they might be scaling new heights. It’s all about what’s cooking in the economy, so if you’re playing the refinance game, better keep your eyes on the prize.