In this article, we are going to shed light on the intricacies of the NC Sales Tax system. Hold on tight, this ride might get a bit tricky!

I. Captivating Kickoff: Shedding Light on the Intricacies of the NC Sales Tax System

NC sales tax, a seemingly straightforward topic, is filled with secretive little nuances that can trip the average Joe up. Retail sales of tangible personal property are subject to the 4.75% State sales or use tax. What this means is that you can end up paying more than you initially thought when purchasing that new lawn chair or refrigerator.

Sure, everyone talks about taxes, but when it comes down to the nitty-gritty, many get lost in the complex web of percentages and local discrepancies. Understanding the NC sales tax isn’t just about being savvy with your money; it’s about knowing where it goes and why it matters.

II. Unveiling the Truth: Is NC Sales Tax 7%?

Contrary to widespread belief, the NC sales tax rate is not a clean-cut 7%. In actuality, the North Carolina sales tax rate is currently 4.75%. However, with the additional county and local taxes in most areas, the rate could rise to a range between 6.75% and 7% in most counties. In some cases, even up to 7.5% can be charged!

Local municipalities can further amplify this rate leading to a total tax rate as high as 7.5%. The additional variation based on local municipalities demonstrates how local taxes can significantly affect the total tax charge.

III. Decoding the 7.25% Tax Mystery in NC

Alright, we have already dived into the overall state sales tax, but let’s take a quick pit stop in Raleigh. Why? Because the NC sales tax tale now has a twist.

The 7.25% sales tax rate in Raleigh is an amalgamation of several components. Mainly it’s the 4.75% North Carolina state sales tax, the 2% Wake County sales tax, and finally, a 0.5% Special tax. Yep, no city tax here, folks! It may seem convoluted, but it’s just different ways the tax pie gets sliced.

IV. What’s Taxable and What’s Not: Items Subject to NC Sales Tax

Not all items are taxable under the NC sales tax rule, and that’s where some of the real magic tricksters hide. Common items like furniture, home appliances, and motor vehicles fall under the taxable goods category.

The good news? Several items are exempt. Items like prescription medicine, groceries, and gasoline are not subject to NC sales tax. This means that essential goods can often make it into the shopping cart without additional tax stress.

V. Hidden Insights: South Carolina vs North Carolina Sales Tax Rate

Crossing state lines can significantly impact your tax obligations. Let’s gauge an example by comparing the NC sales tax rate with the South Carolina sales tax rate. The rates amongst these sister states vary and can result in a significant difference in the total checkout costs. Be sure to take a look at the SC paycheck calculator for more insight into this.

VI. Dive Into History: Evolution of Sales Tax in NC

Taxes aren’t static – they evolve over time. In fact, North Carolina first adopted a general state sales tax in 1933. Since then, the rate has risen to 4.75%.

Several other local sales taxes or special district taxes could further increase this rate, ranging between 0 percent and 2.75 percent. It’s like watching Max Baer Jr in The Beverly hillbilies, always a surprise waiting around the corner!

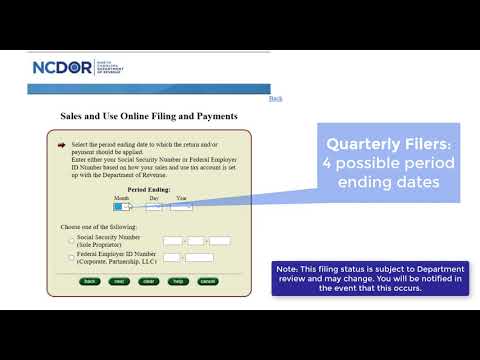

VII. Insightful Guide: Understanding Sales Tax Rules in NC

Similar to how every region has its own Costco, portrayed excellently in this Costco business center article, each region in North Carolina has its own set of sales tax rules. It is essential to familiarize yourself with these to avoid unpleasant surprises at the checkout line.

Local and special district taxes could apply besides the general state sales tax. Knowledge of these regional discrepancies could save you lots of headaches… and dollars.

VIII. Ten Little-known Ways to Save Big

Now, it’s time for the juicy part – how do you save big on NC sales tax? We’ve curated an insightful list of tips, tricks, and secrets to help you squeeze every bit of savings from your transactions.

Stay tuned for a detailed explanation of 10 secrets to save on NC sales tax. Make sure to compare these tips with other states to maximize your savings. Why not take a look at similar tax rates with this handy Indiana sales tax rate link?

IX. Final Thoughts: Leveraging your Knowledge to Navigate the NC Sales Tax Landscape

Understanding the fine details of the NC sales tax system holds real value in keeping those hard-earned bucks in your wallet. It’s like running numbers on a Florida take home pay calculator or an IL paycheck calculator; the knowledge belongs to you.

As you wander through the tax wilderness, your discernment helps you save more at the checkout line or the car dealership. Remember, a penny saved is a penny earned—especially when dealing with taxes!

Remember that the New jersey income tax calculator is there to assist in your calculations. In the world of taxes, accurate information is your most valuable asset.