Navigating the insurance maze can be as tricky as tying a bow with those slippery hair Barrettes. When it comes to older mobile home insurance, the path is particularly winding. Here at Mortgage Rater, we’re all about guiding you through that labyrinth, turning complex jargon into plain English, and helping ensure that your haven on wheels is suitably safeguarded.

Navigating the Complexities of Older Mobile Home Insurance

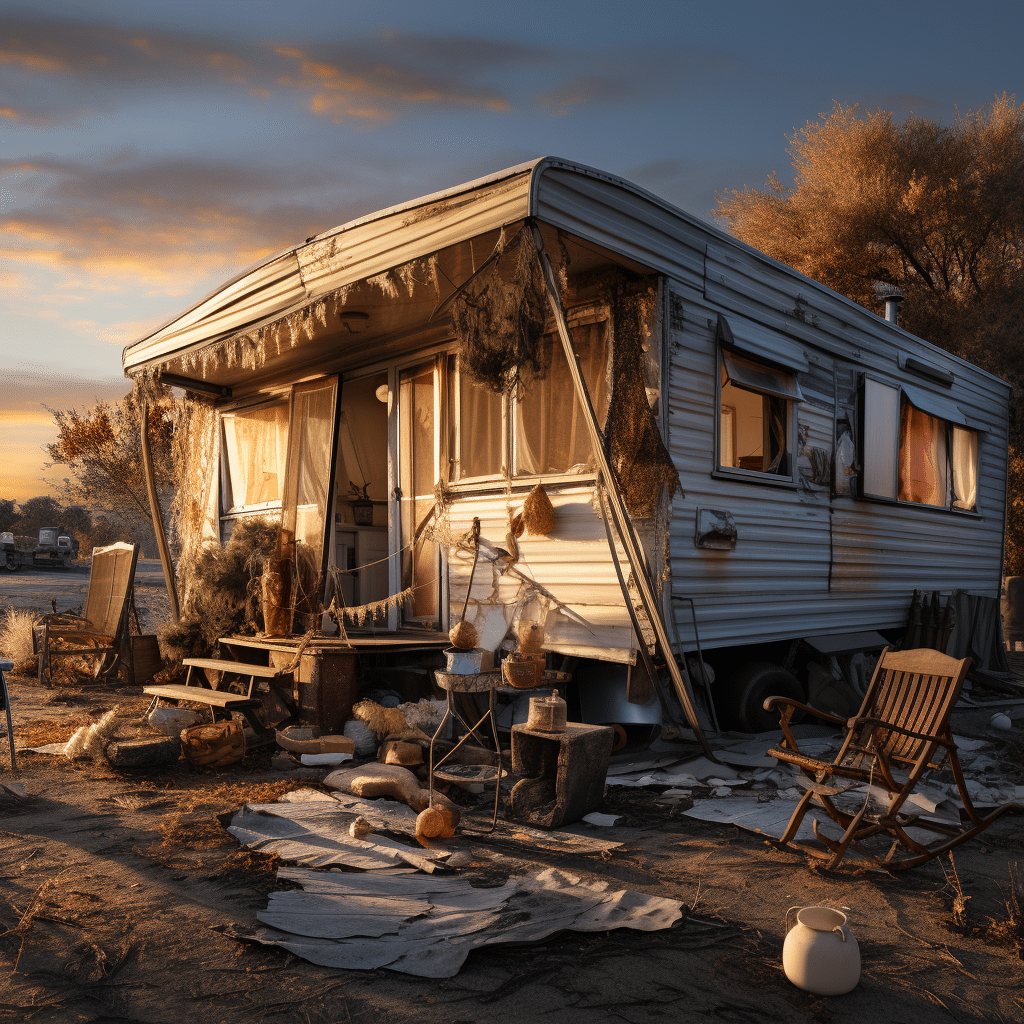

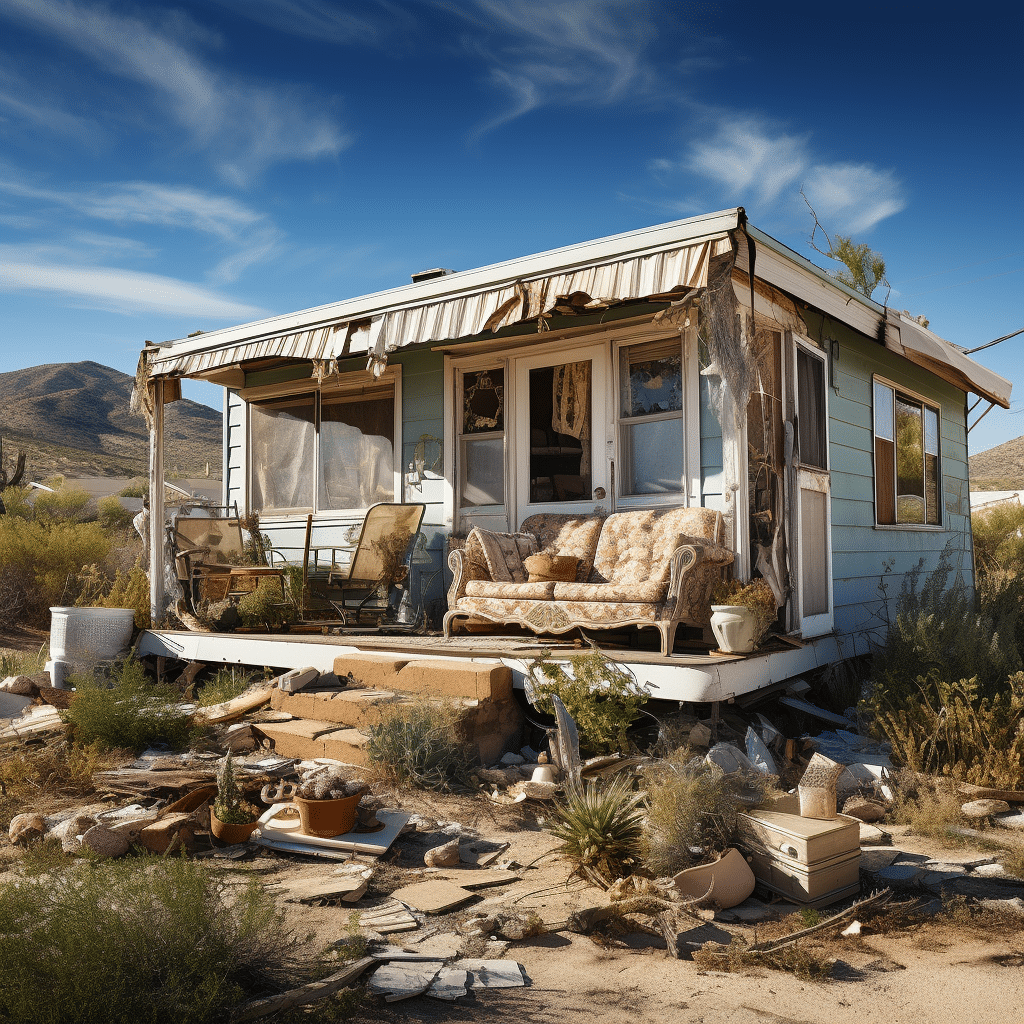

The Unique Challenges of Insuring an Older Mobile Home

Mobile homes, especially the seasoned ones, come with their own set of peculiar peccadillos. The year it was built matters—homes crafted before 1976 are the rebel outlaws of the housing world, often lacking the blessing of insurance providers due to the lack of regulation of their time. These homes are like free-spirited wildflowers, but flower Drawings won’t suffice as insurance cover.

Outdated wiring and the mercurial nature of mobile home infrastructure can lead insurers to give the cold shoulder. Add a pool into the mix, and insurers’ eyebrows raise higher than a cat’s back unless you’ve got a fence tighter than Fort Knox. These unique features that doll up an older mobile home can also bump up the rates and necessitate a special sort of insurance hug.

The Importance of Assessing Older Mobile Home Condition for Insurance Purposes

Assessment is key. Think of it as the data plate on a manufactured home—it’s the tell-all that insurance companies swoon over. Details like the date of manufacture and the serial number are equivalent to a mobile home’s life story—and insurers are avid readers.

A thorough inspection will uncover those nooks and crannies that might give an insurer pause. Sure, the electrical system might have been the bee’s knees in 1975, but today? It might be more of a fly in the ointment. Get that inspection—it’s the crystal ball showing whether you’re headed for smooth sailing or choppy waters with insurers.

Essential Coverage Options for Best Mobile Home Insurance

Understanding the Different Types of Coverage in Mobile Home Insurance Policies

First off, the basics. You’ve got property coverage—the safety net for your structure and belongings. Liability coverage, saving your bacon when someone else cries “oink” on your property. Then there’s trip collision coverage, for when your home hits the road, literally.

And just like a belt-and-suspenders approach to keeping your pants up, insurance for older mobile homes needs an extra dose of vigilance. There’s the peril of the unknown, so ensuring comprehensive coverage is not just smart; it’s non-negotiable.

Additional Protections: Riders and Endorsements for Older Mobile Homes

Like jazzing up an outfit with a snazzy accessory, additional protections can be added to policies. Think of riders and endorsements as customizable trinkets for your insurance policy. They can range from protection for unattached structures—hello, sassy shed—to coverage that’ll keep you from sinking if your abode floods.

| Factor | Details | Impact on Insurance |

|---|---|---|

| Age of Mobile Home | Homes built before 1976 often lack modern safety standards due to less regulation at the time of construction. | May be ineligible for coverage or face higher rates due to increased risk. Some insurers specialize in coverage for these older units. |

| Wiring and Infrastructure | Outdated or exposed wiring can increase the risk of electrical fires and other hazards. | Insurers may deny coverage or charge higher premiums unless updates are made to meet safety requirements. |

| Presence of a Swimming Pool | Additional liability risks, especially if not properly secured. | Requires safety features like a fence for coverage. Without it, insurers might not offer coverage or may charge higher rates. |

| Defining Qualities of the Home | Unique architectural features might increase the home’s value and replacement cost. | Specialized coverage might be necessary, resulting in increased insurance rates compared to standard policies. |

| Data Plate Information | Contains details like date of manufacture, model number, manufacturer, and serial number, critical for identifying the mobile home type. | Helps insurers determine the exact details of the home for accurate coverage, possibly affecting eligibility and cost of insurance policy. |

| Current Regulations | Mobile homes built after 1976 must comply with HUD standards, ensuring better safety and construction quality. | Insurance is generally more accessible and affordable for homes that meet current standards. |

| Specialized Coverage Providers | Some insurers offer policies specifically for older mobile homes. | Allows homeowners to secure coverage that might not be available from standard insurers, possibly at higher rates due to increased risk. |

Top Providers of Insurance for Older Mobile Homes

A Critical Review of the Leading Mobile Home Insurance Companies

The “best mobile home insurance” isn’t a one-size-fits-all hat. There’s Foremost, strutting their stuff with experience in the game, and then there’s American Family, doling out a family-style helping of coverage options.

Comparative Analysis: Coverage Limits, Exclusions, and Premiums for Older Mobile Homes

Comparing these providers is like finding the right spices for your signature dish—it has to be just right. Coverage limits are the safety bubble wrap, while exclusions are the “do not enter” signs. Premiums? They’re the ticket price to that peace-of-mind show, and as expected, typically higher for the aged charm of an older mobile home.

State Farm Mobile Home Insurance: A Deep Dive

Analyzing State Farm’s Coverage Options for Older Mobile Homes

State Farm mobile home insurance might just be the attentive waiter to your insurance appetite. It offers a menu that caters to older homes as if they were valued patrons – with options that recognize the worth behind their vintage veneer.

Customer Experiences and Claims Process with State Farm Mobile Home Insurance

Word on the street or, shall we say, customer whispers, can give you the skinny on State Farm’s rep. With a claims process that’s generally as smooth as a well-oiled skateboard, they’re often hailed for their customer service, painting a pretty portrait of reliability.

Strategic Savings: Finding Affordable Older Mobile Home Insurance

Tips for Lowering Insurance Premiums on Older Mobile Homes

Let’s talk turkey, or rather, saving dough. Boosting security, tying the knot with multiple policies, and raising your deductible can trim those premiums down. It won’t make you a scrooge, but it’ll certainly fatten your wallet.

The Impact of Location and Local Risks on Mobile Home Insurance Costs

Just like How much Is it To break a lease isn’t a one-answer question, location colors the insurance cost picture. Living in Tornado Alley or Hurricane Road could see your rates spinning higher than a twister. It’s all about the risk, baby.

On the Horizon: Future Trends in Mobile Home Insurance

The Role of Technology in Managing and Purchasing Older Mobile Home Insurance

Tech’s taking the reins, and we’re all here to see it. Snapping pics of your home and sending them through an app could snag you an insurance quote while you’re lounging in your PJs—now that’s convenience.

Legislative and Policy Changes Affecting Mobile Home Insurance

Knowledge is power, and keeping tabs on the legal tango can stop you from a misstep. Policy makeovers could mean stricter codes, or even smiles all around with more comprehensive help for mobile home owners.

Safeguarding Your Investment: A Case Study on Older Mobile Home Insurance Success

Personal Stories: How the Right Insurance Package Can Save an Older Mobile Home in a Crisis

Nothing’s more telling than a real-life tale. That’s why we scour for stories that give life to the numbers, finding those moments when the right insurance turned a calamity into a sigh of relief. These anecdotes are the cautionary and celebratory bookmarks in the ledger of older mobile home insurance.

Expert Insights: Financial Advisors on the Value of Robust Mobile Home Insurance

Consider it the “been there, done that” advice—the financial gurus, advisors, and planners that can forecast a potential pitfall from a mile away. Their consensus? Don’t skimp on good cover. Like a trusty umbrella, it’s a small price for a big comfort when the rain pours down.

Crafting Your Insurance Strategy: Steps to Ensuring Comprehensive Coverage

Checklist for Older Mobile Home Owners Seeking Insurance Coverage

It’s checklist time! You’ll want to have your home details on lock, be clear on what you want to protect, and earmark those additional cover cherries you want atop your insurance sundae. It’s about being prepared to ensure no stone—or shingle—goes unturned.

Aligning Insurance Choices with Long-Term Housing Goals

Your game plan should mirror your life plan. If you’re set to stay in your home till the cows come home, then long-term, robust coverage is your knight in shining armor. If you’re on the move, flexibility in insurance might just be your perfect dance partner.

Paving the Way to Security: Protecting Your Older Mobile Home

How Robust Insurance Strengthens Your Financial Safety Net for Mobile Homes

A robust insurance policy is your financial safety net—there to catch you when freefall seems imminent. It keeps you afloat when the murky waters of mishap try to pull you under. It’s like having a financial Batman at your beck and call.

Real-Life Scenarios Where Older Mobile Home Insurance Made a Difference

Imagine if a tree decides to get cozy with your living room after a storm, or if a fire uses your curtains to stage a dramatic performance. These are not ifs, but whens—stories with happier endings when proper insurance steps onto the stage.

Charting a Course to Peace of Mind with Your Mobile Home Insurance

Reflect on the benefits a thorough insurance plan offers for your mobile home’s longevity. As you navigate through the shoals of mobile home ownership, innovative insurance solutions and a proactive approach to homeownership empower you to secure not just a home, but a thriving lifestyle._ALIGN YOUR FUTURE__* with the ideal older mobile home insurance, and sail towards a horizon of security and serenity.

From scrutinizing the implications of default on mortgage to understanding the nuances of older mobile home insurance, your responsibility is as great as your home’s value. Owning an older mobile home is not just being part of a legacy; it’s stepping into a life rich in character and challenges—a distinctive journey that Mortgage Rater is here to support with tailored, empathetic insight into the landscape of mortgages and home insurance.

Fun Trivia & Interesting Facts on Insuring Your Seasoned Mobile Home

Get a Load of This!

Did you know that insuring an older mobile home can feel like trying to square dance in a round room? It’s a unique challenge, but boy, is it vital! Just like a fine wine, your mobile home might have aged gracefully, but that doesn’t mean it’s immune to the occasional hiccup that life throws its way.

A Blast from the Past

Older mobile homes are like time machines – they take us back to a different era of construction and style. But here’s a quirky tidbit: some insurers look at these homes like a prized antique spoon collection – they’re special, they’ve got history, but they can be a tricky thing to cover!

Rolling with the Times

Now, strap in for this rollercoaster fact – mobile homes constructed before the mid-1970s are vintage darlings in the housing world. Why’s that, you ask? Well, it’s because these old-timers were built before HUD standards were set in ’76, making them the rebels of the housing codes back in The life( when bell-bottoms were all the rage.

Age Ain’t Nothing but a Number

Let’s hit the brakes for a sec – while you might think that older mobile homes are as tough to insure as nailing jelly to a tree, they still have some aces up their sleeves. These classics were made in an era when things were built to last. And hold your horses, because many insurers are totally on board with that!

Don’t Judge a Home by Its Chassis

Figuratively speaking, if your mobile home’s been around the block more times than a seasoned marathon runner, then you’ve probably got character and reliability on your side. With some tender loving care, your older mobile home can stand tall and proud, scoffing at “newbies” half its age.

Remember, finding the perfect coverage for your trusty mobile abode may seem like fishing in the dark, but once you reel in the right policy, you’ll have peace of mind and a home that’s all set for whatever the wind blows its way. So keep those spirits up and those wheels firmly planted—you and your home are in it for the long haul!

What makes an old home uninsurable?

Oh boy, trying to insure an old home can be like trying to fit a square peg in a round hole! Insurers may balk at covering it if there are outdated electrical systems, old plumbing, a worn-out roof, or if the house hasn’t been well-maintained. It’s like they’re saying, “Too much risk? No dice!”

Are older homes harder to insure?

Are older homes harder to insure? Well, in short, you bet they are. Older homes often come with a side of issues that make insurers nervous – think dated wiring or plumbing that’s seen better days. It’s kinda like trying to put on a pair of jeans from high school…a tight squeeze!

Can you get insurance on an older mobile home in Florida?

Now, insuring an older mobile home in Florida isn’t exactly a walk in the park, but it’s not impossible either. You might have to hunt around for a company specializing in coverage for these vintage abodes, and when you find one, they’ll likely want the nitty-gritty details on its condition and upkeep.

How do I find out the age of my mobile home?

Curious about your mobile home’s age? Simply peek inside the electrical panel or kitchen cabinets for a data plate hiding like a shy cat. This little gem should spill the beans on when your mobile home rolled off the assembly line.

Is it hard to get homeowners insurance after being dropped?

After your insurer has given you the boot, snapping up new homeowners insurance can be tricky—sort of like trying to mend a burnt bridge. But stay positive! You’ll likely need to explain what went awry and show you’ve made fixes. Remember, honesty’s your best policy here!

What happens if my home is uninsurable?

Suffice it to say, if your home’s deemed uninsurable, you’ve hit a snag. But it’s not the end of the road. You can turn to a state-run FAIR plan as a last resort, though it’s kinda like clinging to a life raft—it’ll keep you afloat, but it’s not the Queen Mary.

What is the best homeowners insurance for seniors?

For the best homeowners insurance for seniors, it’s all about finding that sweet spot—a policy that doesn’t break the bank but still has your back. Many companies roll out the red carpet with discounts and tailored coverage that fits like a glove.

Which homeowners policy is designed to cover an older dwelling?

If you’ve got an oldie but a goodie, a HO-8 policy could be your knight in shining armor. It’s decked out to protect older homes, paying out based on repair costs or functional replacements without breaking a sweat over the actual cash value.

Why do older homes cost more to insure?

Here’s the deal with older homes and insurance: they can cost an arm and a leg to cover. Why? Because they often need TLC and can be as unpredictable as a game of bingo—so insurers hike up rates to cover their bases.

What is the average cost of mobile home insurance in Florida?

In the Sunshine State, the cost of insuring your mobile home is about as steady as a Florida weather forecast. But on average, folks could be shelling out somewhere in the ballpark of $1,000 to $2,000 per year, depending on their place’s specifics.

What is a mobile home policy the same as?

If you’re scratching your head about whether a mobile home policy is like a regular home insurance policy, here’s the scoop: they’re cousins, not twins. Mobile home policies are tailored suits that fit the unique needs of mobile or manufactured homes.

Do mobile homes qualify for homestead exemption in Florida?

Good news for mobile home owners in Florida! You can still plant your flag and claim a homestead exemption, just like with a traditional house. It’s a little golden ticket that can help reduce your property taxes.

Is a mobile home VIN and serial number the same?

When it comes to a mobile home, VIN and serial numbers are like two peas in a pod – they’re the one and the same. This duo of digits is the secret handshake that identifies your home in the big, wide world.

What if I can’t find the VIN number on my mobile home?

No VIN on your mobile home? Don’t throw in the towel just yet. Look in every nook and cranny—closets, cabinets, or under the sink. It’s playing hide and seek, and if you still come up empty-handed, your local DMV or HUD label verification letter might help.

Do mobile homes have serial numbers?

Yup, mobile homes have serial numbers. They act as home’s fingerprints, unique as a snowflake, ensuring your abode isn’t just another face in the crowd.

What does it mean that a property is uninsurable?

When a property’s labeled uninsurable, it’s the red flag on the play. It means the home’s in such a pickle, insurance companies won’t touch it with a ten-foot pole – often due to its condition or a risky location.

What makes you uninsurable?

Being uninsurable is like having a “Do Not Insure” sticker plastered on your forehead. It can happen if you have a chronic illness with a prognosis that makes insurance companies see you as a high-stakes gamble.

Can you get a mortgage on an uninsurable house?

If you’re hankering after a mortgage for a house that’s uninsurable, you’ll find lenders tend to give you the cold shoulder. They need the safety net of insurance, otherwise, they’re as jittery as a long-tailed cat in a room full of rocking chairs.

What voids homeowners insurance?

Voiding your homeowners insurance is easier than you’d think. It can be something like filing too many claims, leaving the house unoccupied without telling them—surprise!—or even doing something risky, like turning your home into the set of a stuntman’s show without a heads up. Play it by the book to keep your coverage on the straight and narrow.