Preapproval for Mortgage: Steps to Secure Your Financing

Homeownership is a significant milestone for many Americans, representing stability, security, and a place to call your own. If you’re thinking about buying a home, one of the first steps you should take is to get preapproved for a mortgage. This process not only paves the way for successful home buying but also helps you grasp your financial position and enhances your buying power. In this article, we’ll dive deep into the essential elements of mortgage preapproval and explain why it is crucial in today’s market.

7 Reasons Why Mortgage Preapproval is Essential for Homebuyers in 2024

When you get preapproved for a mortgage, lenders take a close look at your financial situation. This assessment gives you an accurate picture of how much you can borrow. For instance, if you’re preapproved for $250,000, you’ll know exactly where to focus your house-hunting efforts. Having this financial clarity allows you to cast your net in the right price range, making the process much smoother.

Holding a mortgage preapproval letter in your hand can significantly boost your credibility with sellers. In a fiercely competitive market, presenting a preapproval letter proves you’re a serious buyer. Sellers often prefer offers from buyers who are preapproved, as it signals that you have the finances and commitment to proceed. This can lead to smoother negotiations, potentially securing a lower purchase price.

Once you have preapproval, the home shopping experience transforms. If you’re preapproved for a mortgage of $300,000, you can focus only on homes listed within that range. This targeted approach saves time and reduces the emotional rollercoaster that often accompanies house hunting. You can confidently visit homes, knowing they fit your budget and financial goals.

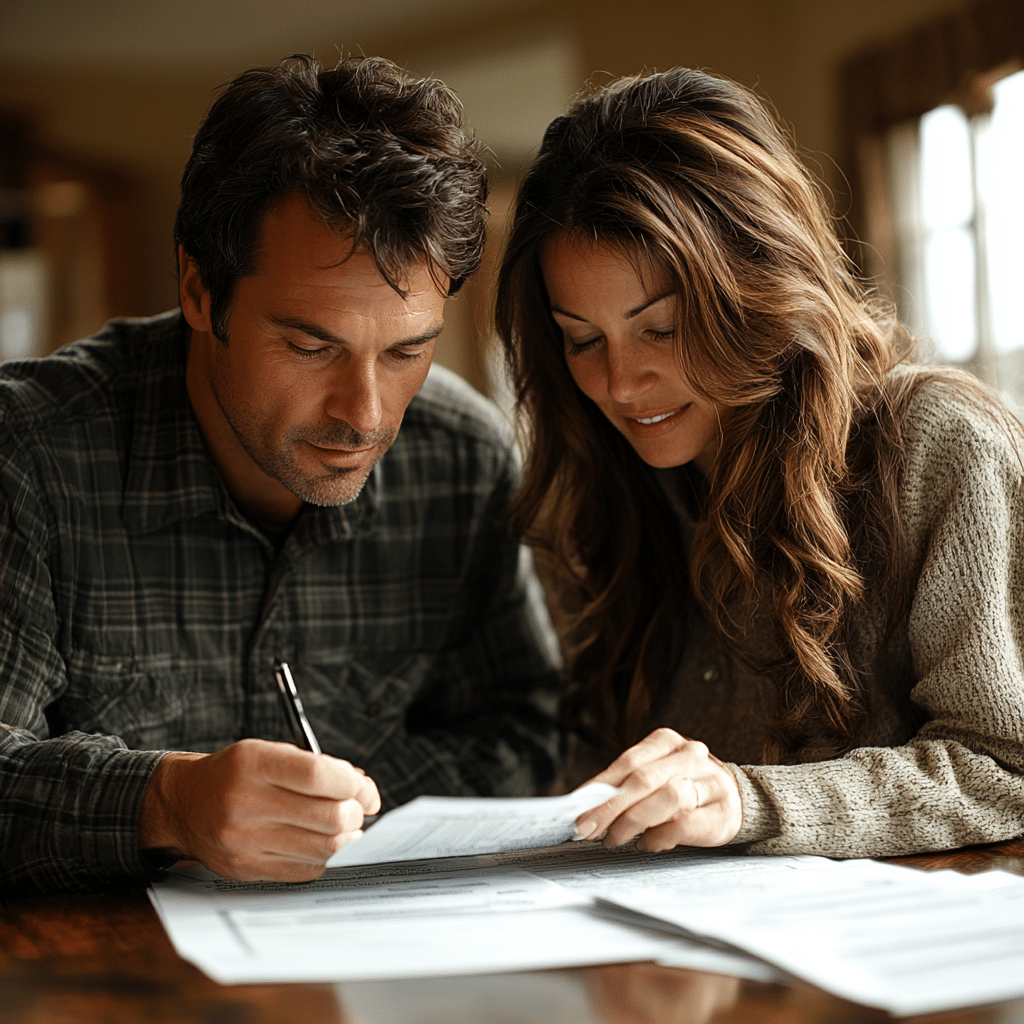

Preparing for homeownership becomes a lot quicker with preapproval. Since much of the paperwork is handled early on, you can speed up the closing process. For example, some lenders can reduce the typical 30-day closing period to as little as 20 days for preapproved buyers. This speed can be critical in competitive markets, allowing you to move into your new home sooner.

With a mortgage preapproval, you’re not just checking how much you can borrow; you’re also identifying any potential pitfalls. If your credit score needs work, for example, getting preapproval gives you time to remedy these issues before you go full throttle into the home-buying process. Tools like Experian can help you keep tabs on your credit and signal if you need to take action.

Did you know that having a preapproval can lead to better mortgage rates? Lenders want to work with serious buyers, which could translate into more competitive rates. Specifically, clients who already have their paperwork in line often report securing rates that save them money over the life of their loans. That’s where the right lender can make a massive difference.

Obtaining a mortgage preapproval opens the door to a variety of loan options tailored to your financial situation. For example, if you qualify for a VA loan, lenders can offer competitive rates with zero down payment. By obtaining preapproval, you can explore what’s available, such as VA refinance mortgage options and even Assumable VA Loans.

The Steps to Get Preapproved for a Mortgage

Getting preapproved for a mortgage doesn’t have to be complicated. By following these solid steps, you can make the process straightforward and stress-free.

Start by collecting your tax returns, recent bank statements, and pay stubs. This documentation helps the lender get a full picture of your financial health. Being organized can streamline your application process.

Don’t settle for the first lender you find. Shop for prequalification for mortgage options via phone or online. For example, lenders like Rocket Mortgage provide a swift application process, resulting in preapproval in as little as 24 hours. The right lender can make all the difference, so take time to find what suits your needs.

Fill out your mortgage application thoroughly, making sure to be as accurate as possible. Incomplete or erroneous information can lead to delays, and we all know how frustrating that can be.

Expect the lender to perform a hard credit inquiry during the process. Before you get to this step, it’s wise to know your credit score. This knowledge can help you prepare for any surprises.

Once your application is reviewed, and everything checks out, the lender will issue a preapproval letter. This letter details how much you can borrow and under what terms. Hold onto this letter; it can be a game-changer in your home-buying journey.

Life can throw curveballs, and changes in your financial situation can affect your preapproval status. If something significant occurs—like a new job or a big purchase—keep your lender informed. This proactive approach can save you from future complications.

Navigating Your Homeownership Journey Post-Preapproval

When you’ve got that preapproval in your pocket, it’s time to hit the ground rolling in your home search. Stay engaged with your lender and keep the lines of communication open as you look for a home that ticks all your boxes.

Working with a qualified real estate agent can also lighten your load. An agent understands the local market and can help you leverage your preapproval during negotiations. They can serve as your guide through this whole process, ensuring you find the right home within your budget.

Remember, the journey toward owning your first home isn’t just about picking the right place; it’s about ensuring you have a solid financial foundation. With preapproval for a mortgage, you’re setting yourself up for success in this exciting venture.

In summary, mortgage preapproval isn’t just a box to check; it’s the vital key that unlocks the door to homeownership. As you prepare and strategize, you’ll navigate the home-buying landscape with newfound confidence, setting you on the path to realizing your dream.

Preapproval for Mortgage: Fun Trivia and Interesting Facts

What is Preapproval for Mortgage?

Did you know that getting preapproval for mortgage is your secret weapon in the home buying journey? With preapproval, lenders assess your financial standing before you start house hunting, putting you in a stronger position when tapping into the market. It’s similar to how a chainsaw man plush gives you a fun, quirky edge in conversation, showing you’re serious about your interests. But, unlike that plush, preapproval is all about hard numbers and ensuring that you’re ready to bid.

The Perks of Preapproval

So, why is preapproval such a hot topic? Well, it can significantly speed up the closing process since lenders already have your financial info on file. Plus, it demonstrates to sellers that you mean business. You wouldn’t throw a party without checking your guest list, right? Just like you wouldn’t want to look at homes before securing that preapproval. Plus, if you’re a veteran, exploring options like a VA loan refinance can offer savings on your mortgage, further elevating your financial game.

Understanding the Market

A quick fact: in today’s market, competition is fierce! Having preapproval can mean the difference between snagging your dream home versus losing it to someone who jumped in quicker. Think of it like knowing your state lotto numbers beforehand—you’d feel a lot more prepared when the winning ticket is drawn! Speaking of preparation, understanding the cost of VA loan closing Fees can help you plan your budget effectively. And if you’re consolidating debts to boost your mortgage capabilities, consider looking into a debt consolidation loan chase.

In essence, securing preapproval for mortgage isn’t just paperwork; it’s an adventure packed with potential savings and opportunities for anyone looking to call a place home. Always be ready, just like a beach trip to the Delaware beach—you never know when the perfect moment will arise! Plus, being informed can put you in the same league as industry pros, like Blake Bozeman, who navigate these waters with ease.