Navigating the world of finances can often feel like walking through a labyrinth in platform Boots, stylish but a tad overwhelming. Amidst this complex financial realm, “prepaid expenses” emerge as an intriguing aspect that warrants a meticulous exploration for both individuals and businesses. They have a knack for popping up on balance sheets, often sprouting several questions along the way. Are they truly a smart money move? Let’s stride into the intricate world of prepaid expenses and discern their roles in our financial strategies.

Navigating the World of Prepaid Expenses

Prepaid Expense

$0.99

Title: Prepaid Expense

Prepaid Expense is a forward-thinking financial management tool designed to streamline the accounting process for businesses of all sizes. This innovative product allows companies to accurately record and track their advance payments for expenses such as insurance, rent, and subscriptions, ensuring precise financial reporting and compliance. Its user-friendly interface provides a clear overview of upcoming expenditures, enabling better cash flow management and budget planning. Prepaid Expense is equipped with customizable reminders and alerts to prevent missed payments, keeping your business operations smooth and uninterrupted.

Beyond just tracking, Prepaid Expense integrates with most major accounting software, automating the amortization of pre-paid costs over their applicable periods. This pivotal feature saves valuable time for accountants by automatically adjusting the expense entries as they become due, enhancing the accuracy of monthly and annual financial statements. The productâs detailed analytical reports help management gain insight into their spending patterns, allowing for strategic financial decisions to be made with ease. Thanks to its robust security measures, users can rest assured that their sensitive financial data remains protected at all times.

For businesses looking to optimize their financial processes, Prepaid Expense stands out as an essential asset. Not only does it provide a comprehensive solution to managing prepayments, but it also offers scalability to grow with your business. Its cloud-based infrastructure ensures that users have access to real-time data whenever they need it, from any device with internet access. With Prepaid Expense, businesses can finally say goodbye to the complexities of managing prepaid costs and hello to streamlined efficiency.

Understanding the Basics: What are Prepaid Expenses?

Oh, the ever-mystifying prepaid expenses! Simply put, they are payments for services or goods received in the future, yet paid for upfront. As of November 3, 2023, in the business lexicon, we embrace them as assets on the balance sheet due to their future economic benefits. They’re like planting a seed, anticipating the blossom of services or goods down the line.

When it comes to prepaid expenses appear in the, they strut onto the balance sheet under current assets. But remember, they get a bit coquettish, transitioning to an expense on the income statement when the time or service period lapses.

Pack Spending Account Tracker Notebooks, Expense Ledger Books for Small Business Bookkeeping, Money Tracker Notebook, Company Supplies for Finances (Pages)

$18.99

Stay organized with the Pack Spending Account Tracker Notebooks, your on-the-go solution for meticulous record keeping and financial clarity. Each notebook in the pack features a clear and user-friendly layout, allowing you to log expenses, track account balances, and monitor your budget with precision. Perfect for small business owners, freelancers, and anyone dedicated to detailed bookkeeping, these Expense Ledger Books are designed with durability and practicality in mind, ensuring your financial records are always easily accessible and well-maintained.

This Money Tracker Notebook comes complete with labeled sections for date, description, amount, and balance, making it a breeze to categorize and reference transactions. Its compact size means it can effortlessly fit into a briefcase or desk drawer, while the high-quality pages ensure that ink won’t bleed through, keeping your entries neat and legible. The ledger’s sturdy construction stands up to daily use, making it a reliable companion for busy entrepreneurs and company staff who require consistent financial tracking.

As an integral part of your Company Supplies for Finances, this notebook elevates your business accounting to the next level. With the ability to keep multiple books for different accounts or departments, the organizational possibilities are endless. The Pack Spending Account Tracker Notebooks deliver an economical and efficient method for managing your business finances, serving as a foundational tool for your companyâs success. Say goodbye to scattered receipts and financial confusion; with these notebooks, you’ll have a tangible and reliable record of your company’s fiscal activities right at your fingertips.

The Pros and Cons of Prepaying Expenses

Is prepaying akin to catching the proverbial worm or setting money on fire? Here’s the lowdown:

Advantages of Prepaid Expenses:

– Cash Flow Management: Like a financial chess game, it’s all about planning moves ahead.

– Budgeting Benefits: Locking down costs can soothe those budgeting nerves.

– Potential Discounts: Who doesn’t love a good deal? Prepay and you might just snag one!

Downsides to Consider:

– Reduced Liquidity: Tying up funds early? That can sometimes feel like a straightjacket for your cash.

– Opportunity Costs: Investing elsewhere could have offered better returns. It’s the classic ‘what if’ scenario.

Prepaid Expenses in Action: Real World Applications

Ever peek into some businesses and see them dancing with prepaid expenses like they’re old flames? These companies often revel in the budget predictability that prepaid expenses provide.

Each industry has its rhythm with prepaid expenses, leveraging them as strategic financial instruments.

Prepaid Insurance: A Closer Look at a Common Prepaid Expense

Consider prepaid insurance the bread and butter of the prepaid expenses world. Paying for coverage ahead of time can insulate against premium hikes and simplify budgeting. Sounds like smooth sailing, right?

Yet, there lurks a riptide. The risk of overpaying and the potential of an unnecessary financial buffer could twist the arm of your cash flow. Individuals and businesses must analyze their coverage needs meticulously to prevent these pitfalls.

S&O Income and Expense Tracker Notebook for Better Money Management Bookkeeping Record Book Income and Expense Log Book Small Business Ledger Books for Bookkeeping Pages, â x â

$6.99

The S&O Income and Expense Tracker Notebook is an essential tool for individuals and small business owners who aspire to take control of their finance through better money management. With its intuitive layout, users can effortlessly track their daily, weekly, and monthly income alongside expenses, providing a clear overview of their financial health. This bookkeeping record book is meticulously designed for simplicity and functionality, allowing for quick data entry and at-a-glance assessments of financial standings. Its compact size of “x”, combined with a durable cover, makes it an easy and reliable companion for on-the-go financial tracking.

A key feature of the Income and Expense Log Book for small businesses is its structured ledger pages that aid in maintaining organized records, ensuring that all financial movements are accounted for. Each page is clearly divided, with ample space for noting down descriptions, dates, amounts, and additional details vital for comprehensive bookkeeping. The ledger’s user-friendly format is suitable for those new to financial record-keeping as well as seasoned bookkeepers looking for a streamlined solution. Moreover, the high-quality paper ensures that the ink doesn’t bleed through, making every entry neat and legible.

As part of the Ledger Books for Bookkeeping series, this notebook is not only a practical tool but also a part of a professional system designed to support financial clarity and growth. It serves as a reliable basis for reports, tax preparation, and strategic planning for future financial endeavors. Users will appreciate the peace of mind that comes from having a tangible and up-to-date record of their financial activity. With pages dedicated to income and expenses, this tracker notebook empowers users to create a more informed and pro-active approach to managing their finances.

Smart Strategies for Prepaying Expenses

“Knowledge is power,” as they say, and truly, it’s the golden key to prepaying expenses wisely. By answering “Which payment option Could have interest charged To You ?“, you dive deeper into the cost implications tied to various payment methods. This critical thinking is invaluable when considering prepaying.

Through these maneuvers, one can maneuver through the minefield of preemption without blowing the budget.

The Impact of Prepaid Expenses on Financial Statements

Onlookers, like investors and creditors, view prepaid expenses with a hawk’s eye. On the financial statements, these entries influence liquidity perceptions and could sway the attractiveness of your business.

Tax aficionados, get this: prepaid expenses can defer tax liabilities, parlaying into short-term financial relief. But don’t let this temporary reprieve lead to complacency, as the ticking tax clock never really stops.

Prepaid Expense

$0.99

“Prepaid Expense” is a user-friendly accounting software tailored specifically for businesses that need to keep track of their advance payments for future expenses. This innovative software solution allows companies to manage and record their prepaid costs such as insurance, rent, or subscription services with ease. With its robust reporting features, users can generate detailed financial statements, ensuring that all prepaid expenses are accurately amortized over the appropriate periods.

The platform’s intuitive dashboard simplifies the complex accounting process by providing real-time visibility into the status of your prepaid expenses. Users can set up automatic expense recognition schedules, which release the prepaid amounts into expense over the period of benefit, guaranteeing that financial statements adhere to the matching principle of accounting. This prevents firms from overstating assets or understating expenses, maintaining compliance with accounting standards.

Security is a top priority for “Prepaid Expense,” incorporating the latest encryption technology to safeguard sensitive financial data. Additionally, the software offers multi-user access, with customizable permission levels that ensure team members can only access information relevant to their roles. With “Prepaid Expense,” businesses can focus on strategic financial planning, confident in the integrity and accuracy of their prepaid expense accounts.

Prepayment in the Age of Digital Finance

Hark, a digital dawn is upon us! Navigating prepaid expenses is now a cybernetic affair. Innovative platforms have simplified the management marathon of prepaid expenditures, turning a tedious task into a sprint.

The role of technology is reshaping the prepaid expenses landscape, introducing a world where budgeting and payment integrate seamlessly into user-friendly dashboards.

![]()

Are Prepaid Expenses Truly a Smart Money Move?

Buckle up, as we dive into an analysis of whether prepaid expenses are a financial panacea or a Pandora’s box in disguise. From the seasoned wisdom of experts, we glean that context is king. Timing, cash flow considerations, and the broader financial strategy orchestrate the symphony of this decision.

With expert insights juggling these variables, the perplexing question of prepayment potency begins to unravel, offering a clearer picture of when and how to wield this financial tool.

Beyond the Last Ledger: Wrapping Up the Prepaid Expenses Debate

Prepaid expenses – they’re neither a hero nor a villain in the annals of accounting. Like a well-seasoned dish, they require a balance of ingredients and timing to truly shine. With one finger on the pulse of your cash flow and an eye on long-term goals, prepaying expenses can be a deft move.

As we part, consider prepaid expenses not just a line item on a balance sheet, but a strategic element in the intricate dance of personal and business finance. Whether they morph into a smart money move is a pas de deux between context and savvy management. Consider your steps carefully, and may your financial ballet be ever graceful!

![]()

What would be considered prepaid expenses?

Alrighty! Here’s the scoop on these money matters, folks:

What accounts are prepaid expenses on balance sheet?

Prepaid expenses? Think of ’em like paying for your coffee before you actually sip it. They’re costs paid upfront for goods or services you’ll use eventually, like insurance or rent for the future.

What are prepaid assets examples?

On the balance sheet, prepaid expenses are kinda like eager beavers sitting under current assets, ready to be used up within the year or play their part in the future.

What is the most common prepaid expense?

For prepaid assets examples, picture things like pre-paying your rent, getting insurance ahead of time, or even stockpiling office supplies before you’ve scribbled a single note.

What is an example of a prepaid expense entry?

The most common prepaid expense? Insurance! Everyone’s rushing to get covered before the rain starts pouring, you know?

What are three golden accounting rules?

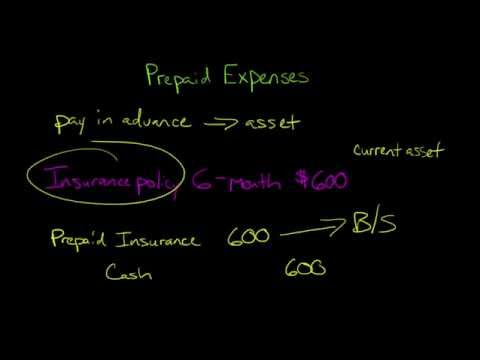

An example of a prepaid expense entry? Say you fork out some cash for six months of insurance; debit that prepaid insurance account and credit cash, showing you’ve paid but not used it all just yet.

How do you record prepaid expenses in accounting?

The three golden accounting rules are like the Three Musketeers of bookkeeping: (1) Debit the receiver, credit the giver, (2) debit what comes in, credit what goes out, and (3) debit expenses and losses, credit incomes and gains.

What is the 12 month rule for prepaid expenses?

To record prepaid expenses in accounting, it’s like setting the table before dinner; debit the prepaid expense account for the future benefit and credit cash or accounts payable for the outgoing dough.

What accounts do not appear on a balance sheet?

The 12-month rule for prepaid expenses is like a “use it or lose it” gym pass – if the service or product will get used up within a year or the business cycle, whichever’s longer, slap it on the balance sheet as a current asset.

How do you amortize prepaid expenses?

Accounts that play hide-and-seek and don’t appear on a balance sheet include owners’ draws and revenues – these are more like the behind-the-scenes action happening in the business.

What is the difference between prepaid expenses and advance payments?

Amortizing prepaid expenses is like slicing your grandma’s pie – you take a little each month and spread the cost over the period you’re benefiting from the expense.

What type of account is prepaid asset?

Prepaid expenses vs. advance payments? Well, it’s like ordering a pizza for tonight (prepaid expense) versus giving your buddy cash to pay you back later (advance payment).

Where are prepaid assets on balance sheet?

Prepaid asset account? It’s like a savings piggy bank for future expenses; you’ve tucked away the cash, labeled as a current asset, and it’ll help cover costs when the time comes.

What company would have a lot of prepaid assets?

Prepaid assets strut their stuff on the balance sheet under current assets, ready to turn into expenses or get used up within the year.

Is prepaid asset a monetary asset?

A company that would have a lot of prepaid assets might be like a big event planner, always booking venues and services way before the party starts.