Stress and tax time go hand in hand like beans and rice, but it doesn’t always have to be that way. Especially when you’re dealing with the ever-important Schedule E tax form. But before you start pulling your hair out, take a deep breath, and let’s navigate this mortgage landscape together.

I. Tackling the Schedule E Tax Form: An Overview

Like the United Polaris is not an ordinary airplaine, this is not your ordinary tax form, the Schedule E tax form is your ticket to properly declaring income or losses from real estate investments, royalties, partnerships, S corporations, estates, trusts, and other income sources. This humble paper could mean the difference between keeping your head above water or drowning in penalties.

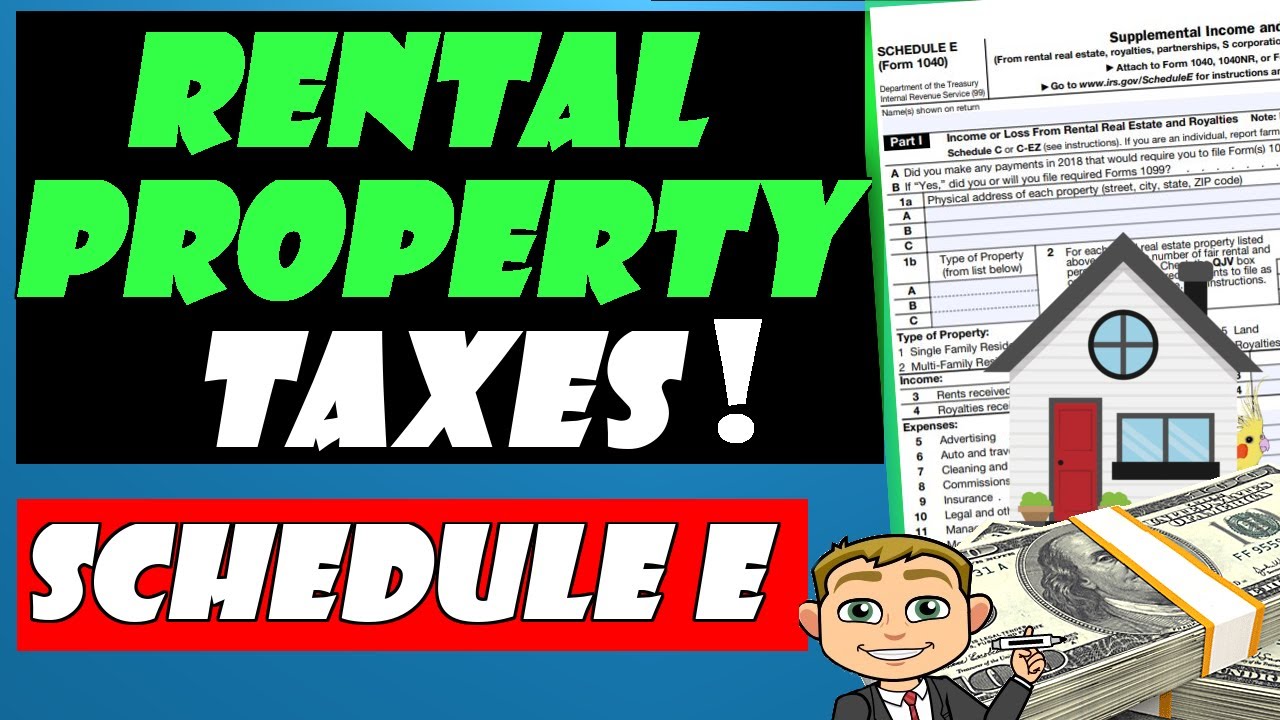

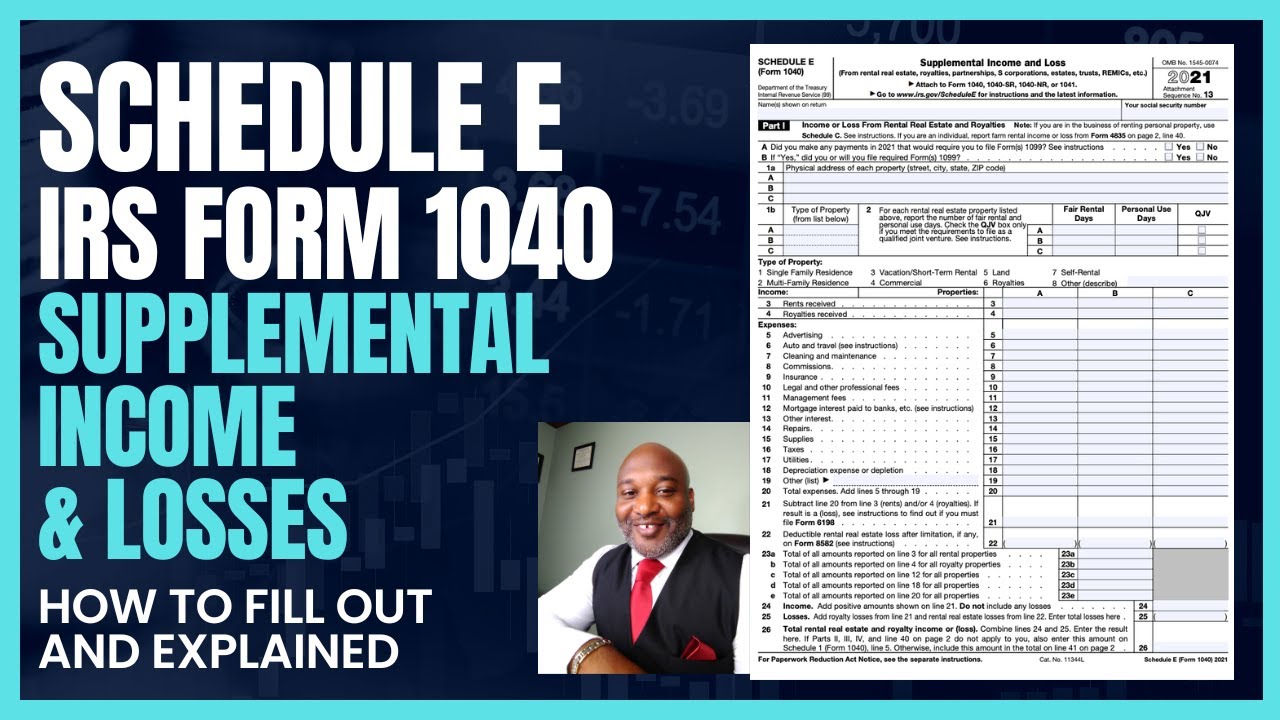

II. What is Schedule E tax form?

In its simplest definition, the Schedule E tax form is a document that taxpayers need to fill out to report supplemental income or loss. It could be from different sources like your chic rental downtown, a juicy partnership deal, or perhaps even royalties from a secret rockstar past. Just remember though, this is not to be confused with other schedules named E – we are talking about the 1040 Schedule E here.

III. Who needs to fill out Schedule E?

Now you might be asking, “Does this apply to me?” Well, do you own rental properties? Do you have interest earnings from partnerships or S corporations? Heck, even Ana de Armas and Emma Watson might need this form for their respective hot and potentially leaked royalty incomes in tinsel town! Jokes aside, if there’s supplemental income, then Schedule E is your trusted companion in presenting these details to the IRS.

IV. The Many Faces of Schedule E: A Closer Look

Diving deeper into Schedule E, you’ll notice it has several fraternities. The prominent one is the 1040 Schedule E which is used by individual taxpayers to disclose income and loss from the mentioned sources. Then there’s the Form 8825, the Schedule E for partnerships and S corps. It’s like the lead guitarist to the lead singer Schedule E – different roles, but both essential to the band.

V. Step-by-step guide on Filing Schedule E

Step 1: Understanding the Schedule E Instructions

There will be guidelines, there will be instructions. Be sure to dissect them thoroughly, else you might be in for a disappointing gig. The Schedule E tax form’s instructions are your backstage pass to getting the filing right.

Step 2: Identifying Your Income Sources

Knowing where your money comes from is paramount. Is it from your rental income or your trusty S corporation shares? This stage is akin to tuning your guitar before stepping on stage – crucial!

Step 3: Accurate Record Keeping

Cash basis accounting is the way to go if you want an accurate depiction of your income and losses. Just like keeping track of your setlist during a gig, every song (or transaction) counts.

Step 4: Filling Out the Form

Now, we get to the meat of the matter – filling out that Schedule E tax form. This process is comparable to writing your song lyrics – you need to be clear, thorough, and honest!

Step 5: Making Use of Tax Software

Can you file Schedule E on TurboTax? Absolutely! Just like auto-tune can save a shaky live show, tax software is there to safeguard your filing process and make sure it hits all the right notes.

Step 6: Verifying and Reviewing

Double-check, triple-check if you must. Your performance doesn’t end when you move away from the mic – and the same applies to your form. It’s not ready until you’ve reviewed and checked it off.

Step 7: Filing the Schedule E Tax Form

The final bow, submitting the form to the IRS. It’s the encore after a well-performed gig. But remember, the show isn’t over till the form has reached its destination.

VI. How does the IRS know if I have rental income?

For all its good and complicated sides, remember that honest taxpayer vibe? It applies here too. Lying low on rental income would be like lip-syncing in a live concert – sooner or later, the truth comes out. The IRS has mechanisms to identify records on rental income, similar to how followers spot a mortgage interest on a 1098 form. So, keep it real and declare straight!

VII. Pro Tips for a Worry-Free Schedule E Filing Experience

Just like seasoned artists passing on advice, we’ve got some insider tips to make your Schedule E filing experience a breeze. From employing tax software to hiring a professional for complicated cases, remember that there is help available. The key is to stay organized, accurate, and honest.

VIII. Navigating the World of Taxes with Grace

At the end of the day, whether you’re filing the Schedule E tax form or any other, being a responsible taxpayer is crucial. This process doesn’t have to be a stress inducer. With the right approach and guidance, much like mastering the correct chords, you can handle your taxes with grace.