Demystifying the Simple Mortgage Payment Calculator

In 2024, the mortgage market is a bustling and complex field. This makes selecting the right mortgage calculator more crucial than ever for homeowners. A simple mortgage payment calculator is an essential tool, whether you aim to buy a home, refinance, or get a better grasp of your current mortgage. Here’s an in-depth guide to understanding and choosing the best simple mortgage payment calculator.

Advantages of Using a Simple Mortgage Payment Calculator

Accurate Financial Planning

One of the major benefits of using a simple mortgage payment calculator is precise financial planning. With a tool like the rate calculator mortgage, you can input different loan amounts, interest rates, and terms to see how these variables influence your monthly payments. This helps in carving a solid financial plan.

Real-time Decision Making

In today’s rapid real estate market, access to real-time data is a game-changer. Tools like The mortgage calculator provide instant results, aiding potential homeowners in making swift and informed decisions.

Ease of Use and Accessibility

Simplicity is key with financial tools. A tool like the total mortgage cost calculator boasts an easy-to-use interface that’s highly accessible, making it invaluable for both first-time buyers and seasoned investors.

| Feature/Item | Details |

| Loan Amount | Varies by user input (Example: $100,000, $400,000, $500,000) |

| Annual Interest Rate (APR) | Varies by user input (Example: 6%, 7%, 7.1%) |

| Loan Term | Typically 15, 20, or 30 years |

| Monthly Interest Rate Calculation | Annual Interest Rate ÷ 12 (Example: 0.06 ÷ 12 = 0.005 for a 6% APR) |

| Formula for Monthly Payment | Principal × Monthly Interest Rate |

| Example Calculation | $100,000 × 0.005 = $500 per month |

| Monthly Payment for $500,000 Loan | $3,360.16 (30-year loan term at 7.1% interest rate) |

| Annual Payment for $500,000 Loan | $40,321.92 |

| 15-year vs 30-year Loan Comparison | $400,000 Loan at 7% APR: 15-year = $3,595/month, 30-year = $2,661/month |

| Additional Costs | Insurance and property taxes not included |

| Acceleration Tips | – Increasing monthly payments – Bi-weekly payments – Extra principal payments |

| Other Acceleration Methods | – Cutting expenses – Increasing income – Lump sum payments from windfalls |

| User Benefits | – Clear insight into monthly payment responsibilities – Options for quicker loan payoff |

Understanding Key Inputs of a Simple Mortgage Payment Calculator

Principal Loan Amount

The principal loan amount is the initial size of the loan or mortgage. It’s vital as it forms the base from which interest payments and mortgage costs are calculated. For example, using the principal loan amount, you can experiment with the simple mortgage payment calculator to see how different loans affect your monthly payments.

Interest Rate

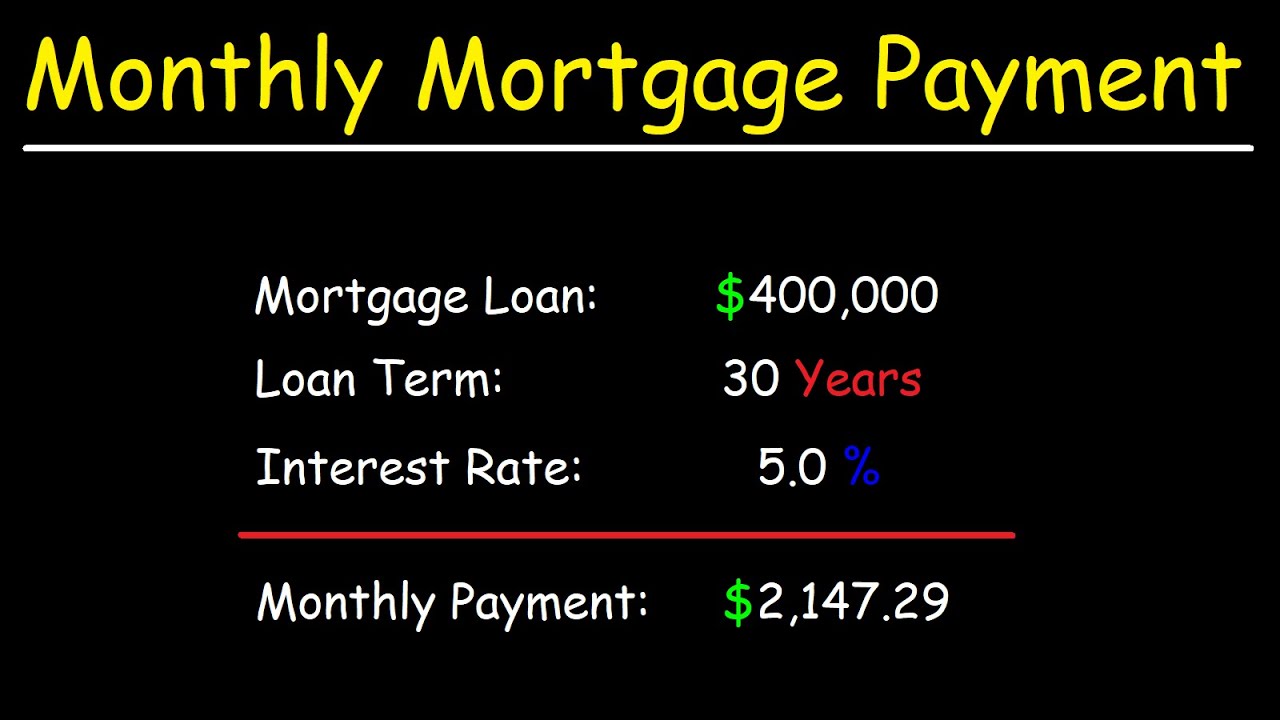

The interest rate significantly impacts the total mortgage cost over its term. Calculators can help you adjust the interest rate, providing a clear picture of how minor rate changes affect monthly payments. For instance, at a 6 percent annual interest rate, divide 0.06 by 12 to get a monthly rate of 0.005. Multiply this by your loan amount, say $100,000, to get a $500 monthly payment.

Loan Term

The loan term, often ranging from 15 to 30 years, influences your payment schedule. Using a simple mortgage calculator, you can compare shorter and longer loan terms. For example, on a $400,000 mortgage at a 7% fixed rate, the monthly payment for a 15-year loan is $3,595, while a 30-year loan is $2,661, excluding insurance or property taxes.

The Best Simple Mortgage Payment Calculators of 2024

Bankrate’s Mortgage Payment Calculator

Bankrate’s tool is noted for its detailed yet straightforward approach. It provides comprehensive breakdowns of principal, interest, taxes, and insurance (PITI), crucial for precise mortgage planning.

NerdWallet’s Mortgage Calculator

NerdWallet includes an intuitive interface and educational components, guiding users through the mortgage process. This calculator provides real-time updates considering current market rates, enhancing reliability for all homebuyers.

Zillow’s Mortgage Calculator

Zillow’s tool integrates seamlessly with their real estate listings, allowing users to view potential homes and calculate mortgage payments concurrently. This feature renders it highly valuable for those aiming for a seamless home-buying experience.

Chase Mortgage Calculator

Chase offers a versatile mortgage calculator with extensive customization options. Users can experiment with various scenarios, such as prepayments or different interest rates, making it a robust tool for in-depth financial analysis.

Rocket Mortgage’s Calculator

Rocket Mortgage offers an intuitive and visually appealing calculator. It simplifies the mortgage process with user-friendly graphs and real-time rate updates, making it an excellent choice for tech-savvy users.

Tips for Maximizing Your Simple Mortgage Payment Calculator

Regular Updates and Reviews

Financial markets are ever-dynamic, so updating your calculator inputs regularly with current data is vital. This way, your financial planning remains accurate and up-to-date.

Comprehensive Analysis

While a simple mortgage payment calculator is a significant starting point, combining insights from multiple calculators can provide a fuller financial picture. Leveraging tools like the ones provided by Bankrate and NerdWallet can immensely benefit your planning process.

Professional Consultation

Although calculators offer preliminary insights, consulting with a mortgage advisor or financial planner can deliver personalized advice. They can help interpret data and formulate strategies that best suit your individual financial situation.

Making the Most of Mortgage Calculators

In 2024, selecting the right mortgage calculator can immensely simplify the mortgage process. From accurate financial planning to real-time decisions, these tools are indispensable for understanding the mortgage landscape. With tools from Bankrate, NerdWallet, Zillow, Chase, and Rocket Mortgage, you can access comprehensive, real-time information tailored to your needs. Embrace these calculators not just as basic tools but as stepping stones to informed financial decisions on your home-buying journey.

For more information on other aspects like How much Is title insurance, understanding Rehab loan, or insights on How To buy a rental property With no money, visit our detailed guides. Dive into the nuances of the mortgage landscape to make the most informed decisions and take on your home-buying journey with confidence.

Dive into the Fun Facts and Trivia about Simple Mortgage Payment Calculators

Did You Know?

Simple mortgage payment calculators are not just straightforward; they’re pretty neat too! They take the guesswork out of figuring out your monthly payments, helping you plan better. Speaking of planning, have you ever heard of a homestead? A homestead can play a crucial role in securing your home and managing finances efficiently. This way, you can use your calculator even more effectively.

Historic Roots

Believe it or not, the concept of calculating mortgage payments dates back to ancient civilizations! In places like Rome and Babylon, people used rudimentary tools to calculate interest rates and payments, a far cry from our sleek digital tools today. Interestingly, communities often gathered to assist each other in understanding these calculations, much like how Baltimore Pride unites the community today for greater purposes.

Modern Gadgets

The evolution of mortgage calculators is fascinating. What once required a room full of people can now be done on your smartphone in seconds! Kudos to modern technology, making homeownership more accessible and manageable. Next time you use a simple mortgage payment calculator, remember it’s doing more than just crunching numbers – it’s continuing a legacy of financial empowerment.

What is the easiest way to calculate a mortgage payment?

Simply put, you take your annual interest rate, divide it by 12 to get your monthly rate, and then multiply that by your loan amount. For example, with a 6% interest on a $100,000 loan, you divide 0.06 by 12, getting 0.005. Multiply that by $100,000, and your payment is $500 a month.

How much is a mortgage on a $500,000 house?

A mortgage on a $500,000 house with a 30-year term at a 7.1% interest rate would have a monthly payment of $3,360.16. Over a year, that’s about $40,321.92 in principal and interest.

How much is a mortgage on a $400,000 house?

For a $400,000 mortgage, if you have a 7% fixed rate, your monthly payment on a 15-year loan would be $3,595. On a 30-year loan, the payment is $2,661, not including insurance or taxes.

How to pay off a $500,000 mortgage in 5 years?

To pay off a $500,000 mortgage in 5 years, you’d need to make much larger payments—likely over $8,000 a month, depending on your interest rate. Speeding up payoff usually involves increasing monthly payments or throwing extra money at the principal whenever you can.

How much house can I afford if I make $70,000 a year?

With an income of $70,000 a year, you should look at homes in the $200,000 to $300,000 range. This estimate depends on your overall financial picture, including other debts and monthly expenses.

What is the formula for the monthly payment?

The formula for calculating the monthly mortgage payment involves the principal loan amount, the monthly interest rate, and the number of payments over the loan term. You’ll use an amortization formula that can be found with most online mortgage calculators or financial software.

What credit score do you need to buy a $500,000 house?

To buy a $500,000 house, lenders typically prefer a credit score of 620 or higher. However, a higher credit score can get you a better interest rate, saving you money over the loan’s lifetime.

How much is a 20 down payment on a 500 000 house?

A 20% down payment on a $500,000 house would be $100,000. This helps you avoid private mortgage insurance (PMI) and potentially get a better interest rate.

Will interest rates go down in 2024?

Whether interest rates will go down in 2024 is hard to predict. Rates depend on many factors, including economic conditions and Federal Reserve policies.

What should my income be for a 400k house?

To buy a $400,000 house comfortably, your income should ideally be around $100,000 a year, assuming you have no other significant debts and a reasonable down payment. This ensures your monthly payments are manageable.

What is the 20% down payment on a $400 000 house?

A 20% down payment on a $400,000 house is $80,000. This can lower your monthly payments and help you avoid PMI.

How much income do I need for a 300k mortgage?

For a $300,000 mortgage, you’ll likely need an income of around $75,000 to $80,000 a year. This estimate depends on your debt obligations and how much you can put down upfront.

What happens if I pay 3 extra mortgage payments a year?

Paying 3 extra mortgage payments a year can greatly reduce both the principal and the interest over the loan’s life, potentially shaving years off your mortgage term.

What happens if I pay an extra $1000 a month on my mortgage?

If you pay an extra $1,000 a month on your mortgage, you’ll reduce your principal faster, which decreases the amount of interest you pay over time and allows you to pay off the loan significantly earlier.

What happens if I pay an extra $2 000 a month on my mortgage?

Paying an extra $2,000 a month would have an even bigger impact, slashing years off your mortgage, saving you tens of thousands in interest, and getting you out of debt much faster.