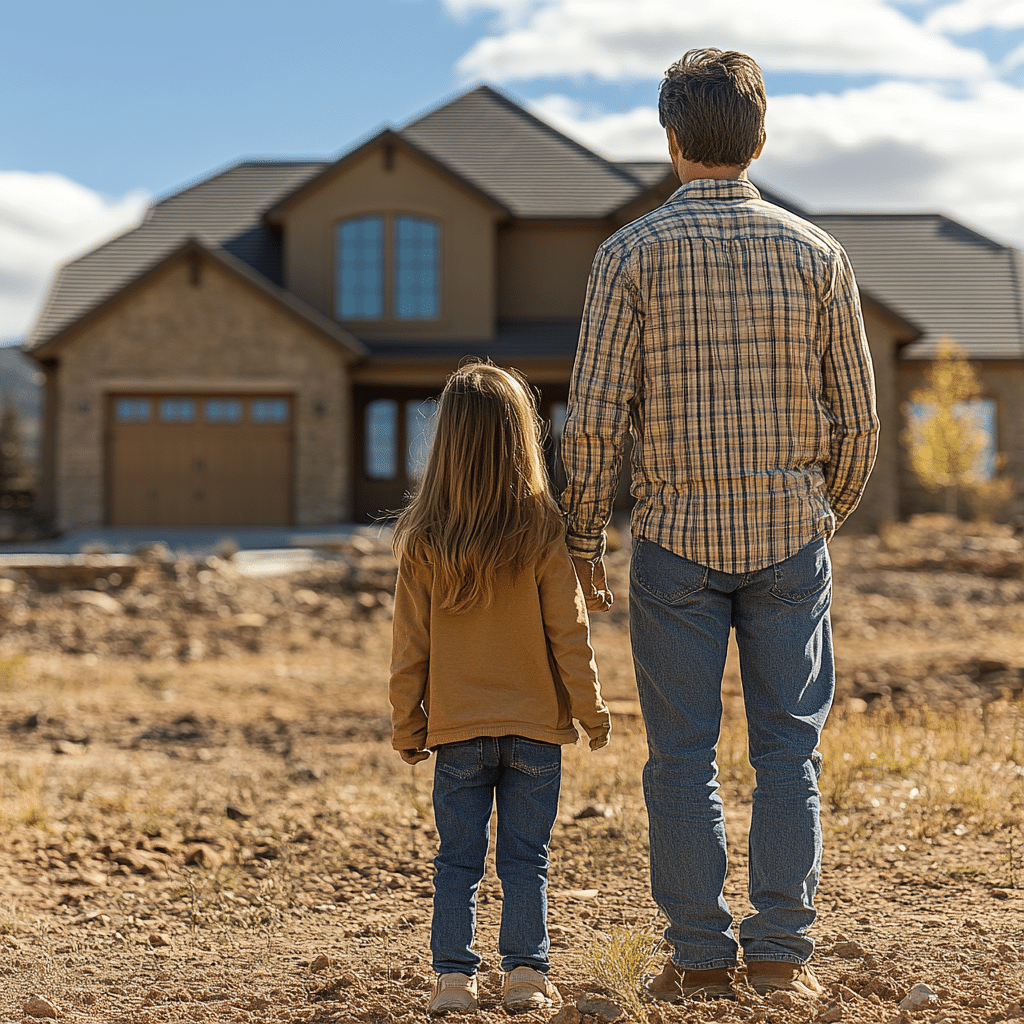

Understanding the Key Steps for Buying a House

Buying a home is a significant milestone, whether it’s your first time or you’ve been through the steps for purchasing a home before. Understanding the essential steps for buying a house can make the journey much smoother and more efficient. Let’s break down these steps with practical insights and real-life examples, giving you a comprehensive roadmap for your home-buying expedition.

Step 1: Assess Your Financial Health

Before diving into the home-buying process, it’s crucial to evaluate your financial stability.

Check Your Credit Score:

Your credit score plays a significant role in your mortgage options and interest rates. Tools like MyFICO or Credit Karma can provide detailed reports. For instance, Lisa, a homebuyer in Austin, saw her interest rate drop by 0.75% after improving her credit score from 680 to 740, saving thousands over the life of her loan.

Calculate Your Debt-to-Income Ratio:

Lenders use your debt-to-income ratio to gauge your ability to manage monthly payments. Aiming for 43% or lower improves your mortgage approval chances.

Save for a Down Payment:

Start saving early. As of 2024, the National Association of Realtors reports that the average down payment is approximately 12% of the home price.

| Step | Description | Key Points and Tips |

| 1. Assess Finances | Review your financial situation, including savings, income, and existing debt. | – Check your credit score. – Ensure you have enough for a down payment and closing costs. – Create a budget for monthly mortgage payments. |

| 2. Get Pre-Approved | Obtain a mortgage pre-approval from a lender to understand your loan options and budget. | – Collect necessary documents (e.g., income statements, tax returns). – Compare pre-approval offers from multiple lenders. |

| 3. Choose a Realtor | Select a qualified real estate agent to guide you through the home buying process. | – Look for experienced agents with good reviews. – Ensure they are knowledgeable about the area you are interested in. |

| 4. Start Home Searching | Identify features you need in a home and begin viewing properties. | – Use online listings and attend open houses. – Make a checklist of must-have features. – Consider location and neighborhood amenities. |

| 5. Make an Offer | With your realtor, draft a competitive offer on your chosen house. | – Negotiate the price and terms if necessary. – Include contingencies (e.g., home inspection, financing) to protect yourself. |

| 6. Home Inspection | Hire a professional to inspect the home for any issues. | – Review the inspection report thoroughly. – Request repairs or negotiate the price based on findings. |

| 7. Obtain Financing | Finalize your mortgage application and secure your financing. | – Lock in your interest rate. – Gather any additional documents requested by your lender. |

| 8. Closing the Sale | Complete necessary legal paperwork and final walkthrough. | – Review the closing disclosure for accuracy. – Sign all required documents. – Pay closing costs and down payment. |

| 9. Move In | After closing, move into your new home and begin settling in. | – Transfer utilities and change your address. – Explore your new neighborhood. |

| 10. Post-Purchase Tasks | Take care of post-purchase responsibilities like loan payments and home maintenance. | – Set up automatic mortgage payments if possible. – Regularly maintain your home to preserve its value. |

Step 2: Determine the Optimal Budget to Buy a House by 30

Setting a budget is critical, especially if you aim to buy a house by 30.

Rule of Thumb:

Experts suggest your monthly mortgage payment should not exceed 28% of your gross income. Use tools like the salary needed To buy a house calculator to determine your range.

For example, John, a 28-year-old engineer in San Francisco, set a budget of $500,000 for his first home. By allocating 25% of his annual income towards savings and avoiding excessive debt, he successfully purchased his home without financial strain.

Consider Other Costs:

Include property taxes, homeowners insurance, and maintenance costs. These extras can add up quickly, impacting your budget.

Step 3: Get Pre-Approved for a Mortgage

Understand Different Loan Types:

Familiarize yourself with mortgage options, such as fixed-rate, adjustable-rate, FHA, Llc loan, and VA loans. Real-world example: Mary and James, a couple from Miami, chose an FHA loan due to their low down payment and moderate credit scores, enabling them to buy their dream home affordably.

Choosing a Lender:

Compare offers from multiple lenders to find the best rates and terms. Sites like Mortgage Rater can assist you in finding the lowest home loan interest rate.

Step 4: Finding the Right Home

Hire a Real Estate Agent:

Working with experienced agents can streamline the process and provide local market insights. For instance, Sarah from Denver successfully purchased her condo FSBO, saving nearly $15,000 in commission.

Research Neighborhoods:

Use sites like Zillow and Realtor.com to investigate school districts, amenities, crime rates, and future developments.

Step 5: Making and Negotiating the Offer

Craft a Competitive Offer:

Research comparable sales (comps) in the area. Tools like Redfin provide recent sale prices for similar properties.

Hire a Great Negotiator:

A skilled agent can negotiate effectively on your behalf, ensuring you get the best possible price.

Step 6: Understand Closing Costs on a House

Common Closing Costs:

These can include appraisal fees, title insurance, origination fees, and attorney charges. According to ClosingCorp, the average closing costs for a single-family home in 2024 are around $6,300.

Saving Strategies:

Negotiate with the seller to cover some closing costs, or shop around for services like title insurance to find competitive rates.

Step 7: Benefit from the Tax Break for Buying a House

First-Time Homebuyer Credit:

As of 2024, eligible first-time buyers might qualify for a credit up to $15,000. This can be a significant incentive.

For example, Laura, a first-time buyer in Seattle, received a substantial tax break, which she used to fund renovations in her new home, increasing its market value.

Deduct Mortgage Interest:

Homeowners can deduct interest paid on their mortgage, significantly reducing taxable income.

Can a Minor Buy a House in the United States?

While it’s uncommon, specific legal structures allow minors to own property. Trusts or custodial accounts can facilitate minor ownership under state laws. For example, in 2023, Alex, a 16-year-old, bought a home in Texas through a trust established by his parents, showcasing how these unique circumstances can be managed legally.

Your Home-Buying Journey Awaits

Understanding the steps for buying a house empowers you to handle the market confidently. By assessing your financial health, determining an optimal budget, exploring mortgage options, negotiating effectively, accounting for closing costs, and leveraging tax breaks, you are well-equipped to make informed decisions. These practical strategies and a thorough understanding of the intricacies can turn your homeownership dreams into reality.

Happy house hunting!

Steps for Buying a House Guide: Fun Trivia and Interesting Facts

Historical Tidbits

Let’s get into some fun trivia while going through the steps for buying a house. Did you know the average age To buy a house in the U.S. has actually been rising? That’s right; recent studies show that most first-time homebuyers are now in their early 30s. Wild, huh? This shift is often attributed to factors like student loan debt and rising home prices. Speaking of first-timers, remember to check out what credits first time home buyers receive. These credits can considerably ease the financial squeeze.

Pop Culture Connections

Here’s something you might find intriguing, especially if you’re into pop culture. The steps for buying a house can sometimes feel like navigating a maze, almost like you’re a character straight out of the Hellsing Manga. There’s always some unexpected turn or twist, but with the right information, you’ll come out victorious. And while we’re on the topic of unexpected twists, guess what? You’ll need to lighten up the stress occasionally. How about cracking some 911 Jokes? Laughter is a great stress buster and can take the edge off the whole home-buying adventure.

Real-Life Advice

And if you’re juggling family responsibilities, particularly the role of a mom, it can be doubly overwhelming. Check out these helpful coping Strategies For Mothers that can help you manage stress while you navigate the home-buying process. These tips can offer some valuable insights into balancing family life and making big financial decisions.

So, there you have it—a little bit of everything to make the steps for buying a house more engaging and less stressful. Happy house hunting!