Buying your first home is a thrilling milestone, but let’s be honest – the steps to buying a house can feel like a daunting maze. Fortunately, breaking down the house buying process into simple, digestible actions can set you on a smooth path to homeownership. So, buckle up as we dive into the steps to buy a house, one detail at a time.

Understanding the Home Buying Process

Before diving in, it’s essential to get a bird’s-eye view of the home buying process. From assessing your finances to closing the deal, each step plays a pivotal role. Buying your first home can be both exciting and nerve-wracking, but we’re here to make it straightforward.

Step 1: Assess Your Financial Health

First things first, you need to assess your financial health. Are you financially ready to leap into homeownership? This means scrutinizing your credit score, understanding your front-end ratio, your debt-to-income ratio, and creating a robust savings plan. Per a 2023 Experian report, you’ll need at least a credit score of 620 for most conventional loans.

Consulting a financial advisor can provide additional insights. Platforms like Credit Karma and NerdWallet offer valuable tools to track your credit standing and manage finances effectively.

Step 2: Get Pre-Approved For a Mortgage

Securing a mortgage pre-approval is fundamental in the steps to buying a house. It gives you a clear picture of your budget and shows sellers you’re serious. The 2023 surge in pre-approval applications reported by lenders like Quicken Loans and Rocket Mortgage emphasizes its importance.

For pre-approval, you’ll generally need:

– Proof of income (pay stubs, tax returns)

– Proof of assets (bank statements)

– Credit history

– Employment verification

– Personal identification

Step 3: Define Your Home Buying Criteria

Next, figure out what you want in a home. Consider factors such as location, size, price range, and amenities. Websites like Zillow and Realtor.com allow you to filter and search based on these criteria, making the home buying process more manageable.

For instance, do you need easy access to schools or maybe a short commute to work? Confirming these priorities early helps narrow down your choices.

Step 4: Hire a Real Estate Agent

A great real estate agent can be your best ally in the home buying process. Agents have insider access to listings, neighborhood insights, and they can negotiate on your behalf. The National Association of Realtors reported that 86% of buyers used a real estate agent in 2023.

Notable agencies like Keller Williams, Coldwell Banker, and Century 21 can connect you with experienced agents to help you find your dream home.

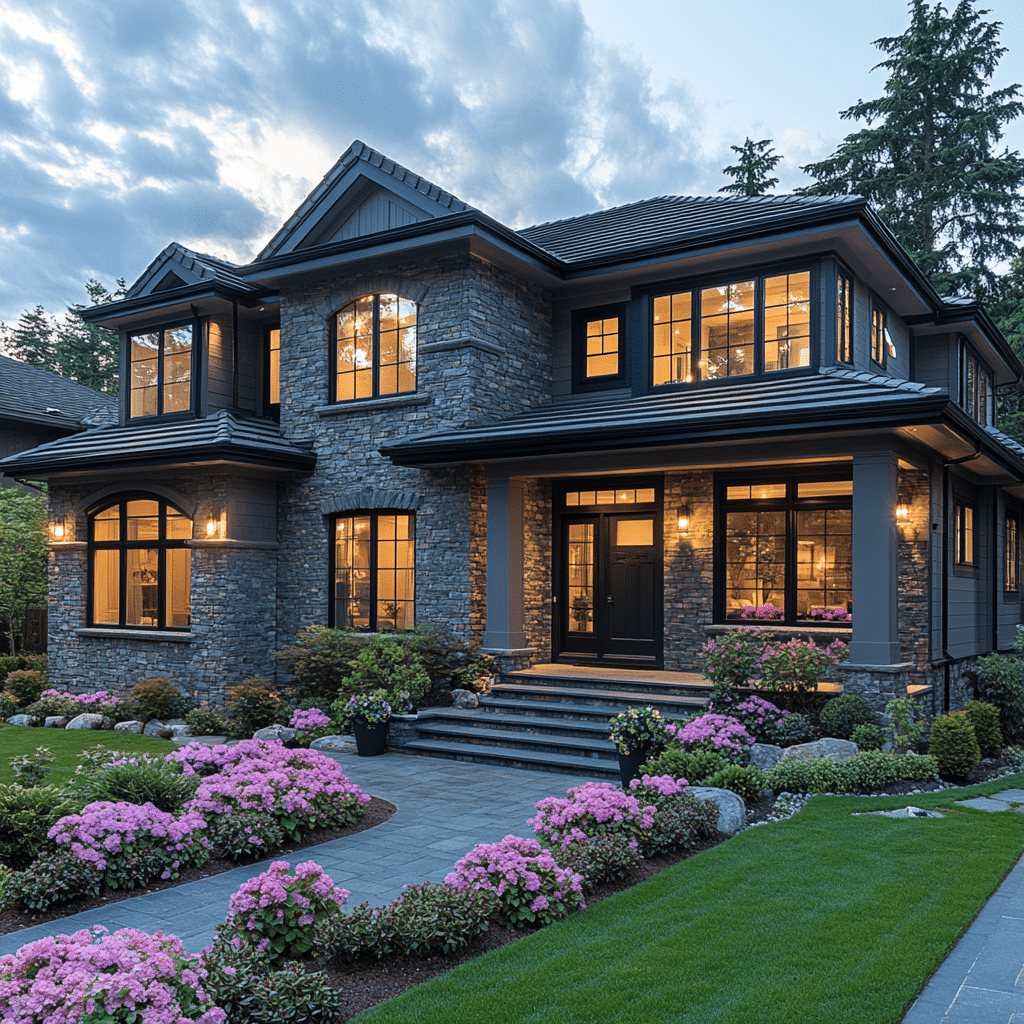

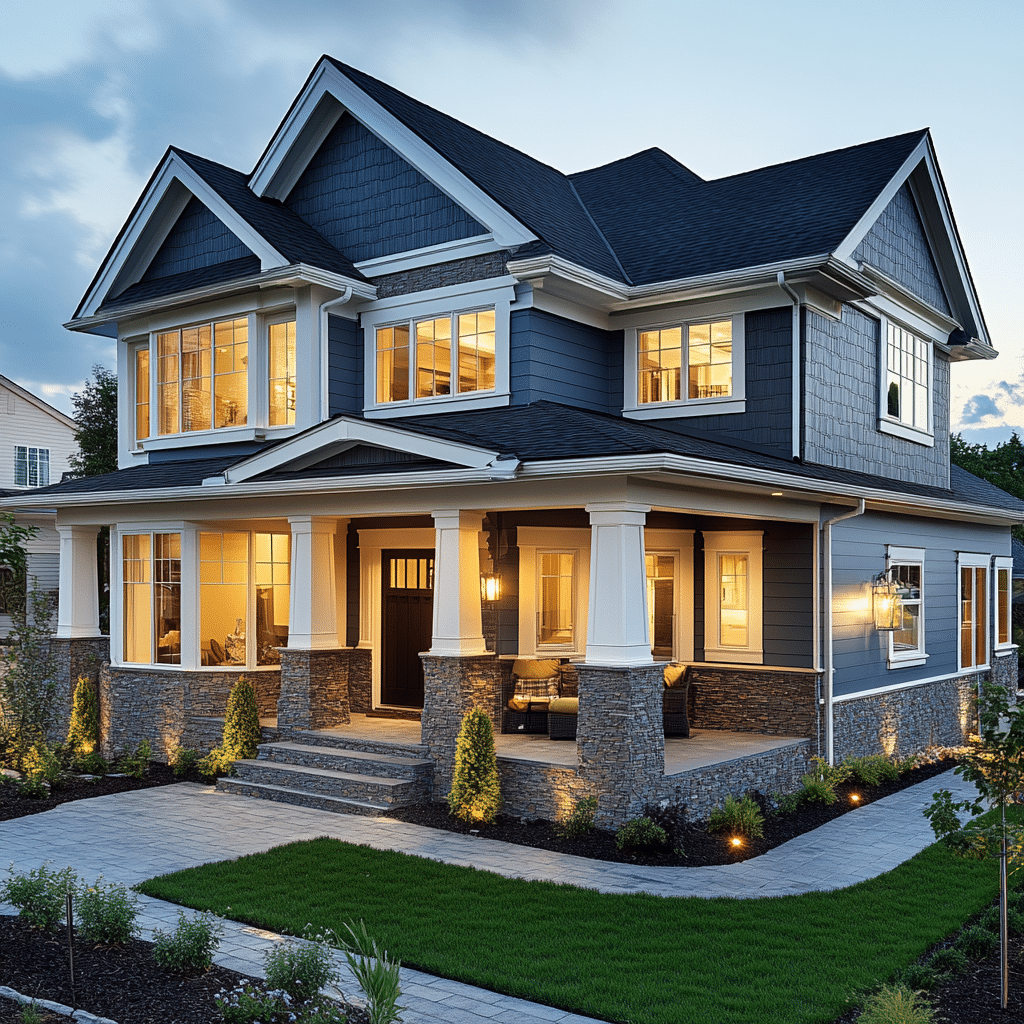

Step 5: Start House Hunting

Now comes the fun part—house hunting! Equipped with your pre-approval and clear criteria, you can start attending open houses or private showings. Sites like Redfin and Trulia offer excellent virtual tours and detailed property descriptions.

Remember to keep an eye on new listings and be ready to act quickly, especially in competitive markets.

Step 6: Make an Offer

Found the perfect home? It’s time to make an offer. Your real estate agent will guide you to craft a compelling offer based on market conditions and comparable sales. In hot markets, offers above asking price and a personal letter to the seller can make a big difference.

Step 7: Conduct Home Inspections and Appraisals

Once your offer is accepted, the next step involves inspections and appraisals. Hiring a certified inspector through companies like HomeAdvisor or Angie’s List ensures any potential issues are uncovered. Meanwhile, your lender arranges the appraisal to confirm the property’s value aligns with your loan amount.

Step 8: Renegotiate or Confirm Your Offer

Inspection results might lead you to renegotiate. If significant repairs are required, you can ask the seller for a price reduction or repair credits. Using this step wisely ensures you’re making a smart investment.

Step 9: Close the Deal

Finally, it’s time to seal the deal. Closing involves signing a stack of documents, including the loan agreement, title, and deed. Be ready for closing costs, which generally are 2% to 5% of the purchase price.

Wrapping Up Your Home Buying Journey

Following these steps to buying a house transforms what could be an intimidating process into a smooth, systematic experience. From assessing your finances to closing the deal, each step is crucial. With this comprehensive guide and industry insights, you’re well-equipped to make informed decisions and secure your perfect home. Welcome to your new chapter!

Looking for more resources? Check out these for further reading:

We hope this guide empowers you on your journey. Happy home buying!

Steps to Buying a House: Secrets Unveiled

Initial Preparations

When it comes to the steps to buying a house, it’s essential to get your ducks in a row early. First off, understanding key financial metrics like the front end ratio will give you a clear picture of your financial health. Fun fact: Did you know the term “mortgage” actually stems from Old French, literally meaning “death pledge”? It signifies a loan lasting until repayment or foreclosure. Also, it’s a good idea to chat about your home-buying journey with your close ones — Co-workers or Coworkers, whichever spelling you prefer. Their experiences might offer critical insights or warnings.

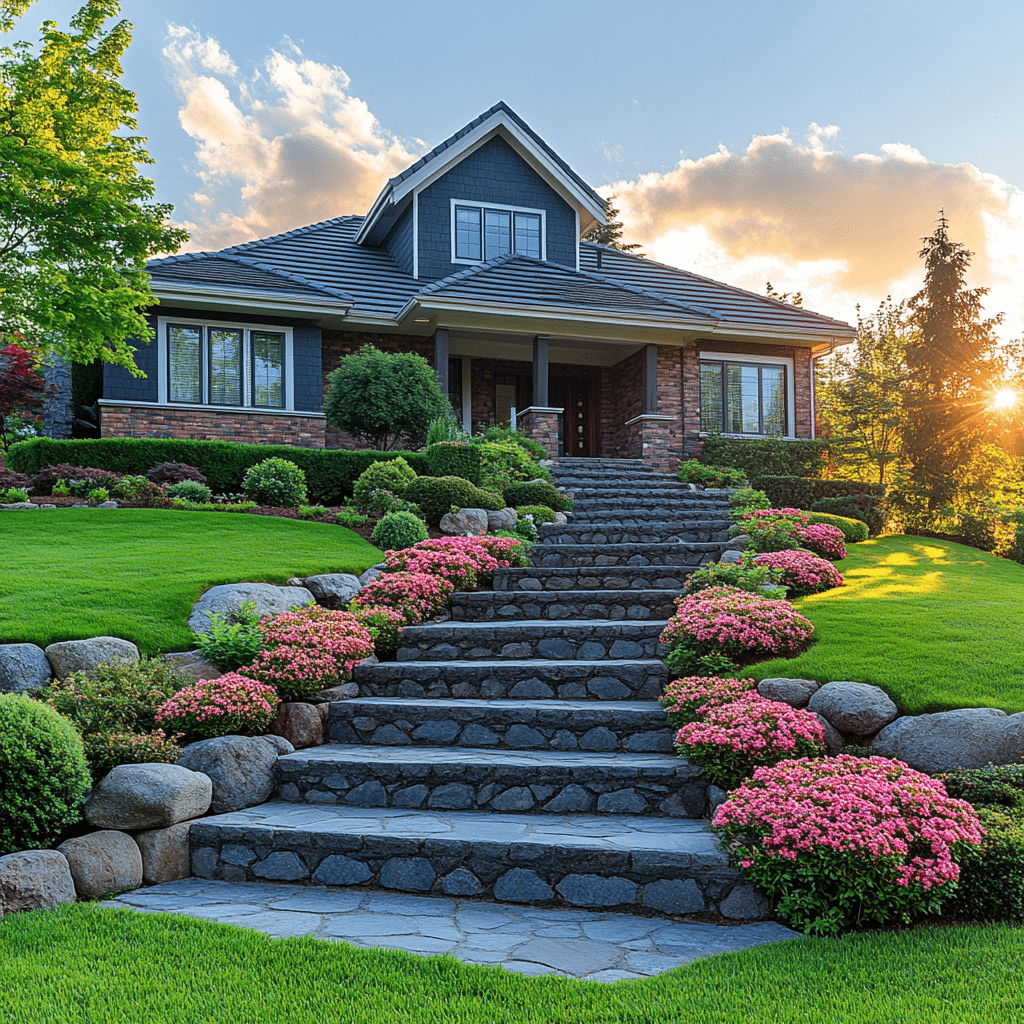

The Home Search

Once you’ve prepped financially, it’s time to hit the pavement — or the browser — to start house hunting. Knowing How do You buy a house step by step can be beneficial here. Ever heard of open meetings in community spaces like the Manhattan Beach community church? They sometimes serve as great opportunities to meet realtors and potential neighbors who can offer invaluable advice about the local housing market.

Making an Offer

After finding your dream home, you enter the most nail-biting stage: making an offer. A well-researched offer could make all the difference. Did you know there’s an actual connection between the negotiating strategies employed by homebuyers and those used by sports teams, like those detailed in real madrid Vs Rayo Vallecano Lineups? Sports strategies often revolve around making calculated moves and knowing when to strike, which parallels making an informed, timely offer to buy a house.

Navigating the steps to buying a house may seem daunting, but with fun trivia sprinkled along the way, it’s definitely a journey that’s both educational and enjoyable. Let’s put the playbook into practice and make your home-buying experience a winning game!