Understanding today’s 30-year fixed rate mortgage climate is akin to mastering the art of balance; it’s a dance between what we know and the unpredictability of the future. Just as a martial artist expertly wields a Bo staff with precision and fluidity, homebuyers and investors must navigate the mortgage market with equal parts knowledge and agility.

Understanding Today’s 30-Year Fixed Rate Mortgage Landscape

In recent memory, we’ve been on quite the financial roller coaster. Think of it this way—imagine you’re at the Alamo Drafthouse lakeline, popcorn in hand, bracing yourself for the latest economic thriller that has more twists and turns than a Hollywood blockbuster.

Today’s 30-Year Fixed Rate Mortgage: Factors and Influences

When we talk about the factors influencing today’s 30-year fixed-rate mortgages, it’s a bit like trying to pin the tail on the moving economy—exciting, but you need to know what you’re aiming for.

| Category | Details |

|---|---|

| Current 30-Year Fixed Rate | X.XX% (rate as of last update, subject to change daily) |

| Lender Variety | Varies by lender; includes major banks, credit unions, online mortgage companies, etc. |

| Qualification Criteria | Credit score, down payment, debt-to-income ratio, employment history, etc. |

| Average Mortgage Fees | Origination fees, application fees, underwriting fees, appraisal fees, etc. |

| Benefits of 30-Year Fixed Rate | Stable monthly payments, predictable budgeting, potential for no prepayment penalty |

| Forecast for 2024 | Expected to decline by at least 0.50% through the middle of 2024 |

| Economic Indicators Influencing | Decreasing inflationary pressure and falling federal funds rate |

| Rate Change Expectation | Gradual decrease rather than rapid, starting in 2024 |

| Expert Predictions | – Fannie Mae |

| – Mortgage Bankers Association | |

| – National Association of Realtors | |

| Considerations for Borrowers | Timing the market, budgeting for rate fluctuations, locking in rates, choosing fixed versus ARM |

| Potential Risks | Higher initial rates compared to other loan types, the opportunity cost of refinancing |

Predicting Shifts in Today’s 30-Year Fixed Rate Mortgage

Forecasting the direction of mortgage rates can feel like peering into a crystal ball—sometimes clear, often murky. But in this world, solid data and sharp analysis can cut through the fog.

Borrowers’ Guide to Navigating Today’s 30-Year Fixed Rate Mortgage

Imagine you’re setting sail on the vast ocean that is the mortgage market—navigating today’s 30-year fixed-rate mortgages requires a sturdy map, a keen eye, and a bit of tenacity.

Real-Life Examples: Impact of Today’s 30-Year Fixed Rate on Homebuyers

They say truth is stranger than fiction, and in the mortgage cosmos, real-life stories can be just as captivating as any celebrity gossip.

Strategic Forecasting for Today’s 30-Year Fixed Rate Mortgage

If homebuying is a game, then strategic forecasting is akin to having the best coach in your corner.

Today’s 30-Year Fixed Rate Mortgage Amidst Digital Transformation

The digital revolution is turning the mortgage industry on its head, much like how Quicken Loans’ “Rocket Mortgage” transformed the mortgage application process.

The Future of Today’s 30-Year Fixed Rate Mortgage

Peering into the crystal ball, the future of today’s 30-year fixed-rate mortgage exudes potential progress and innovation.

Closing Thoughts on Navigating Today’s 30-Year Fixed Rate Mortgage

In this ever-evolving marketplace, staying squarely in the loop and informed is not just wise—it’s absolutely essential.

The key takeaway? Just as there’s no one-size-fits-all solution to managing personal finance, every homebuyer’s journey is unique. Understanding your options, the market’s direction, and the interplay of various factors at work can help secure a mortgage that suits your financial goals like a tailored suit. Keep learning, stay nimble, and let’s make homeownership happen—even as today’s 30-year fixed-rate mortgage landscape evolves.

The Fascinating World of Today’s 30 Year Fixed Rate Mortgage

As we peek into the crystal ball of home financing, it’s pretty wild to think about the rollercoaster ride that today’s 30 year fixed rate mortgage has been on. Buckle up, because we’re diving into some remarkable factoids that’ll make you the life of any party – if you attend the kind where mortgage rates are the toast of the town!

Did you know that in some circles, understanding Todays interest rates 30 year fixed is considered as impressive as reciting Shakespeare? Imagine chatting away at a swanky soiree, a glass of bubbly in hand, dropping knowledge bombs about the latest trends. But it’s not just for show—knowing the ins-and-outs of interest rates can be as financially rewarding as finding a forgotten Monet in the attic. Plus, comparing the stakes of today’s rates with those of the past is more thrilling than the plot twists in a Joivan Wade action flick!

Now, you might think the topic of Todays 30 year mortgage rates” is as dry as a desert, but hold on to your hats. Picture this: Way back when, in the unpredictable landscape of ye olden days (we’re talking way before Jesse Spencer was setting hearts aflame), getting a mortgage was akin to a game of high-stakes poker. You could bet your bottom dollar that 30 year interest rates today weren’t even in the same ballpark as those back then. And just like a classic western duel, timing was everything. Lock in a rate at the right moment, and you might just walk away with enough cash saved to be the hero of your own financial frontier.

So, the next time someone casually mentions “todays 30 year mortgage rate,” you can flash a knowing smile. It’s not every day you stumble across a treasure trove of trivia about the ebb and flow of the mortgage world. Whether you’re saving for your future ranch or simply fascinated by the zigzag of economic history, keeping an eye on these figures is as smart as investing in apple seeds before Johnny Appleseed hit the road. With this titillating tidbit under your belt, who wouldn’t want to dive deeper into the captivating saga of mortgage rates?

What is the current 30 year fixed rate mortgage?

– The current 30-year fixed rate mortgage? Well, that’ll change quicker than the weather, won’t it? To snag the latest figures, you’re best off checking a real-time mortgage rate tracker or hitting up a local lender.

Are 30 year mortgage rates dropping?

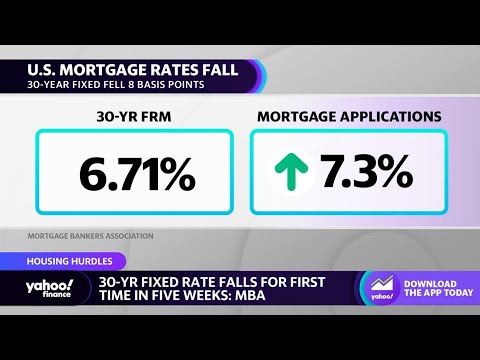

– Are 30-year mortgage rates dropping? You betcha! Industry bigwigs like Fannie Mae and pals expect rates to take a dive, shedding at least half a point by mid-2024. So, keep those champagne corks on standby!

What are real time 30 year mortgage rates?

– For real-time 30-year mortgage rates, the internet’s your oyster. Rates fluctuate faster than a rabbit in a carrot patch, so for the up-to-the-minute scoop, hit those rate trackers or chat up a lender.

Are mortgage rates going down in 2024?

– Are mortgage rates going down in 2024? Looks like we’re in luck! The crystal ball—ahem, experts—says with decreasing inflation and a snoozing federal funds rate, rates should mellow out. Think slow and steady, not warp speed.

Are mortgage rates expected to drop?

– Are mortgage rates expected to drop? Signs point to yes. Experts in the know are betting on rates easing up a bit as things cool off in the economy. Keep your fingers crossed—it could be good news for your wallet!

Will mortgage rates ever be 3 again?

– Will mortgage rates ever be 3% again? Well now, wouldn’t that be something? While no one’s got a magic 8-ball, the chatter points to potential dips ahead. Just don’t hold your breath—it’s a watch-and-wait game.

What is the mortgage rate forecast for 2024?

– What is the mortgage rate forecast for 2024? The forecast calls for rates to chill out, actually. Think of a sunny day after a storm—that’s what the big players like Fannie Mae are predicting.

What is the lowest rate ever for a 30-year mortgage?

– What’s the lowest rate ever for a 30-year mortgage? History’s pages saw rates hit rock-bottom back in the day, but as for how low—well, it’s a record that’s tough to beat.

What are interest rates expected to do in 2024?

– What are interest rates expected to do in 2024? Word on the street is that they’ll saunter downwards, thanks to Uncle Fed easing off the gas pedal.

What is the highest 30-year mortgage rate ever?

– What is the highest 30-year mortgage rate ever? Now, that’s a number for the history books. Think sky-high, but for the exact summit, hit the archives.

What is a good mortgage rate?

– What is a good mortgage rate? “Good” is in the eye of the beholder—or the borrower, rather. It’s all about timing the market and locking in a rate that feels like a high-five to your finances.

What is Fed interest rate today?

– What is Fed interest rate today? The Fed’s rate is like the boss of all rates—it sets the tone. For today’s number, peek at the Fed’s latest press release or news tickers.

Will 2024 be a better time to buy a house?

– Will 2024 be a better time to buy a house? If the experts have read their tea leaves right, with friendlier mortgage rates, your house-hunting saga might just have a happy ending.

How low will mortgage rates go in 2025?

– How low will mortgage rates go in 2025? Ah, we’re farming future’s field now! Let’s cross that bridge when we come to it, but if trends stick, we could be looking at more favorable rates.

What will mortgage rates be in May 2024?

– What will mortgage rates be in May 2024? That’s a few calendar pages away yet. With a bit of luck and economic tailwinds, we’re banking on the numbers to take a gentle dip.

Is 2.75 a good mortgage rate?

– Is 2.75 a good mortgage rate? In today’s climate, that’d be a steal—like finding a four-leaf clover in your backyard. But remember, “good” can be as fleeting as shooting stars, depending on the market.

What is the Fed interest rate today?

– What is the Fed interest rate today? For the daily digits, it’s best to look up the Federal Reserve’s latest rate announcement. It’s the beacon that guides other rates’ ships.

What is today’s prime rate?

– What is today’s prime rate? The prime rate today? It’s a hop, skip, and a jump away—just a quick search or a banking hotline away from knowing.

Should I lock mortgage rate today?

– Should I lock in my mortgage rate today? If the rate’s looking sweet and you’re not one to gamble with your cash, locking it in could be smarter than playing chess with a pigeon.