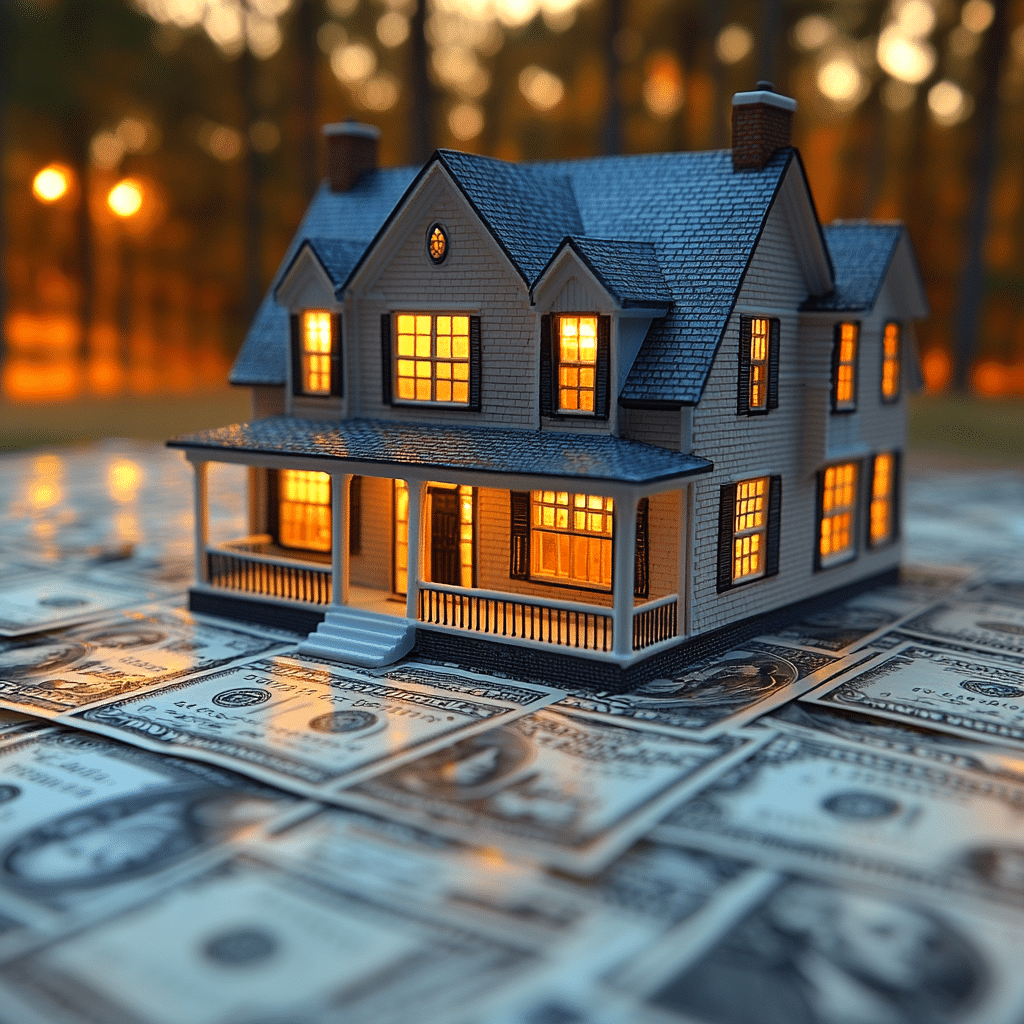

In April 2024, today’s mortgage rates 30 year have become a hot topic for those looking to step into the world of homeownership. With the average rate floating around 6.5%, various elements come into play, shaping this number. This article will unravel how decisions made by the Federal Reserve, along with economic trends like inflation and employment rates, all intertwine and impact today’s 30-year mortgage rates.

Understanding Today’s 30-Year Mortgage Rates

Understanding today’s mortgage rates 30 year hinges on more than just looking at one number. With inflation figures and future rate changes by the Fed constantly in mind, prospective homeowners find themselves at a pivotal point in the real estate market. As of now, enduring inflationary pressures are causing many to feel increased financial strain, which could influence their long-term purchasing decisions.

Additionally, other factors blend into this puzzle. For instance, as more people enter the housing market, demand rises, which naturally puts pressure on mortgage rates. In turn, lenders may take advantage of this by raising their rates. Whether you’re a first-time buyer or a seasoned property owner, being aware of this dynamic can either guide you towards favorable deals or lead you to unfavorable outcomes down the road.

This evolving situation underscores the importance of being informed. As the market shifts, having a finger on the pulse of today’s mortgage rates 30 year means not just understanding the current landscape but predicting where it could lead during the latter parts of 2024.

Top 7 Factors Influencing Today’s 30-Year Mortgage Rates

To better grasp the current mortgage climate, let’s break down the seven pivotal factors impacting today’s 30-year mortgage rates.

The Fed has a hand in shaping interest rates. Speculation around potential rate hikes is rampant, especially with inflation sticking around. Their moves can send ripples through the mortgage landscape, altering rates significantly.

Increased activity in the housing market drives rates up. Demand has stabilized since the surge in early 2024, yet the entry of new buyers could tip the scales again, altering where rates settle in the short term.

Consumer confidence and GDP growth rate reports gather attention. A robust economy might nudge rates higher, while declines could present homeowners with lower offerings, providing some wiggle room for potential buyers.

Inflation remains a staunch focal point for lenders. The Consumer Price Index (CPI) presents data that suggests some cooling; however, lingering inflation caused lenders to keep their rates on the higher side for the foreseeable future.

Local supply and demand directly determine mortgage rates. For example, limited inventory in areas like the suburbs of Atlanta can spark sharper competition, subsequently pushing rates higher.

Personal creditworthiness plays a critical role, too. Individuals with credit scores over 740 typically enjoy lower rates compared to the average, impacting what homebuyers pay month-to-month.

Events like geopolitical unrest can rattle investor confidence in mortgage bonds. This year, unexpected surprises keep stakeholders on their toes, leading to fluctuations in mortgage rates that resonate across the board.

Understanding these factors can arm you with the knowledge necessary to navigate today’s mortgage rates 30 year and prepare you for any shifts as they happen.

Current Trends in Today’s 15-Year and 20-Year Mortgage Rates

It’s not only the 30-year rates attracting attention. The todays 15-year mortgage rates currently sit around 5.5%, offering an enticing option for buyers willing to tackle higher payments upfront. For those looking for a middle ground, today’s 20-year mortgage rates hover around 6.25%, making it a practical bridge between the popular 15-year and 30-year choices on the market.

When weighing the options, consider your financial comfort level. A 15-year loan tends to yield significant interest savings, but it also requires you to commit to higher monthly payments. Knowing how it aligns with your budgeting can make a substantial difference in your home financing strategy.

The broad array of choices available in today’s mortgage market underscores the need to stay attuned to the trends, ensuring you find a plan that fits your long-term financial landscape effectively.

Comparisons: Interest Rates Today on a 30-Year Mortgage Vs. 15-Year and 20-Year Mortgages

To equip you with a clearer perspective, here’s a snapshot of interest rates today on a 30-year mortgage compared to its shorter-term counterparts:

These rates show the immediate savings of a 15-year mortgage but at the expense of larger monthly payments. This contrast is particularly important for first-time buyers, who may feel the pinch of a tighter budget. Knowing these differences can clarify which path is right for you, allowing you to assess how much you’re willing to dedicate towards monthly obligations.

Expert Insights: Predicted Trends for 2024

Looking ahead, analysts forecast a somewhat volatile landscape for mortgage rates in 2024. According to David Stevens, former CEO of the Mortgage Bankers Association, “Homebuyers should be prepared for a bumpy interest rate environment as the year progresses.” It’s apparent, then, that while rates might stabilize, the mix of inflation pressures and Federal Reserve policies will continuously shape the market.

As economic conditions fluctuate, the rates may shift unpredictably. Hence, staying updated through reliable resources like Mortgage Rater can provide an advantage in this dynamic arena.

Strategies for Locking in Today’s Favorable Mortgage Rates

For those getting ready to make large financial commitments, timing is essential. Here are practical tips to consider for securing today’s mortgage rates 30 year:

Taking these strategic steps can provide peace of mind, helping you secure favorable financial conditions in an unpredictable environment.

Wrapping Up the Mortgage Rate Landscape

In managing the intricacies of today’s mortgage rates 30 year, gaining a deeper understanding transcends piecing together a single number. Instead, it entails recognizing the broader economic landscape and embracing the available options. By staying educated and informed, homebuyers can better navigate the mortgage process and make optimal decisions that serve their financial futures.

Remember, today’s mortgage rates 30 year represent merely the first step in a long-term financial journey that may yield greater benefits down the road. Visit Mortgage Rater regularly to stay updated on critical shifts in the market and to find tools that help you smoothly transition toward homeownership. Your dream home is within reach, but preparation is key to making the best moves in today’s bustling market.

Today’s Mortgage Rates 30 Year You Can’t Ignore Today

Fun Facts and Trivia about Mortgage Rates

Did you know that today’s mortgage rates 30 year have a significant impact on homebuyers’ decisions? It’s a crucial slice of the financial pie that can determine how folks invest in their dreams. Back in the early 1980s, interest rates danced at a whopping 18%! Just imagine trying to secure a home with those kinds of rates—yikes! Fast forward to today, and you can get these 30-year fixed loan rates today at remarkably lower percentages, making homeownership a bit more palatable for many. To find out today ‘s interest rate, check out this handy tool that lays it all out clearly.

The Economic Nuances

Mortgage rates aren’t just random numbers; they’re influenced by the economy, government policies, and even international events. For example, when inflation spikes, interest rates often follow suit, shaking things up for buyers. Today’s fixed mortgage rates can be as volatile as a roller coaster depending on these economic winds. Speaking of ups and downs, there’s an amusing snake meme going around that jokingly represents the stress of house shopping during rate fluctuations. It’s a relatable chuckle amid serious financial decisions! So, have a good laugh, but keep an eye on those interest rates 30 year!

Consumer Awareness

The rate you lock in can mean the difference between a cozy abode or extra stress in your wallet. That’s why understanding wholesale rates and their implications is key. Many buyers get tangled up in the details, but knowing how these factors play into today’s mortgage rates 30 year can really tip the scales in your favor. Additionally, a figure like Dana Boyle has gained attention for advocating better consumer education about these financial choices. With a touch less confusion and a bit of knowledge, you might just snag a deal that feels like finding the Popeyes logo in a sea of fast food.

As we dive deeper into today’s mortgage rates 30 year, it’s clear that a small understanding can yield big benefits. When munching on your favorite snack while scrolling through options, keep in mind the essential truths about your mortgage and how it affects your long-term financial freedom. And, perhaps, remember to steer clear of off-topic distractions—like that recent incident involving Sean Richards from Hinsdale—because staying focused on finding the right rate can lead you right to your dream home.