Understanding USDA Financing: The Key to Affordable Homeownership

Embarking on the adventure of homeownership can be a real challenge, especially if you’re a first-time buyer. Thankfully, USDA financing pops up as a fantastic option that simplifies this process. With its flexible terms and numerous opportunities, securing a place to call home starts to feel within reach.

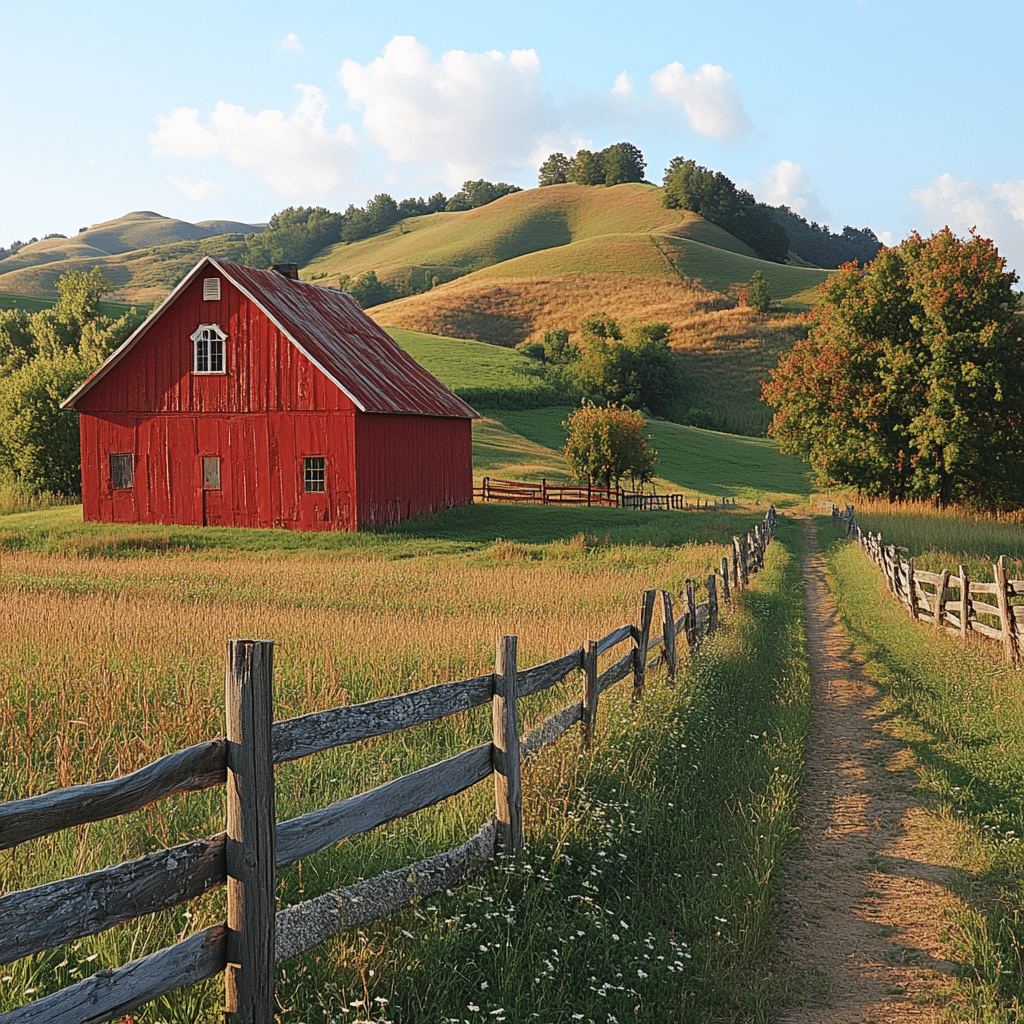

What’s great about USDA financing is that it isn’t just for rural farmers—it’s a financial tool aimed at fostering affordable housing in designated rural areas. In essence, these loans allow folks to get into their dream homes without breaking the bank. According to the USDA, these loans were developed to encourage growth and development in America’s rural areas, which creates vibrant communities that benefit everyone.

When we peel back the layers, we see that USDA loans offer a real chance for people to own homes. With this financing option, families can find comfort in knowing they can pick a safe and beautiful neighborhood without emptying their savings. As we dive deeper into the specifics, you’ll discover that there’s a lot more to USDA financing than meets the eye.

Top 7 Secrets of USDA Financing You Must Know

One of the biggest perks? You can snag a home with no down payment! That’s right—eligible buyers can waltz into homeownership without shelling out savings that many struggle to gather. Compared to conventional loans, which typically ask for 3% to 20% down, this option becomes a game-changer for many hopeful homeowners.

Now, not just anyone can walk in and snap up a USDA loan; there are some requirements to meet. You’ll need to fall within certain income limits and select homes in approved areas. For example, if you’re a family of four, your total income shouldn’t exceed about $90,000, depending on the county. Understanding these USDA loan requirements is a must if you want to make this financing work for you.

The USDA Rural Development Loan goes beyond just getting you a home; it’s all about enhancing the community. Just last year, the USDA approved over $14 billion in loans, transforming countless rural areas and making them more livable. This community-centric approach adds value to your home, too, fostering local growth and stability.

Many homebuyers fret over their credit scores, but here’s some good news: USDA financing often comes with more lenient credit history requirements. If your score sits at 580 or higher, you could still be eligible. This flexibility gives more folks the opportunity to achieve homeownership compared to stricter conventional loans, which often demand scores of 620 or above.

Have you thought about building your own pad? USDA construction loans can help facilitate everything from land purchase to actual construction costs. Companies like Caliber Home Loans equip customers to create personalized homes that fit their visions, all while benefiting from the financial perks USDA offers.

Say goodbye to exorbitant mortgage insurance! With USDA financing, borrowers shell out a one-time guarantee fee (usually 1% of the loan amount) along with an annual fee of about 0.35% of the current loan balance. This is considerably cheaper compared to FHA or conventional loan options, making your monthly payments even lighter.

Looking ahead, it’s clear that USDA financing will evolve to meet the growing demand for affordable housing. Experts predict enticing shifts in eligibility criteria and funding limits to continue assisting homebuyers. Advocates are speaking up for rural communities, ensuring that USDA loans remain a practical choice for years to come.

Common Misconceptions about USDA Financing

Even with all the benefits, some myths about USDA financing continue to circulate. One of the most common misconceptions is that these loans are exclusively for farmers. In reality, they’re available to anyone meeting the requirements—not just those with livestock!

Another widely held belief is that you must live way out in the sticks to qualify for a USDA loan. While it’s true that the program serves rural areas, many eligible homes are located in suburban neighborhoods. It’s worth doing a little digging to uncover the potential gems in your desired location.

Debunking these myths is essential in helping potential buyers recognize the validity of USDA financing. It’s about broadening perspectives and understanding that homeownership is feasible and accessible, regardless of your background.

Real-Life Success Stories: Achieving Homeownership through USDA Financing

Let’s get inspired by real-life examples of folks who made their homeownership dreams a reality through USDA financing! Take the Johnson family, for instance. Hailing from Missouri, they utilized a USDA loan to purchase their cozy first home in 2022. Transitioning from renting to owning seemed like a distant dream—until a USDA loan opened that door.

They were thrilled to discover a charming home in a vibrant community that not only met their needs but helped them flourish. Simply put, USDA financing was the solution that allowed them to shift gears in their lives, moving towards a stable future. Their journey shows fellow homebuyers that such options can lead to happy endings, proving that dreams are attainable.

Hearing stories like the Johnsons not only fills you with hope but also provides realistic insights into the effectiveness of USDA loans. It’s possible to build your future through accessible homeownership, and real families and individuals are doing just that!

Tips for Maximizing Your USDA Loan Experience

Ready to make the most of your USDA loan experience? Check out these practical tips that’ll guide you toward smart borrowing:

By following these guidelines, you’ll position yourself to fully capitalize on USDA financing’s benefits, ensuring a successful home-buying experience.

The Future of Homeownership and USDA Financing

As we look toward 2024 and beyond, USDA financing stands out as a vital tool in the ongoing quest for affordable housing. Awareness about these loans is crucial; many organizations advocate for their growth and broader accessibility. Ensuring that everyone knows about USDA loans reinforces housing options for rural communities, leading to overall economic growth.

Ultimately, understanding and leveraging the unique features of USDA financing can lead hopeful homeowners to a new chapter. By fostering a culture of awareness and encouragement, we can turn dreams into tangible outcomes. So, why not take the plunge and consider how USDA financing could unlock the door to your future?

Homeownership is an attainable goal, and with the right tools, you can step confidently into your new life. As you explore your options, take note that USDA financing is not just a figment of imagination; it’s a pathway to realizing your dreams. Whether it’s investing in Foreclosed Houses For sale or building new spaces with USDA construction loans, the possibilities are endless.

The journey toward homeownership can be a beautiful one; don’t let those fears hold you back. Explore the potential of USDA financing, and you just might find your perfect home waiting for you!

USDA Financing Secrets for Homeownership Success

Understanding USDA Financing

Did you know that USDA financing isn’t just for farms? It’s true! The USDA home loan program is primarily designed for rural and suburban homebuyers who might not qualify for traditional financing. With no down payment required and competitive interest rates, it’s a secret weapon for first home buyers. In fact, these loans play a similar role as a comfort blanket for buyers, especially in regions bustling with life, like those inspired by the charm of baseball caps. The concept resonates with many since it offers a secure path to homeownership without the substantial initial costs associated with other loans.

Interesting Facts About USDA Financing

Here’s a fun tidbit: USDA loans can cover properties in designated rural areas, and you’d be surprised where some of them are located. For those living near dynamic suburbs, you might not even realize your area qualifies! Picture a family excited about moving into their dream home, perhaps while brushing up on family trivia — did you know that during the remarkable case of the septuplets, affordability was key in finding a suitable home? Whether you’re a large family or just want space to breathe, USDA financing opens up opportunities.

And here’s something even cooler: even if you’re navigating a digital landscape, making the right homeowner decisions is crucial. With options like homeowner Warranties that protect against unexpected repairs, it’s easy to tap into a wealth of resources. In today’s tech-driven world, managing finances can be as easy as accessing your rocket account login. Having a handle on your financial health is essential, and a USDA loan can set one up for long-term success, especially when considering monthly plans versus unpredictable expenses.

Closing Thoughts on USDA Financing

So, if you’re pondering whether USDA financing can be your ticket to homeownership, remember that this option often slips under the radar. With the right knowledge, you can dodge the hurdles many face. Just like how many folks find joy in reading aa books when they need support, diving into USDA financing details could lead to some fantastic outcomes! Those looking to make a strategic move should also consider the importance of cutting-edge tools like the logitech g433 gaming headset — they showcase how modern solutions can enhance your experience in diverse areas, including finance. Don’t miss out on the chance to explore all your options in this exciting journey toward homeownership!