Navigating the ever-changing waters of state taxes can feel akin to exploring uncharted territories, but consider this your compass for the Beehive State. Today, we’re embarking on a journey to understand the nuances of the Utah tax rate, ensuring that you, the residents, can sail smoothly through your financial responsibilities. Let’s dive into a comprehensive insight that will have you managing your finances with the efficiency of an expert accountant.

Breaking Down the Utah Tax Rate: A Comprehensive Insight for Residents

The Lay of the Land: An Overview of Utah’s Tax System

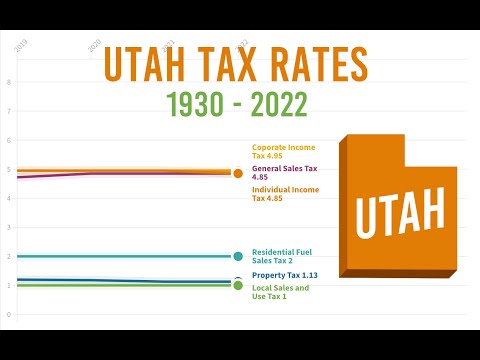

The tax system in Utah is a unique creature in the vast expanse of the American tax landscape—it stands out with its simplicity. With a flat 4.85 percent individual income tax rate, the structure is straightforward, but don’t let its simplicity fool you; there’s more to it than meets the eye. Utah also extends its flat rate to corporate income taxes with the same figure, promoting a sense of fairness in the business realm. But how does it stack up against our national averages? While Utah’s approach might seem like a one-size-fits-all, it effectively balances out as other state’s tiered tax systems often lead to similar tax burdens across various income levels.

The Intricacies of Property Tax in Utah

Understanding the Structure of Property Tax in Utah

When it comes to property tax in Utah, the plot thickens. The valuation process is like a sophisticated dance, with county assessors leading the way, ensuring that each property’s assessed value reflects its market value as of January 1 each year. By May 22, you can expect to receive valuation notices, and by November 30, the tax payment curtain closes.

Navigating Property Tax Rates and Exemptions

Speak of property tax, Utah, and you’ll find residents paying one of the lowest average rates in America. Yet, even with an effective rate that’s the seventh-lowest in the country, there’s room for relief. Programs like homestead exemptions and the “Circuit Breaker” tax credit offer a helping hand to those who qualify, especially our dear elderly and disabled homeowners. It’s this sense of community aid that adds a silver lining to the fiscal cloud.

| Tax Type | Description | Rate | Additional Information |

|---|---|---|---|

| Individual Income Tax | Flat tax applicable to all income levels regardless of filing status | 4.85% | Taxes Social Security benefits; no local income taxes |

| Corporate Income Tax | Flat tax applicable to corporate profits | 4.85% | Aligns with individual income tax rate |

| State Sales Tax | Basic tax rate applicable to most goods and services | 6.10% | |

| Maximum Local Sales Tax | The highest possible additional local tax on top of state sales tax | 2.95% | |

| Average Combined Sales Tax | The average of state plus local sales tax rates | 7.19% | Above the national average |

| Property Tax | Tax on property based on its assessed value | Varies by locality | Utah has the seventh-lowest effective property tax rate in the U.S. (rate not specified here as it varies by locality) |

Clarity on Utah Income Tax Rate for Earners of All Brackets

Dissecting the Single-Rate Income Tax System

A single-rate income tax system—it’s as straightforward as it sounds. All taxpayers in Utah are subject to this 4.85% rate, regardless of their earnings. Unlike the ladders of a tiered system, this flat structure means that, from the billionaire entrepreneur to the fresh-out-of-college startup founder, everyone contributes their fair share, according to the same percentage. Some may argue this doesn’t climb the mountain of progressive taxation, but it does provide predictability.

Preparing for Tax Season: Deductions and Credits in Utah

Now, don’t let the flat rate deter you from finding ways to lower your tax liabilities. Utah offers specific deductions and credits to ease the burden, including those for charitable donations and medical expenses. To define meaning in your tax returns, you’ve got to navigate these options like you’re plotting a course through the Wasatch Range—strategically and with an eye on the destination.

The Spectrum of Utah Sales Tax: More Than Just a Percentage

Unraveling the Base Utah Sales Tax and Local Surtaxes

The base state sales tax in Utah sits at 6.10 percent, but the plot thickens when local surtaxes enter stage left. Depending on where you drop your shopping bags, local municipalities might tack on up to an additional 2.95 percent, leading to an average combined rate of 7.19 percent. While that’s indeed above average, it’s part of the tapestry that funds our state’s needs. Still, it’s crucial to note that no cities in Utah charge their own local income taxes, an anomaly worth toasting to, don’t you think?

Unique Aspects of Sales Tax in Utah: Exemptions and Special Cases

Utah’s sales tax system isn’t entirely about additions; there’s a list of exemptions that’s quite the exclusivity club, including necessities like groceries which benefit from a reduced rate. Yet, when dining out, prepared foods find themselves on the other end of the spectrum with a higher rate. It’s a balancing act, much like checking your diet amid all the scrumptious options Salt Lake City has to offer.

A Deeper Perspective on Utah State Tax: Beyond the Basics

State Tax Nuances That Every Utahn Should Know

Drill down deeper, and you’ll discover other state taxes that may nibble at your wallet—fuel, tobacco, alcohol, each with their own set parameters. Last fiscal year, there were changes afoot, but none so drastic as to cause an upheaval in your financial planning. It’s akin to noting the changing seasons and adjusting your wardrobe accordingly.

Effective Tax Planning: Strategies for Utah Residents

Tax planning is hardly about luck; it’s an art. Considering the overall Utah state tax landscape, there are avenues to ease the burden—retirement savings accounts, investing in education savings plans, or dipping into health savings accounts. They’re the spice to your tax dish—use them wisely, and you can enhance the flavor of your fiscal year.

Comprehensive Analysis of the Utah State Tax Rate

Syncing Up With Contemporary Tax Trends in Utah

Understanding the current Utah tax rate trends is a bit like observing the migratory patterns of birds—a few are bound to change course with time. The state’s tax administration system is evolving, embracing tech advancements that could streamline processes and enhance transparency. Keep your eyes peeled for any new legislation that might cause ripples in your tax planning.

The Big Picture: Fiscal Health and How Utah State Tax Rate Fits In

Utah’s tax strategy is more than just collections; it’s about maintaining the state’s fiscal health. Each dollar collected contributes to the arteries of public services and infrastructure, carrying the lifeblood of the community. It’s like lending a hand to help your neighbor build their porch—integral to fostering communal harmony.

Forecasting the Future: Projections and Predictions for Utah’s Tax Landscape

With current economic trends, the future of Utah’s tax rates could see modifications as subtle as a change in the wind’s direction. Experts tilt their forecasts like a captain gauges the stars, speculating on possible shifts that could impact everything from property tax Utah to sales taxes. It’s about being prepared for the voyage ahead.

Innovative Steps Utah Could Take in Tax Policy

Imagine policies as inventive as the tech that’s taken root in Silicon Slopes. Speculation points to potential reforms that could redefine Utah’s tax climate in years to come. The state could consider adjustments to maintain competitiveness while ensuring vital public services don’t fall by the wayside.

Wrapping Up the Fiscal Tapestry: A Final Reflection on Utah’s Tax Climate

How does the Utah tax rate influence life in this beautiful state? It’s a question as deep as the Great Salt Lake itself. Our discussions should light a spark within you to manage your taxes proactively and with a keen eye, taking the insights woven throughout this article to heart.

In Utah, the fiscal landscape immerses itself within daily life. From the sidewalks we tread to the libraries we cherish—it’s the silent backbone of our community. So here’s to wrangling your taxes, Utahns! With strategic management and a dash of savvy, you’ll not only ride the wave of this year’s state tax rate but navigate it with the prowess of skilled financial navigators on the high seas of the Beehive State.

Did You Know? Utah’s Tax Tidbits!

Hey there, Utah residents and number crunchers! We’re diving into a treasure trove of facts about the Beehive State’s tax scene. Buckle up ’cause we’re about to add a dash of pizzazz to the typically dry world of taxes.

The Low-Down on Property Tax

Ever wonder where your property tax dollars are bustling off to in Utah? Unlike a “How do septic Tanks work“, it’s not all about the hidden flow of things. Utah boasts one of the lower property tax rates in the nation, which is pretty sweet for your wallet. It’s a complex system, but imagine each dollar rolling up its sleeves and getting down to business, funding local services that make your community shine.

Income Tax – One Size Fits Most!

Utah loves to keep things simpler than a game of checkers when it comes to income tax. With a flat rate that’ll have you skipping the headache of staggered brackets, the state says, “One rate to rule them all!” Well, not quite like a fantasy film, but you get the gist. Moving money around? Maybe you’re dabbling in a “discover home Loans” adventure. Keep in mind, whether you’re as rich as Midas or hustling hard, you pay the same rate on that taxable income.

Sales Tax – A Dash Here, A Pinch There

Now, sales tax can hit you like a spontaneous game of dodgeball—different rates depending on where you’re shopping. There’s the state level, sure, but then local areas might sprinkle a little extra, like a chef finessing the perfect dish. Feel like you’re forever funneling cash into sales tax? You might be curious about a “loan For rent” to keep your budget shipshape. Watch those local rates, as your final tally at the checkout could be more than you’d expect!

A Splash of Color: Tax Credits and LGBT Pride

Now, wouldn’t you know it, among the tax forms and numbers, Utah’s got a heart for diversity. Similar to the diverse “Lgbt Flags“, the state offers a spectrum of tax credits that add a splash of color to your tax filing. From energy-saving upgrades in your home to helping out those less fortunate, taking advantage of these credits can be a bright spot in the tax season hustle.

Remember, these tax tidbits are just the tip of the iceberg, folks! Always double-check the details and consider grabbing a local tax pro to wade through the jargon jungle. Yakking about tax may not be everyone’s cup of tea, but being in the know can leave you sitting pretty and, dare we say, even a bit chirpier when tax season rolls around.

Is Utah a tax friendly state?

Is Utah a tax friendly state?

Well, hold your horses! It’s not as clear-cut. Utah can be kind of middle-of-the-road when it comes to tax-friendliness. They’ve got a uniform state income tax rate that doesn’t play favorites, but, man oh man, they also have some property and sales taxes that can make you think twice before opening your wallet.

How much is Utah pay tax?

How much is Utah pay tax?

Listen up, wage earners! If you’re clocking in and out in Utah, expect the state to take a flat 4.95% of your hard-earned cash in state income tax. Just remember, Uncle Sam wants his cut, too, with federal taxes in the mix.

Does Utah have high state income tax?

Does Utah have high state income tax?

Well, it’s not through the roof, but it’s not exactly bottom of the barrel either! Utah charges a flat rate of 4.95%, which is neither the lightest touch nor the heaviest hand in the cookie jar when you look at income taxes across the states.

What is the Utah state tax rate for 2023?

What is the Utah state tax rate for 2023?

Utah’s playing it steady as she goes, with a state income tax rate fixed at 4.95% for 2023. No surprises this time around – it’s the same number as before.

What is not taxed in Utah?

What is not taxed in Utah?

Get this: Utah is pretty chill with unprepared food items – they dodge the regular sales tax. Prescription drugs also get a free pass. But before you jump for joy, keep your eyes peeled, because most other goods and many services don’t get off the hook so easily.

Why are the taxes so high in Utah?

Why are the taxes so high in Utah?

Oh, boy, that’s the million-dollar question! It’s a mix of things, really. With a flat income tax rate and additional local sales taxes that can stack up, it might feel like you’re always reaching into your pockets. These taxes fund public services, and well, quality doesn’t come cheap!

How much is $100,000 after taxes in Utah?

How much is $100,000 after taxes in Utah?

If you’re raking in a cool $100k in Utah, guess what? After the state’s taken its 4.95% slice and the feds have had their share, you’re looking at pocketing around $70,000 to $75,000. But hey, don’t quote me on that – it’s a ballpark figure, and your actual take-home pay may vary based on deductions and other taxes.

Is Utah an expensive state to live in?

Is Utah an expensive state to live in?

Alright, let’s keep it real. Utah isn’t the cheapest ticket in town, but it’s not making wallets cry as much as some coastal states do. Housing can get pricey, especially in hot spots like Salt Lake City, but overall, you can find ways to stretch a dollar in the Beehive State.

Are taxes higher in California or Utah?

Are taxes higher in California or Utah?

Oh California, land of the sun and sky-high taxes! Without a doubt, if you’re a tax detective, you’ll find that Cali ranks higher on the tax scale with its progressive income tax reaching a whopping 13.3% for top earners. Utah’s flat rate of 4.95% looks like small potatoes in comparison.

Are there tax advantages to living in Utah?

Are there tax advantages to living in Utah?

Sure thing, Utah has some perks up its sleeve! Besides the cool mountain air, that flat income tax rate means no surprises come tax time, and there are retirement income exemptions that surely sweeten the deal for seniors. It’s all about the small wins, amigo!

What is the most tax-friendly state to live in?

What is the most tax-friendly state to live in?

Drumroll, please… If you’re looking for tax heaven, states like Wyoming, Nevada, and Alaska roll out the red carpet with no state income tax and other tax breaks. It’s like a tax vacation year-round!

Is Utah a tax haven?

Is Utah a tax haven?

Hold your horses – Utah’s no Swiss bank account, if you catch my drift. It’s got a straightforward tax system but doesn’t quite hit the haven status compared to those states where income tax is just a myth.

Which state has the lowest taxes?

Which state has the lowest taxes?

If it’s a quest for low taxes you’re on, put your treasure map away because states like Tennessee, Florida, and South Dakota might just be your X marks the spot, offering some of the lowest tax burdens around.

Which states have no income tax?

Which states have no income tax?

The no-income-tax club is pretty exclusive, but states like Texas, Washington, and Florida will let you keep all your income tax chips. These states prefer to play the sales and property tax game to rake in the dough.

How much is food tax in Utah?

How much is food tax in Utah?

Chowing down in Utah doesn’t come without its costs. Prepared food can face a tax of around 3% on top of the general sales tax, but if you’re sticking to the grocery list, unprepared food is taxed at a reduced rate of just 1.75%.

Are there tax advantages to living in Utah?

Where does Utah rank in taxes?

When the numbers are crunched, Utah usually settles somewhere in the middle tier nationally—it’s neither a tax paradise nor a high-tax horror story. With its flat tax rate and reasonable (but not the lowest) property and sales taxes, it places moderately in the grand scheme of state taxes.

Where does Utah rank in taxes?

Is Utah a tax-friendly state for seniors?

Utah throws the golden agers a bone with some tax friendliness. Seniors can catch a break with Social Security exemption and a retirement income tax credit that can take the edge off during the golden years. Not too shabby, Utah!