House hunting can feel like watching the New Orleans pelicans Games: exciting, fast-paced, full of strategies and right down to the wire. One of the crucial parts of this game is deciding what type of mortgage to get. Today, we’ll explore ‘what is a 5/1 arm’, a mortgage type that can be as fascinating as an episode of Monica Geller‘s life.

Fathoming the Concept: What is a 5/1 ARM?

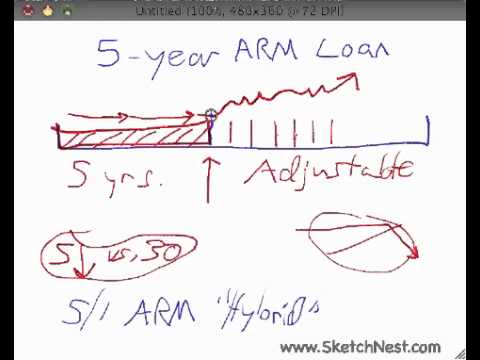

A 5/1 ARM or 5/1 Adjustable Rate Mortgage is a mortgage loan type where the ‘5’ and ‘1’ are numbers that dictate the loan’s interest rate characteristics. But first, let’s understand ‘adjustable-rate mortgage.’ It’s a mortgage type that, unlike fixed-rate mortgages, has an interest rate subject to change over time.

The figure ‘5’ in ‘5 year arm meaning’ implies the fixed rate period- precisely, the first five years. And ‘1’? That’s the interval, in years, at which the interest rate adjusts after the initial five-year period. The existence of 5/1 ARM caters to a specific set of borrowers, much like a special menu at a restaurant!

Mind-Boggling Intricacies: 5/1 ARM Meaning Explained

Now that we understand ‘what is a 5 year arm’, let’s dive into details, much like unraveling the mysteries of a gripping novel plot. During the first five years – the ‘fixed-rate period’, the interest rate remains unchanged.

When the five years are up in this 5/1 arm scenario, the excitement begins! The interest rate then adjusts annually based on a reference interest rate index. This adjustment refreshes your mortgage rate and, consequently, affects your monthly payments too.

| Subject | Information |

|---|---|

| Definition of 5/1 ARM | Adjustable-Rate Mortgage (ARM) where the interest rate is fixed for the first five years and then adjusts annually. |

| Benefits | It is a great choice for people aiming to save money on their monthly payments during a specific period. |

| Risks | The loan balance is not paid down in the interest-only period, which may result in a substantial payment rise if it is not cleared before the expiry of this period. |

| Prepayment | Yes, a 5/1 ARM can be paid off early either through selling the property or refinancing the original loan. However, prepayment penalties may apply. |

| Ideal Users | Suitable for those planning to live in the property for a limited number of years or are looking to pay off the mortgage before the possibility of interest rate increases. |

| Duration of Fixed Interest Rate | The fixed interest rate usually spans from one to seven years. In the case of a 5/1 ARM, it is fixed for the first five years. |

Advantageous Aspects of 5/1 ARM

You may wonder about the ‘5/1 arm rates’ benefits. Just as some folks savor the thrill of roller coaster rides, some borrowers can financially gain from this ride.

Such borrowers might plan to stay in their homes for less than five years, allowing them to capitalize on lower initial interest rates and potentially save on monthly payments. It’s much like spotting an early bird discount for a product you were intending to purchase!

Diving Deeper into 5/1 ARM Rates and Impacts on Homebuyers

Interest rates on a 5/1 ARM can be as unpredictable as weather conditions; they change based on market conditions at the time of each annual adjustment. The 7/1 arm rates or 10/1 arm work similarly. These rates can greatly influence your overall mortgage cost.

One quirk of a 5/1 ARM is that during the initial fixed-rate period, the first five years, the loan balance isn’t paid down, somewhat like a marathon runner maintaining a steady pace in the first lap. This could result in a leap in payment if the loan isn’t paid off when the interest-only period expires.

Answering the Key Question: Can You Pay Off a 5/1 ARM Early?

Speaking of paying off your 5/1 ARM early, you might echo the famous ‘Friends’ phrase – “We were on a break!” and decide to strategically break from your loan commitment. Yes, it’s possible to pay off the loan early. However, like a sting in a tale, some 5/1 ARMs might come with prepayment penalties.

Just as knowing the rules of a board game helps, understanding the implications of prepayments is vital.

Strategies for Early Payoff

Repaying your 5/1 ARM might seem as challenging as preparing a gourmet meal, but strategies exist! You could sell the property, akin to cashing in your chips at the right time. Alternatively, refinancing the original loan might be an option too, much like swapping a questionable dish at a restaurant for something more palatable.

Making Informed Decisions: What is a 5/1 ARM Suitable For?

Much like deciding on the perfect outfit for an occasion, choosing a 5/1 ARM mortgage depends on your circumstances. If you plan to live in your home for a short period or aim to pay off the mortgage early, a 5/1 ARM might be a sensible choice. However, the unpredictability of future interest rates can be as nerve-wracking as a cliffhanger episode. Make sure your financial planning includes these possible fluctuations!

Top 3 Tips for Prospective 5/1 ARM Homebuyers in 2024

Here are some tips that might serve you as well as a well-played chess move:

Curating your Course: Final Reflections on the 5/1 ARM Journey

Summing up our 5/1 ARM journey, it’s unique and catered for specific financial situations, just as a custom-tailored suit would be. The decision to choose a 5/1 ARM, akin to an adventurous expedition, should consider individual financial scenarios.

Keep in mind that information is power! So don’t hesitate to ask ‘what is a 5/1 arm’ or ‘what is a 5/1 arm meaning.’ The more informed and calculated decision you take, the better your home-buying process will be. Much like the sigh of satisfaction at the end of a tough Is-7 puzzle game, you will appreciate the benefits of your careful planning!

Is it a good idea to have a 5 1 ARM?

Well, a 5 1 ARM can be a sweet deal or a tough pill depending on your circumstances. For folks planning on moving in a few years, the initial low-interest rates can make it a winning choice. The risk, however, lies in the adjustable-rate period, where mortgage rates could rise and give you a bit of a nasty shock.

Can you pay off a 5 1 ARM early?

Sure thing, you can pay off a 5 1 ARM early, but watch out for those prepayment penalties! Some lenders charge an arm and a leg if you decide to break free early. So, it’s best to sniff around and understand the terms before signing on the dotted line.

What is the 5 1 ARM mortgage rate today?

Ah, the 5 1 ARM mortgage rates…always shifting and changing like the wind! For today’s rates, your best bet would be hopping on our website, where we keep the digits updated, pretty much around the clock.

Is it a good idea to get an ARM loan?

Getting an ARM loan can be a bit of a roller coaster ride, truth be told. If you play your cards right and market conditions are favorable, it could be smooth sailing. But, remember, the rates are variable, and if they spike, it’s like being caught between a rock and a hard place.

What happens after 5 year ARM expires?

After the 5-year ARM expires, well, buckle up! Your rate will start adjusting annually based on the market. It could go up, down, or loop-de-loop – it’s anyone’s guess really!

Is 5 year ARM risky?

Risky? Can’t deny that a 5-year ARM has its thrills. You’re essentially playing the market game and rates could go sky high after the fixed period. So yes, there’s a bit of a gamble involved.

What are the dangers of an ARM vs fixed?

ARMs vs fixed-rate loans? It’s like comparing apples and oranges. An ARM can start with a much lower rate, but it’s a bit like walking on a tightrope. A fixed-rate, on the other hand, is the slow and steady turtle, with predictable monthly payments.

What credit score do you need for a 5 1 ARM?

For a 5 1 ARM, you generally need a pretty spiffy credit score. We’re talking mid-to-high 600s or higher. But remember, credit score isn’t everything! Debt-to-income ratio, down payment, and other factors weigh in as well.

What is the difference between a 30-year fixed and a 5 1 ARM?

The difference between a 30-year fixed and a 5 1 ARM is straightforward. A 30-year fixed is your trusty steed, with constant rates and payments for the full loan term. A 5 1 ARM, however, is a bit of a changeling, with fixed rates for 5 years and then variable rates thereafter.

Can you refinance a 5 1 ARM anytime?

Refinance a 5 1 ARM anytime? You sure can, but let’s not jump the gun. Remember, refinancing entails costs, and it may not always be worthwhile unless you can substantially lower your interest rate or alter your loan term for the better.

How much is 30 years fixed interest rate?

The 30-year fixed interest rate varies depending on market conditions, your credit standing, down payment, and more. For the latest rates, give our website a quick visit.

What is a 5 1 ARM 30-year term rate?

A 5 1 ARM 30-year term rate is kind of a mixed bag. For the first 5 years, your rate is fixed and then zippity-doo, it becomes adjustable for the remaining 25 years, based on market movements.

What credit score do you need for an ARM?

With an ARM, you’ll generally need a credit score of 660 or above. But hey, remember, it’s not set in stone! The exact number can vary from lender to lender.

What is the disadvantage of an ARM loan?

The big disadvantage of an ARM loan is the uncertainty. After the initial fixed period, your rates could climb higher than a kite, making your mortgage payments jump up like they’ve gotten a hot foot!

Why do people get ARM mortgages?

People choose ARM mortgages for the initial low rates, it’s no rocket science. It can be a good pick for those who plan to sell or refinance before the rate adjustments kick in.

Is a 5 1 ARM a good idea in 2023?

A 5 1 ARM in 2023, a good idea? Now, that’s entirely dependent on market projections and your personal circumstances. It could be a case of a quick win or being penny wise and pound foolish.

How long does a 5 1 ARM last?

A 5 1 ARM lasts for 30 years, with the first 5 years at a fixed rate, and the remaining years floating with the tide of market rates.

Can you refinance a 5 1 ARM after 5 years?

Refinancing a 5 1 ARM after 5 years is doable. Just watch out for any refinancing costs and make sure it gives you an upper hand in the long run.

Are 5 year fixed-rate mortgages a good idea?

Are 5 year fixed-rate mortgages a good idea? They can be! If you cherish predictability and like knowing what your payments are going to be like rain or shine, then yes, they make sense. However, these mortgages often come with slightly higher interest rates than their adjustable counterparts, so it’s all about weighing up your options.