Determining your home value can be a complex process, but it’s crucial for homeowners who are selling, refinancing, or just curious about their property’s worth. In this comprehensive guide, we’ll cover everything you need to know about finding your home’s value accurately.

Understanding What is My Home Value in 2024

Before diving into the methods, it’s essential to understand what is my home value and why it matters. Home value is the estimated price at which a property would trade in a competitive market. This value is influenced by various factors, including location, size, condition, and market trends.

Knowing your home value is not just about numbers. It’s peace of mind, financial planning, and smart decision-making. You might be looking to sell, refinance, or just track your investment. Understanding what is my home value can provide clarity in all these scenarios.

The Importance of Property Value Estimates

Accurate property value estimates are vital for:

| Aspect | Description |

| Definition | Home value is the estimated amount a property would likely sell for in the current real estate market. |

| Factors Affecting Home Value | – Location: Proximity to amenities, schools, and employment centers. – Size and Age: Square footage, number of bedrooms/bathrooms, and construction year. – Condition: Structural integrity, updated appliances, and overall maintenance. – Market Trends: Current demand and supply in the real estate market. – Comparable Sales: Recent sales prices of similar homes in the neighborhood. |

| Valuation Methods | – Automated Valuation Models (AVMs): Use algorithms and data analysis (e.g., Zestimate). – Comparative Market Analysis (CMA): Performed by real estate agents based on recently sold, similar properties. – Professional Appraisal: Conducted by licensed appraisers using standardized methods. |

| Tools for Estimating Home Value | – Online Estimators: (e.g., Zillow Zestimate, Redfin Estimate) – Real Estate Agent: Local market knowledge and CMA reports. – Hiring an Appraiser: Professional in-depth evaluation. |

| Benefits of Knowing Home Value | – Refinancing: Helps in securing better loan terms. – Selling: Helps in setting a competitive asking price. – Equity Calculation: Determining home equity for financial planning. – Investment Analysis: Evaluating return on investment if selling or renting. |

| Costs Involved | – Online Estimations: Typically free. – Real Estate Agent CMA: Often free, but may be part of agent services. – Professional Appraisal: Usually ranges from $300 to $500. |

| Useful Tips | – Regular Updates: Monitor your home value periodically as market conditions change. – Home Improvements: Invest in renovations that increase value (e.g., kitchen remodel, energy-efficient windows). – Stay Informed: Keep track of local real estate trends and market conditions. |

Methods to Find Your Home Value

1. Online Valuation Tools

Tools like Zillow’s Zestimate, Redfin, and Realtor.com offer free instant property value estimates based on algorithms and public data. For instance, you can use the Zillow home value estimator to get a starting point. These tools provide a base figure but should always be cross-referenced with other methods for accuracy.

2. Hiring a Professional Appraiser

A certified appraiser inspects your home, considering various factors, including recent sales of similar properties, to deliver a detailed appraisal report. This is one of the most reliable ways to find home value.

3. Comparative Market Analysis (CMA)

Real estate agents perform CMAs by comparing your home to similar properties that have recently sold in your area. This method gives a detailed look at how your home’s features match up to those recently sold, helping you estimate home value more precisely.

Factors Influencing the Value of My Home

1. Location

Proximity to schools, parks, public transportation, and other amenities can significantly affect home value. For instance, properties in highly-rated school districts like Palo Alto Unified School District often have higher values. Learn more about the significance of location, especially the California capital areas.

2. Home Size and Usable Space

Square footage and the number of bedrooms and bathrooms are crucial metrics. Homes in Dallas with larger living spaces tend to fetch higher prices because size matters when calculating how much your house is worth.

3. Condition and Age

Renovated homes and properties with modern updates typically have higher values. Older homes might need inspections to assess structural integrity, which can influence value. Does your property shimmer like a black Shrek or does it need polishing?

4. Market Trends

Understanding current real estate trends is crucial. Financial factors such as mortgage rates also play a role. For example, during the 2024 housing market upswing, properties in growing metros like Austin saw significant value increases.

Tools to Calculate How Much is My House Worth by Address

1. Realtor.com Home Value Estimator

Inputting your address will give you a detailed report on how much is your house worth, including recent sales of comparable properties in your neighborhood. It’s an easy way to gauge the market’s heartbeat.

2. Zillow’s Zestimate

Entering your address into Zillow can provide an instant estimate. While sometimes critiqued for accuracy, it’s improved significantly with advancements in AI, thus a reliable starting point.

How Much is My Property Worth – Expert Insights

Industry experts like Barbara Corcoran of Shark Tank suggest combining online estimates with professional appraisals and market analysis for the most accurate valuation. Knowing the worth of your property empowers you to make informed decisions.

Local Real Estate Market Trends to Watch

Keeping an eye on local market trends is crucial. For example, the housing boom in areas like Nashville has led to steep increases in property values. Observing these trends can help you determine the optimal time to sell or value your home accurately.

Tips for Enhancing My Home’s Value

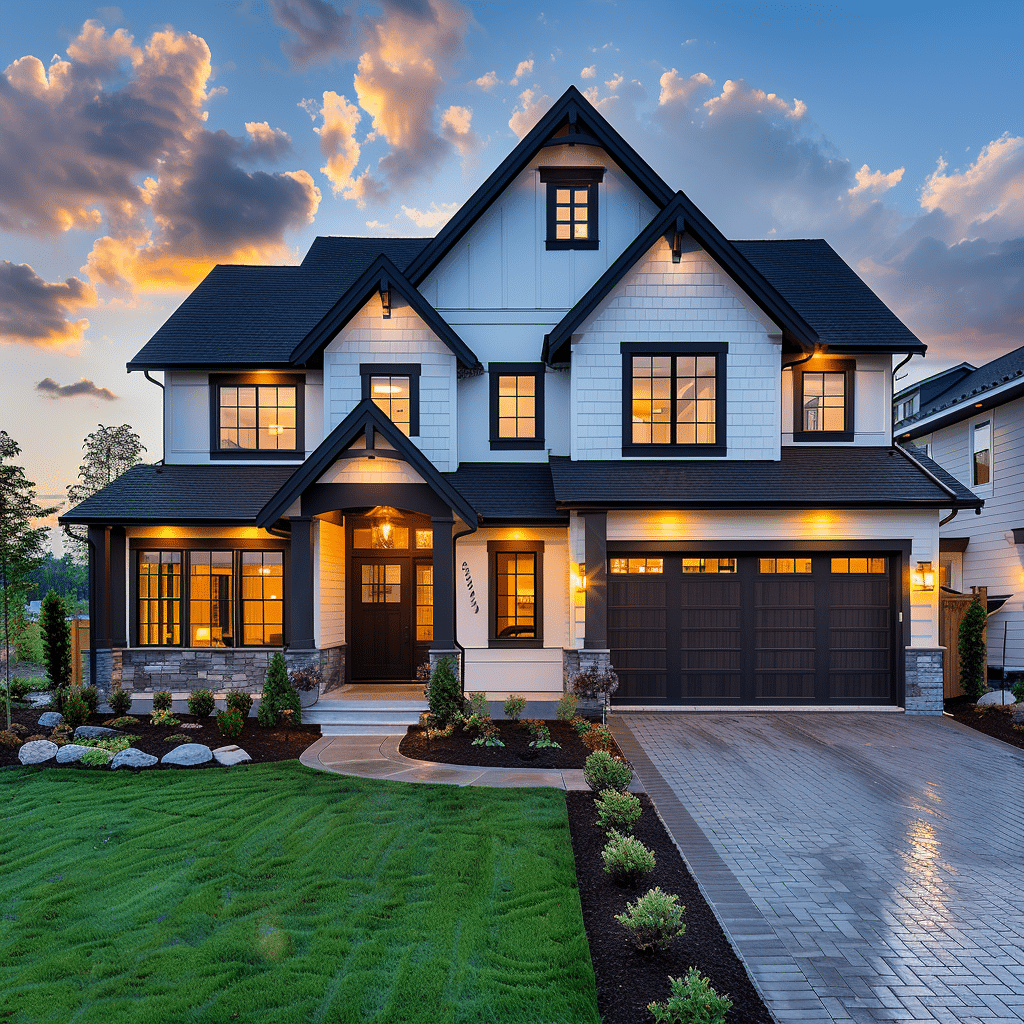

1. Curb Appeal

Simple upgrades like landscaping, a fresh coat of paint, or new front doors can significantly increase your home’s appeal and value. First impressions matter, right?

2. Interior Upgrades

Investing in kitchen and bathroom remodels often brings high returns. Companies like Lowe’s offer financing options for major renovations, allowing you to make impactful upgrades without denting your wallet.

3. Energy Efficiency

Eco-friendly improvements, including solar panels from Tesla or energy-efficient appliances from Energy Star, can boost your property value. Going green is not just trendy; it’s financially smart.

Frequently Asked Questions (FAQs)

What Impacts My House Worth the Most?

Location and market trends generally have the most substantial impact. For instance, coastal properties in San Diego tend to have higher values due to desirable locations. Check how market trends can twist your home value.

How Often Should I Check My Home’s Value?

It’s smart to evaluate your home’s value annually or before significant financial decisions. Market fluctuations and improvements you’ve made can alter your home’s value.

Innovative Paths to Monitor the Value of My House

Beyond traditional means, innovative platforms like Homebot offer dynamic home valuation tracking, providing monthly updates on your home’s estimated value, mortgage balance, and potential refinance options.

Without explicitly labeling this segment as a conclusion, it’s time to embrace these strategies and tools. By accurately assessing your home’s value, you can make well-informed decisions that enhance your financial well-being. Stay proactive and utilize all available resources to keep keen insight into the real estate landscape.

What Is My Home Value Essential Guide

Have You Ever Wondered?

Ever been curious about what makes your home worth what it is? Knowing what is my home value can be quite enlightening. Did you know that a home’s market value is influenced by various factors beyond just its location and size? For instance, even the cicada sound in your area can subtly impact the desirability and, in turn, the value of your property. It’s these little-known tidbits that peek into the complex world of home valuation.

The Role of New Construction

Interestingly, new house construction in your neighborhood can significantly elevate your home’s value. When new homes are built, they often come with modern amenities and superior designs that can raise the bar for property values in the area. This ripple effect can be beneficial if you ever plan to sell your house. Understanding how fresh developments influence your home’s worth can help you better estimate what is my home value over time.

Synonyms for Value

Did you realize there are numerous values synonym considered when appraising your home? Factors like “worth,” “market price,” and “cost” all play a role in determining your property’s value. Each term, while slightly different, adds a layer of insight into the comprehensive evaluation process. Knowing these can demystify parts of the assessment that many people find perplexing, making it easier to grasp what is my home value.

Random Fun Facts

In the quest for finding what is my home value, did you know the principles of house market value apply not only to the general structure but also to quirky aspects like the type of trees in your yard? Yep, certain tree species can add a premium to your home’s value. Moreover, houses with names, believe it or not, sometimes command higher prices just due to their unique branding!

So, next time you’re pondering what is my home value, remember it’s a mix of fun facts and practical considerations. From the cicada sound around to the new house construction nearby, every detail counts in this ever-fascinating field.