Understanding the Current Average Interest Rate on a Home Loan

Historical Context: The Interest Rate Landscape Over the Last Decade

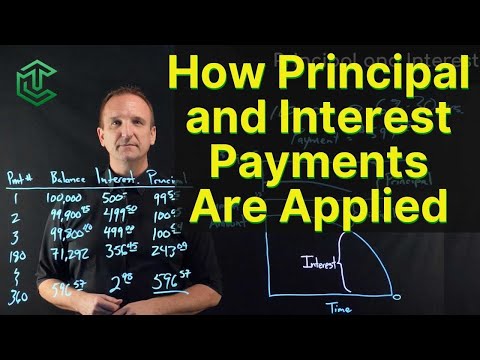

As we dive into what is the average interest rate on a home loan, let’s take a quick jaunt down memory lane. Over the past decade, we’ve seen mortgage rates ride a roller coaster of highs and lows. Starting from a relatively low point in 2014, rates dipped and danced, dropping to historical lows around 2020 when the world got unhinged, thanks to the global pandemic.

Factors that historically influenced mortgage rates include the likes of economic growth, inflation, and the Federal Reserve’s monetary policy. These aspects played a pivot-like dance, leading to those tempting sub-4% rates that homeowners and buyers cherished not too long ago. Fast forward to recent years, and you find yourself at the precipice of an economy saying, “Hold my Diet Pepsi, because, well, we’re seeing rates that are enough to make your wallet shake.

Dissecting the 7% Spike: What Led to the Surge?

The financial landscape that’s left us with what is the average interest rate on a home loan hitting the 7% mark can feel like a scene from the best new horror Movies – startling and with a twist you might not have seen coming.

A combination of factors came into play here. Economic indicators like inflation, employment data, and even whispers of recession fears had lenders and borrowers alike on edge. Then, you have policies and market conditions – the Fed stepping in with rate hikes in a bid to slow inflation, for example – turning the heat up. It’s reminiscent of yesteryears’ high volatility, but this time, it’s mixed with a modern economy that’s more interconnected than ever before.

The Average Interest Rate on a Home Loan: How It Compares to the Past

Presently, What Is The average mortgage interest rate? It sits in the mid-6% range for a 30-year loan, which (let’s be real) can feel like a cold splash of water compared to the low rates we’ve basked in before. Not long ago, snagging a rate anywhere near 4% would have had you clicking your heels.

Comparing this to historical averages, there’s a stark contrast. We also can’t ignore regional variations in home loan interest rates, bringing a whole new level of complexity to home buying across the states.

How Mortgage Lenders Are Reacting to the New Rate Environment

Mortgage lenders, including heavyweights like Quicken Loans and Wells Fargo, have had to adapt and get creative faster than you can say “Jason Momoa ethnicity” discussion on a movie set.

These financial gurus are rolling out fresh loan products and services purpose-built to soften the blow. Deep within the halls of finance, experts like William Patterson offer a silver-toned lining with insights on managing this new roller coaster.

Home Buyers’ and Homeowners’ Strategies in the Face of Rising Rates

The grip of the 7% spike is reshaping buyer behavior as folks are now weighing out renting Vs buying a house with a more analytical eye.

There are strategies afoot, though! Refinancing is becoming as mainstream as avocado on toast, while locking in rates has become the new financial safety dance. Homeowners are looking for wisdom; imagine Suze Orman meets Robert Kiyosaki – that level-headed yet astute demeanor to navigate these choppy waters.

The Rippling Economic Effects of a 7% Interest Rate Increase

This isn’t just about the housing market; it’s about the broad economic rundown, folks. We’re talking dips in sales volumes, home prices getting a reality check, and new construction projects moving slower than weekend traffic.

The broader economy takes a hit too. People might tighten their belts hard enough to make consumer spending nosedive, affecting investments and even job security in some sectors. Economists are tucked away in their think-tanks cooking up predictions, but the consensus? It’s a long-term view kind of game now.

Global Perspectives: Comparing the U.S. Rate Spike to International Trends

Strap in for a quick global tour. Yes, believe it or not, the U.S. isn’t alone in dealing with these mortgage market shake-ups.

In some ways, looking across the pond or over at our neighbors can offer us a glimpse into different responses – a financial systems shock absorber, if you will. It’s no blanket solution, but there are snippets of strategy in the global markets that could offer the U.S. food for thought.

Navigating the New Norm: Long-term Considerations for Stakeholders

Government policy could be a guardian angel in this narrative, either steadying the ship or injecting some adrenaline into the housing market.

Financial advisors are not sitting this one out – they’re coaching clients for a potential marathon of volatility. Meanwhile, tucked away in their think-tanks, experts whisper forecasts that could inspire your next strategic move.

An In-depth Look at Real-world Effects: Testimonies and Case Studies

REAL humans, actual home buyers, have faced this spike head-on, and their stories are worth more than gold. They’ve navigated the tumult with strategies as diverse as the Us mortgage rate history is long.

The lending industry is in reaction mode, from pop-up products to bold policy shifts. And we’re analyzing which mitigation strategies are not just surviving but thriving in this new frontier.

Innovative Financial Products Emerging from the Rate Hike

Creativity has been the name of the financial game. As these rates rear their heads, banks and institutions have put on their thinking caps, ushering in mortgage products tailored for the high-interest era.

Amongst the innovators, firms like JPMorgan Chase and Citi have taken charge. Their new offerings are hitting the market like a storm, and consumers, with bated breath, are taking notice. How are these received? That’s the juicy part we’re all watching closely.

Conclusion: Embracing the New Interest Rate Reality

To wrap up this wild ride, we have to acknowledge the implications of a 7% interest rate spike. It’s changing the game, redefining financial planning for home loans, and setting a new baseline.

Sure, it might not be the ‘happily ever after’ we all scripted in our minds, but there’s strength in adaptation. Industry stalwarts and savvy consumers are learning to navigate this future, steadfast in the face of high rates that, for now, seem to be here to stay.

What Is the Average Interest Rate on a Home Loan?

Hold onto your hats, folks, because we’re diving into the wacky world of home loan interest rates. Now, if you’re like most people, the mere thought of interest rates sends your excitement levels through the roof, right? Just kidding! But stay with me – this stuff is crucial when you’re eyeing your dream home.

Buckle Up for Interest Rate Roller Coasters

Okay, so here’s the deal. The average interest rate on a home loan can be as unpredictable as your Aunt Martha’s mood at Thanksgiving—it goes up, it goes down, and sometimes it throws a curveball that catches everyone off guard. One minute, you’re getting quoted one rate, and the next, it’s like, “Surprise! Time to pay more!” But why the fluctuation?

Well, interest rates are kind of like a seesaw at the playground. They’re impacted by a ton of factors like inflation, Federal Reserve policies, and even global events. That’s the game of loans for you! And sure, we’ve recently been on the “up” side of the seesaw, where rates are deciding to reach for the sky.

Keep a Sharp Eye on the Prize

Now, you might be wondering, “Alright, but what’s this mythical average interest rate?” Word on the street (or on the informative interwebs) is that you could’ve snagged a sweet deal with rates hovering below 4% in recent history. Those were the days, my friend! But, hold your horses because the national mortgage interest rate has been showing us that it’s got a mind of its own.

Ready for the kicker? Say your piggy bank is feeling pretty heavy, and you’re in the market to buy. Well, buddy, having a solid grasp on the “what is the average interest rate on a home loan” vibe is crucial. Why’s that? Because, my friend, your monthly payments, total interest shelled out over the lifespan of the loan, and, yup, even your ability to snag that charming fixer-upper all hinge on it.

Mortgage Rates: The Unpredictable Plot Twist

And just when you thought you had it all figured out, these rates hit you with a plot twist straight out of a soap opera—a jaw-dropping 7% spike! Holy smokes, right? But fear not! Even though the average interest rate on a home loan can sometimes feel like it’s hopping on a pogo stick, there are still ways to wrestle these wild rates to the ground.

Becoming a savvy shopper, locking in rates at just the right moment, and comparing lenders like you’re judging a pie-eating contest at the county fair—these moves can be game-changers. And hey, don’t forget that credit score. Buffing up that number is like putting on your best suit for a job interview—it can make a heck of an impression.

So, dear readers, now that you’re armed with the spicy deets on what the average interest rate on a home loan is up to these days, you’re better prepped to navigate the mortgage maze. Will rates go up? Will they go down? It’s anyone’s guess! But one thing’s certain—keeping an eye on the prize (and keeping the loan gods happy) is the way to go for your wallet and your peace of mind.

What is a 30 year mortgage rate right now?

– As quick as a hiccup, things in the mortgage world can change, but as it stands, a 30-year mortgage rate is typically starting in the mid-6% range. Bear in mind, that’s the latest as of January 19, 2024, so keep your ear to the ground – or your eyes on the screen – for the latest figures.

Is 7% a bad mortgage rate?

– Well, well, well — is 7% a bad mortgage rate? Once upon a time, we’d have gasped at such a number. Compared to a couple of years back, 7% feels like a bitter pill to swallow. But hey, context is everything! These days, it’s not uncommon for borrowers who’ve secured a mortgage in the last year to be looking at rates of 7% or higher. Don’t shoot the messenger — that’s just the way the cookie crumbles right now.

Is 5% a high mortgage rate?

– Yikes, is 5% a high mortgage rate? Once, that would’ve had us raising eyebrows, but hold your horses — with good rates for a 15-year fixed loan starting in the high-5% range as of now, 5% doesn’t seem so outlandish anymore. It’s all relative, and compared to today’s rates, 5% could be considered more middle of the road than sky-high.

What is a good interest rate for a mortgage now?

– On the hunt for a good interest rate for a mortgage now? Buckle up! ‘Good’ is a bit of a moving target, but as of January 19, 2024, a decent rate for a 15-year fixed mortgage generally kicks off in the high-5% neighborhood, while for a 30-year fixed, the party starts in the mid-6% area. Keep your eyes peeled, though, as this landscape changes faster than the weather in April!

Are mortgage rates expected to drop?

– Are mortgage rates expected to dip anytime soon? Well, if I had a crystal ball, I’d be lounging on a yacht instead of crunching numbers! But here’s the scoop: Forecasting rates can be like trying to nail jelly to the wall, as so much hinges on unpredictable economic factors. No promises, but keep your fingers crossed and stay tuned.

Who is offering the lowest mortgage rates right now?

– Scouting for the lowest mortgage rates on the block? Keep your ear to the ground, amigo. The playing field’s constantly shifting, with banks, credit unions, and online lenders all jostling for your business by offering competitive rates. Hunts for pinpointing the rock-bottom rates can be like trying to pin the tail on the donkey, but it’s out there – just make sure to shop around.

Will mortgage rates ever be 3 again?

– Back to 3% mortgage rates? In your dreams, right? Well, hold your horses! While the rearview mirror shows us lower rates in the early 2020s, predicting future rates is slippery business. As they say, never say never, but don’t hold your breath – economic shifts as wild as a rollercoaster could take us there or keep us dreaming.

Will mortgage rates go down 2023?

– Will mortgage rates take a nosedive in 2023? Hey, wouldn’t we all love a crystal ball for this one? Since economic soothsaying isn’t an exact science, we’re all in the same boat—watching, waiting, and wagering guesses. Keep your eyes on the market’s pulse, because only time will tell.

Will interest rates go down in 2023?

– Interest rates dropping in 2023? Well, that’s the million-dollar question, isn’t it? It’s a bit like asking if it’ll rain next week – we’ve got forecasts and hunches, but Mother Nature and the economy both love a surprise party. Stay on your toes, and watch the market trends for any sign of drizzle.

Will mortgage rates go down 2024?

– Is 2024 going to be the year we see mortgage rates tumble? Gazing into the proverbial crystal ball, it’s tough to say. Economists and fortune-tellers alike could gab ’til the cows come home, but the truth is, it hinges on so many ifs and buts. Keep checking back, and maybe, just maybe, we’ll have good news.

Is it possible to get a 4% mortgage rate?

– Snagging a 4% mortgage rate? Given the current trend, it seems like a long shot, doesn’t it? But don’t toss it in the ‘impossible’ pile just yet. Remember, the mortgage rate track sees more ups and downs than a yo-yo, so it’s not inconceivable. Keep your eyes peeled and your hope tank full!

Will interest rates go down 2024?

– Interest rates taking a dive in 2024? I’d bet you’d like to hear a reassuring ‘yes’, but it’s tricky business, this forecasting. We’re all riding the economic waves, hoping not to wipe out. So, stay strapped to your surfboard, and let’s see where the tide takes us.

Is a 2% mortgage rate possible?

– Dreaming of a 2% mortgage rate may feel like chasing rainbows nowadays. It’s in the ‘super unlikely but never impossible’ range. Just like spotting a unicorn, you’d need a hefty dose of magic (read: a wildly unexpected economic turn) for rates to drop that low. Don’t lose all hope, but maybe don’t bet the farm on it.

What will mortgage rates be in 2024?

– Mortgage rates in 2024, what’s the word on the street? Can you believe it’s still murky waters? Pros in the field are making educated guesses, but let’s face it, they’re about as solid as a house of cards. Stay updated, and let’s hope for a winning hand rather than a gust of wind.

How can I get a lower mortgage interest rate?

– If you’re itching for a lower mortgage interest rate, roll up your sleeves and get to work! It’s time to put your best foot forward – improve your credit score, save up for a bigger down payment, shop around for the best offer, and don’t shy away from negotiation. It’s not rocket science, but it sure takes some elbow grease.